Gross Annual Income In Quickbooks

Revenue also referred to as Sales or Income and subtract them from each other rather than to forecast future gross profit directly. Unlike gross sales gross receipts capture anything that is not related to the normal business activity of an entity tax refunds donations interest and dividend income and others.

How Do I Run A Month To Month Sales Revenues Comparison For 2018

And your accountant can provide financial expertise based on your statement.

Gross annual income in quickbooks. You can also use the statement to measure profitability by calculating business. Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. How to Create a Formula for Income Expenses in Excel.

Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques. Investors and lenders want to see your income statement to assess your businesss risk. Knowing this percentage gives you an idea of how much your COGS is taking away from your sales.

Most sole proprietors. It should be filed with form T1 for your annual personal income tax return. Follow the instructions in part 3 of your form to find your total business income for each form T2125.

There are nine tax rates in California starting at 1 and going up to 123. Adjustments are made by taking certain tax deductions. For example for future gross profit it is better to forecast COGS and revenue Revenue Revenue is the value of all sales of goods and services recognized by a company in a period.

By knowing the gross income you can calculate the gross profit margin which is the percentage of revenue remaining after subtracting COGS. The first part of the Income Statement reveals the Gross Profit earned by Microsoft from the years 2016 to 2020. Lets take the example of Microsofts Income Statement to understand how to read a standard Income Statement.

For example if sales are 1 million and gross income is 400000 the gross profit margin would be 40. Income and expense spreadsheets can be useful tools to help you see where your personal or business finances stand. Use the PL statement to summarize monthly quarterly or annual operations.

On the form regarding GSTHST and add the amount of GSTHST to your gross sales or fees to calculate your adjusted gross sales or adjusted professional fees. Add Your Business Expenses. The information can show you where your money is going.

California has one of the highest state income tax rates in the country. Similar to calculating federal income taxes taxpayers have to make adjustments to their gross income to get to their adjusted gross income. In the year 2020 the company earned a Gross.

After youve assembled. Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE.

Sample Quickbooks Contractor Company Income Statement Accounts Chart Of Accounts Accounting Quickbooks

Browse Our Image Of Household Income Statement Template For Free Income Statement Template Statement Template Income Statement

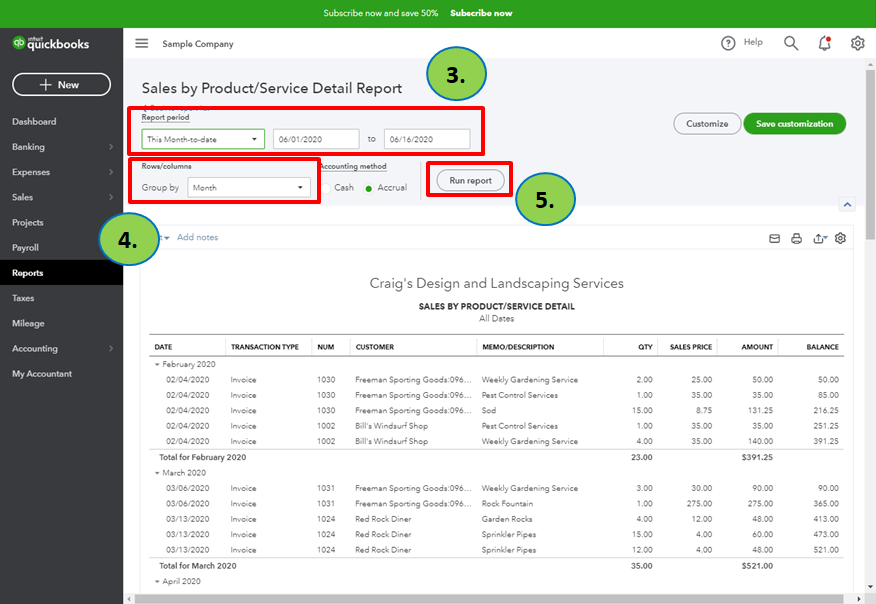

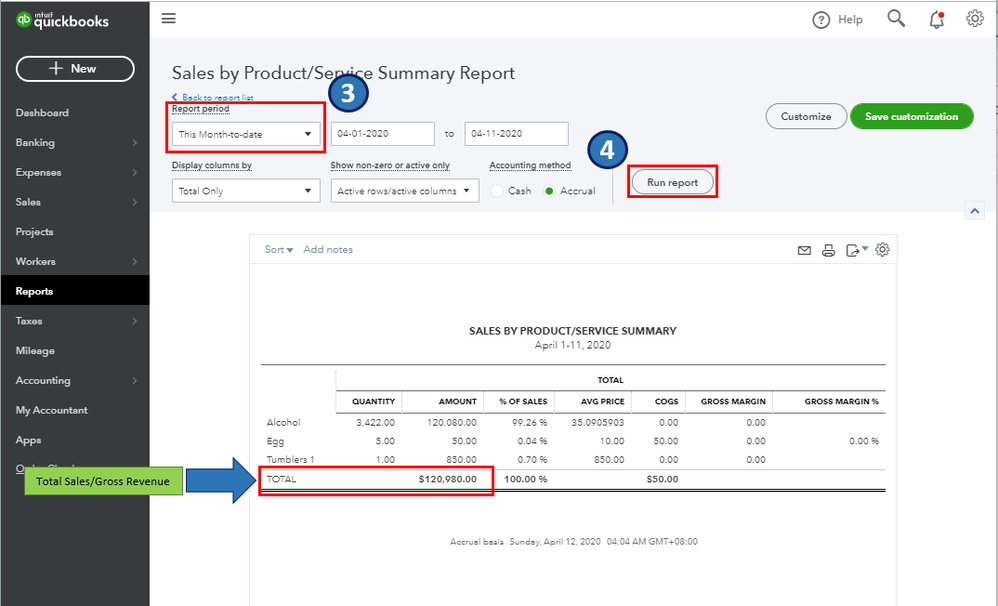

Can You Please Tell Me What Report Shows Gross Revenue Instead Of Gross Profit In Qb Online

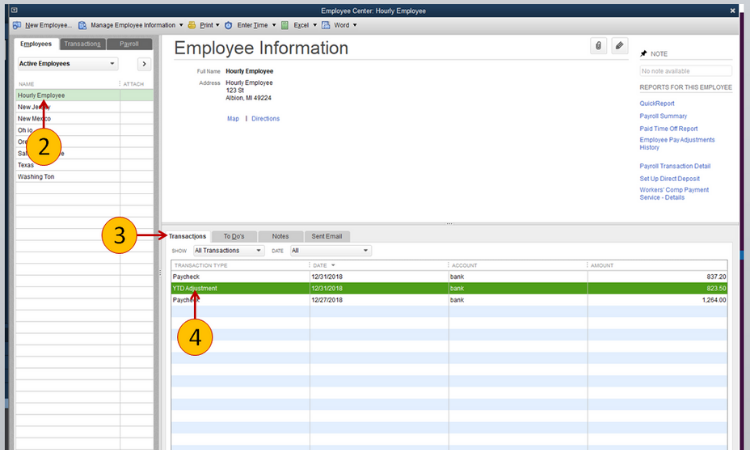

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

Custom Quickbooks Revenue Report Youtube

The Ultimate Quickbooks Guide For Entrepreneurs Arielle Gelosi Quickbooks Business Finance Management Small Business Bookkeeping

Can You Please Tell Me What Report Shows Gross Revenue Instead Of Gross Profit In Qb Online

Pin On How To Learn Quickbooks

How To Run Payroll Reports In Quickbooks In 3 Quick Steps

How To Adjust Ytd Payroll In Quickbooks Online

How To Add Payroll Items To Multiple Employees In Quickbooks Payroll Quickbooks Quickbooks Payroll

Illinois Income Tax Calculator Smartasset Federal Income Tax Capital Gains Tax Income Tax

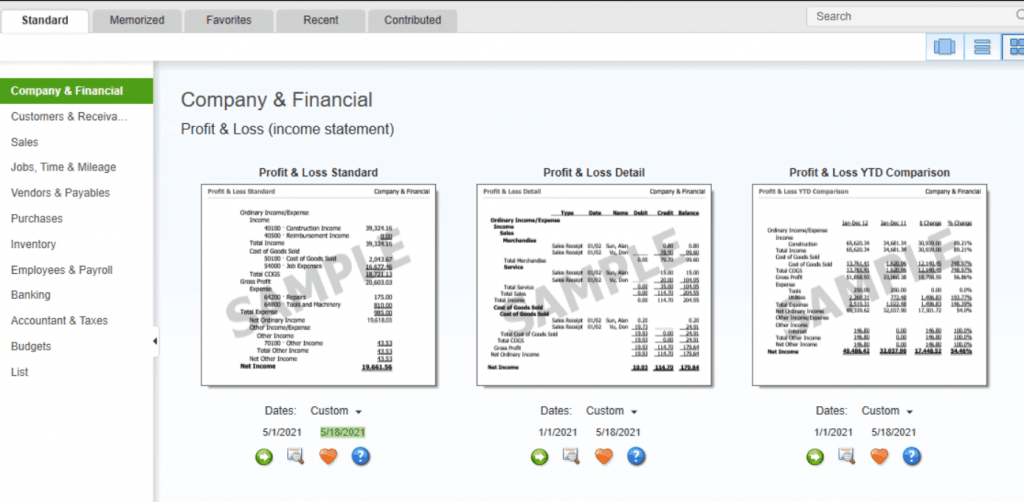

How To Create A Profit And Loss Report In Quickbooks Webucator

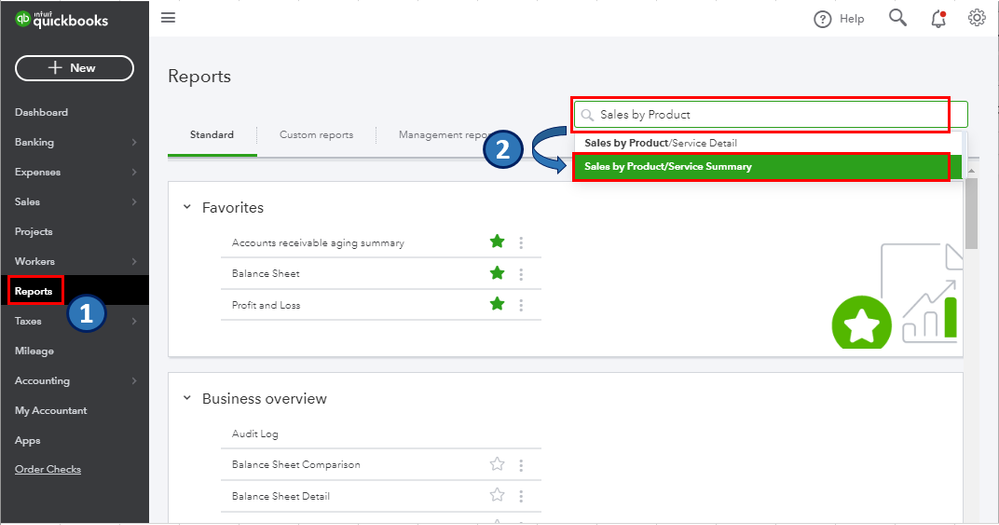

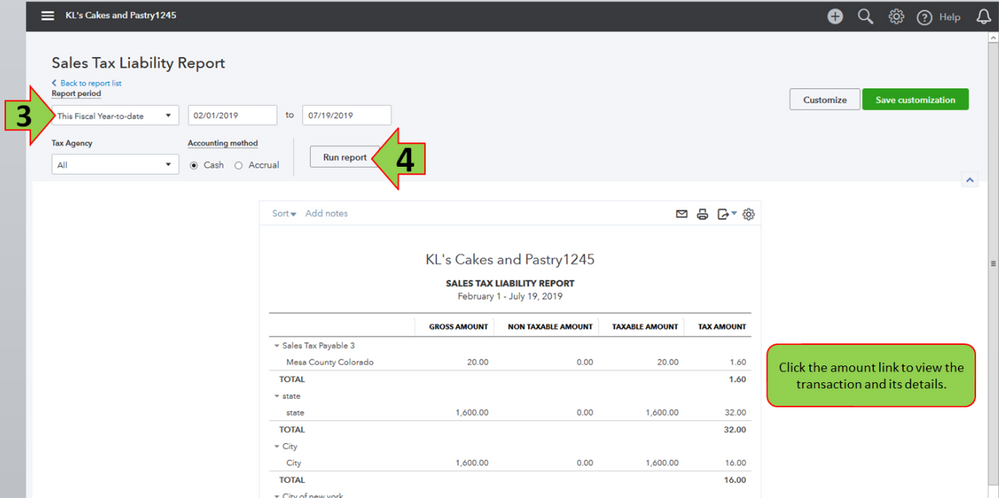

How Do I Find The Total Gross Sales In Order To Fill Our My Sales Tax Filing

Annual Filing Season Program Tax Prep Records Quickbooks

Using The Quickbooks App To Stay On Top Of Your Bookkeeping Small Business Finance Personal Finance Small Business Bookkeeping

How To Create A Gross Revenue Report For Sales Tax Liability In Quickbooks Desktop Youtube

Post a Comment for "Gross Annual Income In Quickbooks"