Salary Sacrifice Vs Salary Deduction

Salary sacrifice reduces your taxable income so you pay less income tax. In this situation you will most likely be better off claiming a tax deduction.

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Fortunately most employers do the right thing and dont reduce their SG contributions.

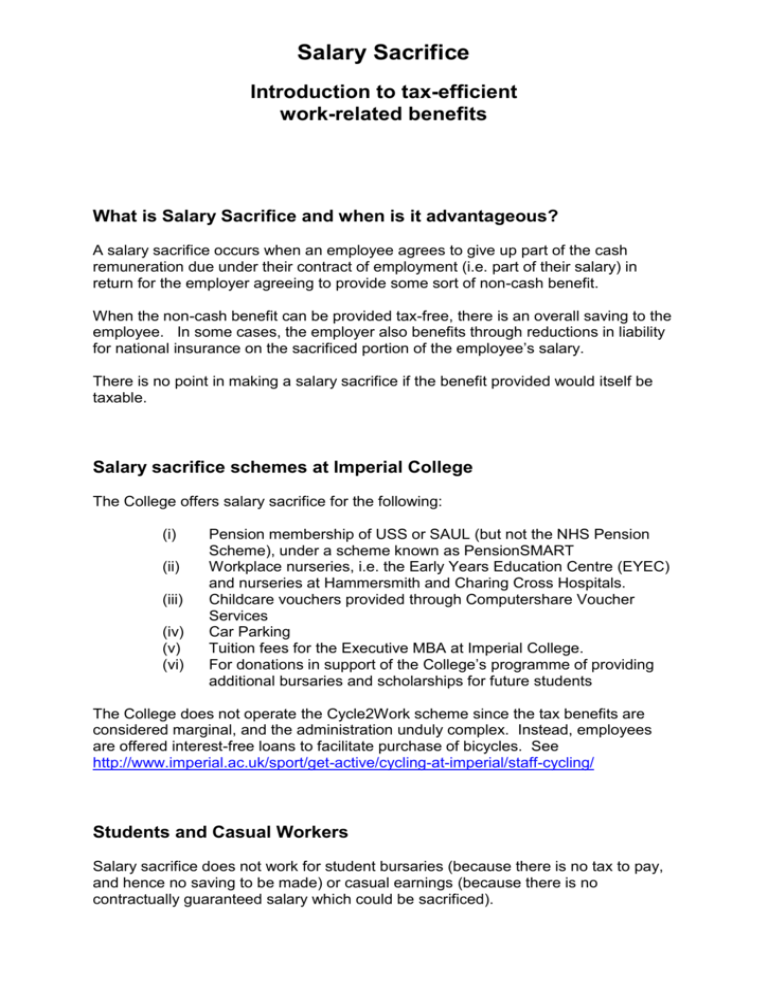

Salary sacrifice vs salary deduction. Posted 2007-Apr-2 316 pm AEST ref. Only 15 tax is deducted from your salary sacrifice amount to super compared to the rate you pay on your income which can be up to 45 plus the Medicare levy. I believe Salary Sacrifice is the cheaper option in terms of what it actually costs but I think I read at some point it could affect pension contributions and therefore take an effect on the final salary pension she has.

In a salary sacrifice arrangement you ask your employer to pay part of your pre-tax salary to your super fund rather than paying itand taxing itas salary. Legally employers only need to pay SG on the actual salary amount so for every 1000 of salary sacrifice you would lose 95 in SG. Posted 2007-Apr-2 316 pm AEST OP.

For starters employers dont have to offer salary sacrifice. This deduction is pre-tax reducing the taxable gross and is reported on end-of-year payment summaries as reportable employer super contributions. About a third salary sacrifice to super.

And for those working casually or with irregular work patterns salary sacrifice does not offer the flexibility to alter their contribution amount from pay period to pay period. The process is simple. Salary sacrifice was traditionally used by planners to build retirement benefits for clients.

Salary Sacrifice is an agreement between an employee and their employer. If they dont claiming a tax deduction is the only option. Following the removal of the 10 per cent test in 2017 many clients switched to personal deductible contributions.

Archive View Return to standard view. Others that stand to benefit will be individuals whose employers previously did. This reduces your assessable income and with it the.

Output tax is due on the amount deducted from the employee. I am thinking about. Salary Sacrifice vs Tax Deduction.

Rather than having to save up or take out expensive credit in order to buy a new car mobile device or holiday your staff can. Another thing to look out for. You starting amount for the state pension may also include a deduction if you were in certain earning-related pension schemes before 6 April 2016 or had certain workplace personal or stakeholder pensions before 6.

Legally employers only need to pay SG on the actual salary amount so for every 1000 of salary sacrifice you would lose 95 in SG contributions. Reducing salary results in a saving in individual income tax and employee and employer national insurance contributions. When you claim a deduction the amount is taken off your yearly income which reduces the tax that you pay for the year.

The ability to claim a tax deduction for personal Super contributions will effectively put these employees in the same position as if they are able to make salary sacrifice contributions without this penalty. You should consider your marginal income tax rate when determining whether salary sacrifice is beneficial for you. The employee agrees to exchange part of their gross before tax salary in return for a non-cash benefit like a pension contribution.

SALARY DEDUCT OPTIONS UNDER ONE ROOF. The federal government has also announced plans to ensure salary sacrifice does not. 1 GST 2 Deduction of the payment Net of GST is from Gross Pay therefore dollar saved has a higher value.

Salary sacrifice is not likely to affect your entitlement to the state pension unless your lowered salary is under the threshold to make National Insurance contributions. Our salary deduct schemes can improve your employees ability to afford both everyday essentials and luxuries by contributing funds directly from their payslips. Deduction from salary - where an amount is deducted from an employees pay in return for a supply of goods or services by the employer.

As the laptop would cost over 300 you would not be able to claim a deduction for the full amount. You basically get a fully paid for car apart from fuel through a lease deal which you can take as Salary Sacrifice or Salary Deduction. I do this yearly before each March FBT Year for mobile phone laptop or other personal devices used for Work.

The good news for salary sacrifice arrangements from 1 January 2020 is that employers can no longer reduce SG entitlements. Check out our page on Implications of entering into a salary sacrifice arrangement. If salary sacrifice is available will your employer still make SG payments on your pre-sacrifice salary.

Last updated posted 2009-May-31 506 pm AEST posted 2009-May-31 506 pm AEST User 81318 323 posts. If you sacrifice some of your salary to make payments into your pension then you are also lowering your income. When you salary sacrifice the amount comes off your income before it is taxed each pay period.

A lower income could mean reduced benefits from your employer. If the amount of your salary you choose to sacrifice brings you below a certain threshold you may lose a proportion of life cover your employer provides.

The Lowdown On Salary Sacrifice Schemes And Tax

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Salary Sacrifice For Auto Enrolment Brightpay Documentation

On Top Of Tax Preparing For The Upturn Debt Restructuring Anti Av

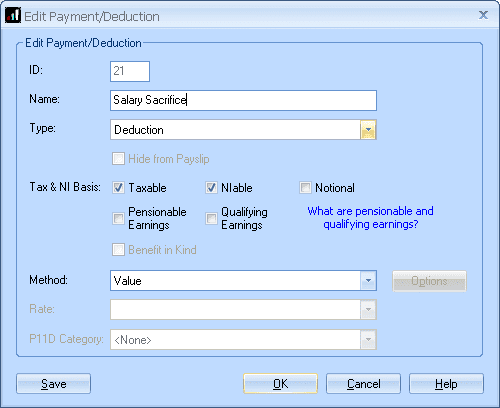

Setting Up Salary Sacrifice Payroll Support Uk

Salary Packaging Eastern Health

Payroll Salary Sacrifice Setup Basic Ps Support

Https Www Unison Org Uk Content Uploads 2019 06 Salary Sacrifice Pdf

What You Need To Know About The Upcoming Changes To Salary Sacrifice Super Offsets Payroll Support Au

What To Do When The Holiday Payout Balance Shows Negative Figures In Myob Payroll Payroll Negativity Shows

Salary Sacrifice Pension Scheme How It Works Benefits

Salary Sacrifice Clause Lexisnexis

What Does Coronavirus Mean For Salary Sacrifice The Accountancy Partnership

How Do I Process A Salary Sacrifice Deduction Iris

What Umbrella Company Employees Need To Know About Salary Sacrifice Pensions

Infographic A Snapshot Of Employee Benefits Travail

Post a Comment for "Salary Sacrifice Vs Salary Deduction"