Gross Annual Income Does It Include Bonus

Your total gross annual income may consist of. The month paid to the employee or in the case of stocks and shares.

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Profit from your business if you are self-employed if this can vary it may be appropriate to provide minimum reliable figure you can support with accounts or tax returns if asked.

Gross annual income does it include bonus. And if your employer doesnt give you a bonus. Unfortunately it isnt and you must include your bonuses on your tax return. Some lenders require two or three years worth of evidence of the bonus in the form of payslips or P60s while others will base their calculations on the average or lowest bonus you were awarded during that period.

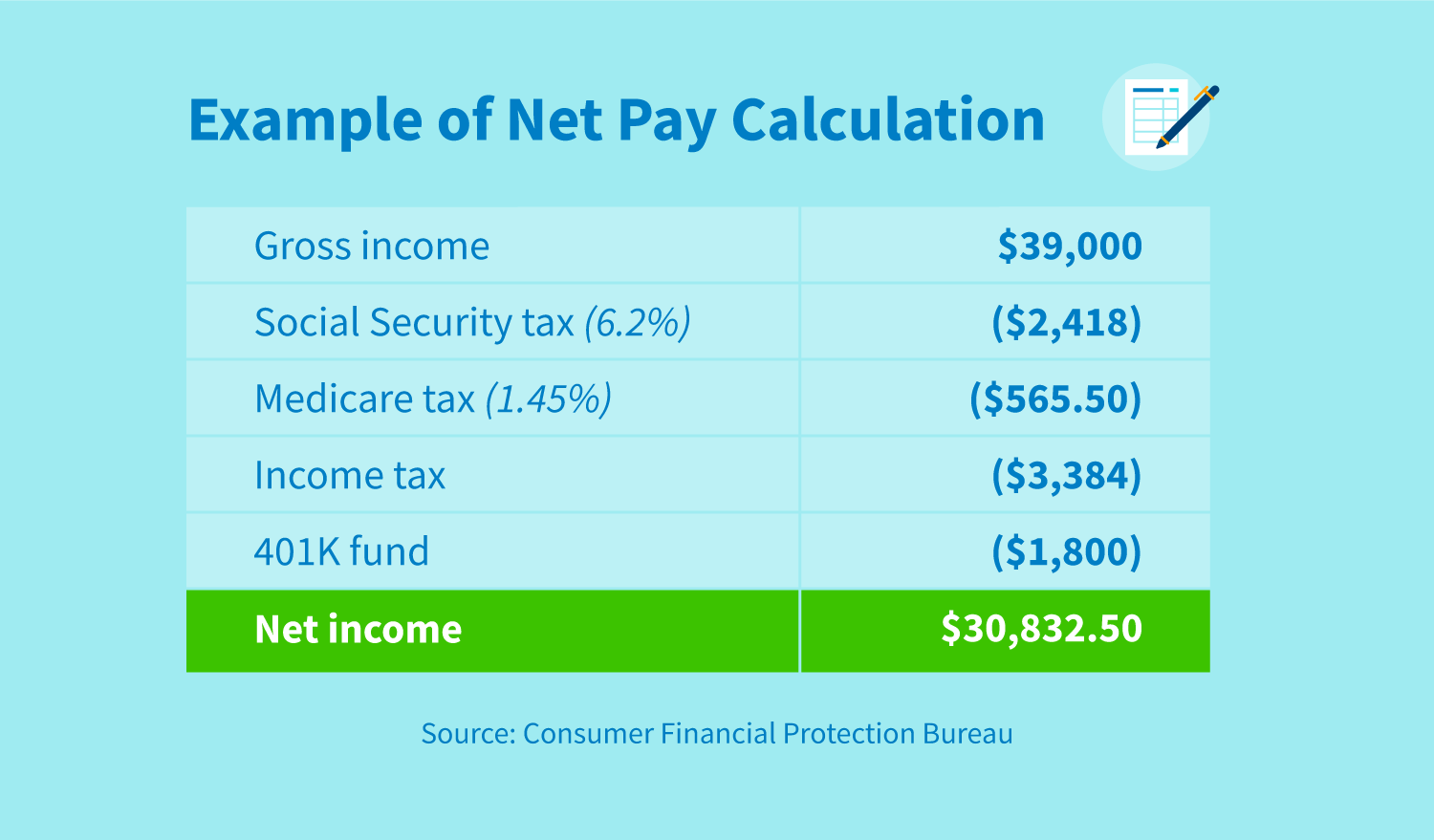

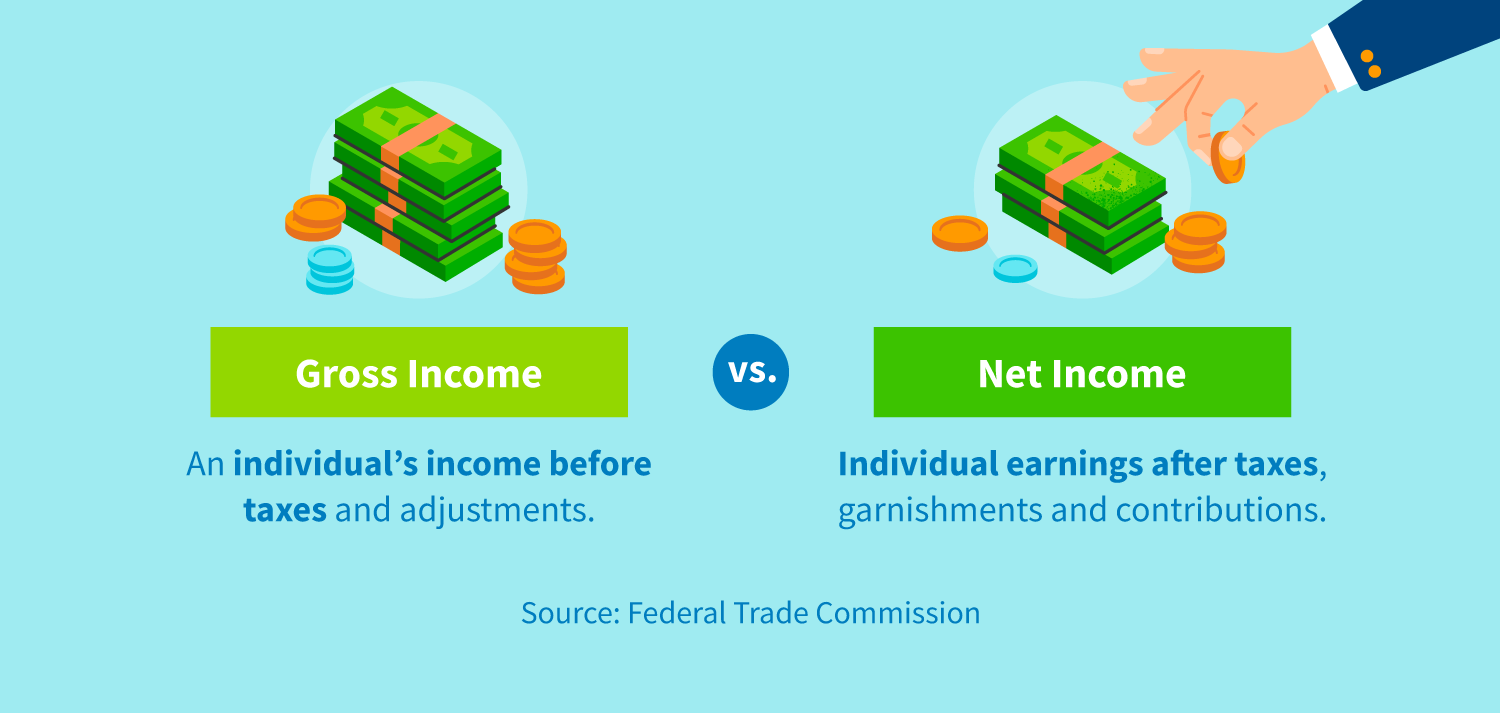

In other words Gross Salary is the amount paid before deduction of taxes or deductions and is inclusive of bonuses over-time pay holiday pay etc. If youve received bonuses as well as your salary you will need to include the full amount you received before taxes in bonuses when you calculate your gross salary amount. If your bonus has varied over the past couple of years your lender may average it out.

I was wondering if anyone had any advice as to whether or not to include my annual discretionary bonus in income when applying to credit cards. Your salary or wage earnings before tax and other deductions such as national insurance contributions to occupational or personal pension scheme. The EPF in India is an employee-benefit scheme recommended by the Ministry of Labour which provides employees with.

With few exceptions the bonuses you receive from your employer must be included in your gross income each year and are therefore subject to income taxes. For example if your employer agrees to pay you 60000 per year without bonuses that will be your gross income. For employees it refers to the gross monthly wages or salaries before deduction of employee CPF contributions and personal income tax.

17 lignes Profit sharingshares. When your employer provides you with a bonus they will report it on your W-2 in box 1but its combined with your normal wages or salary. The Capital One Venture Rewards Credit Card application says income can include.

It includes all overtime bonuses and reimbursements from your employer and it does. I know that people ordinarily just report their base salary but my bonus typically makes up a large percentage 50 of my annual compensation. Basically gross pay refers to all the money your employer pays you before any deductions are taken out.

This will inevitably increase your adjusted gross income or AGIwhich can potentially increase the amount of tax you owe. Wages from full-time part-time or seasonal jobs. 12000 this year and 8000 last year gives you 20000 for 48 months or 416 extra income a month.

In the eyes of the Internal Revenue Service your bonus is no different than the salary you receive. Its important to add the gross bonus amount to your gross salary because bonuses are often taxed at a different rate than regular income. Gross Monthly Income From Work refers to income earned from employment.

Gross Salary is employee provident fund EPF and gratuity subtracted from the Cost to Company CTC. Interest or dividends from investments. A list of job recommendations for the search does annual salary include bonus is provided here.

Shared income from somebody else that is regularly deposited into your individual account or into a joint account. Whether you can include an annual bonus as income often depends on how many consecutive years youve received the bonus. Basic salary is a rate of pay agreed upon by an employer and employee and does not include overtime or any extra compensation.

Fluctuations in Income Most bonuses arent that consistent even if you stay with the same employer. Gross salary however is the amount paid before tax or other deductions and includes overtime pay and bonuses. It comprises basic wages overtime pay commissions tips other allowances and one-twelfth of annual bonuses.

All of the job seeking job questions and job-related problems can. To put it in simpler terms Gross Salary is the amount paid before deduction of taxes or other deductions and is inclusive of bonuses over-time pay holiday pay and other differentials. For example if your employer agrees to pay you 6000000 per year without bonuses that will be your gross income.

Income includes salary commissions royalties wages bonuses rents dividends pensions interest trust income annuities workers compensation benefits unemployment insurance benefits disability benefits social security benefits and spousal support paid by someone other than the other parent. Although I dont have anything in writing the general range of my bonus has been.

What Is A Formula In Excel And How Do I Use It Excel Formula Excel Shortcuts Excel

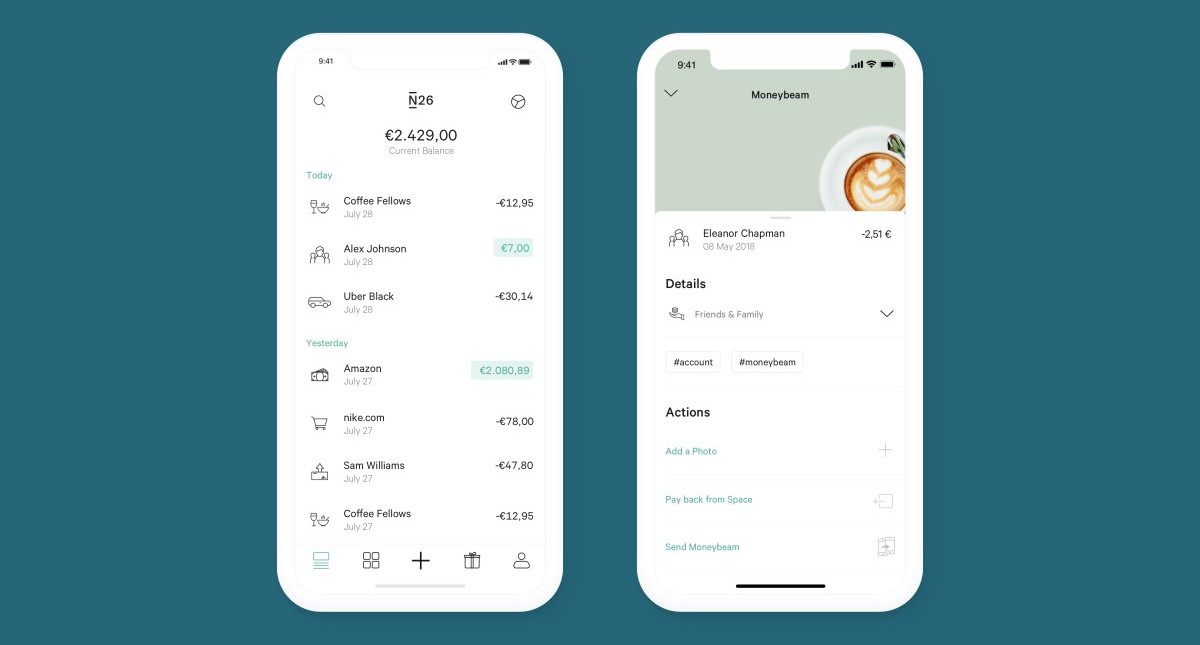

Base Salary Explained A Guide To Understand Your Pay Packet N26

Annual Income Definition Calculation And Quiz Business Terms

What Should I Include In My Employee Payroll Records Bookkeeping Business Small Business Bookkeeping Business Tax

What Is Basic Salary Definition Formula Income Tax Exceldatapro Federal Income Tax Tax Deductions Dearness Allowance

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Should I Use Net Income Or Gross Income For Tenant Screening The Closing Docs

Q Write A C Program To Calculate Bonus On Salary Grade Wise Program Statement Write A C Program To Input Sala Programming Tutorial Salary C Programming

Gross Income Vs Net Income Creditrepair Com

Gross Income Vs Net Income Creditrepair Com

Base Salary Explained A Guide To Understand Your Pay Packet N26

Salary Certificate Sample Is Prepared By Human Resource Department Of An Organizations In Certificate Format Salary Certificate Format Business Letter Template

Bonus Plan Template Excel Fresh Excel Template For Pcb Bonus Calculation How To Plan Payroll Template Business Plan Template

Affidavit Of No Income Peterainsworth Formal Letter Template Templates Disability Application

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Base Salary Explained A Guide To Understand Your Pay Packet N26

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Gross Pay And How Is It Different From Your Salary Or Net Pay The Motley Fool

Post a Comment for "Gross Annual Income Does It Include Bonus"