Salary Sacrifice Uk

An employer can set up a salary sacrifice scheme and must mention the scheme in your contract or terms and conditions of employment. An electric vehicle salary sacrifice scheme lets an employee pay for an electric car each month using their gross salary thats before tax and other contributions are deducted.

Https Quantumadvisory Co Uk Wp Content Uploads 2017 07 Salary Sacrifice Flyer A5 Final Pdf

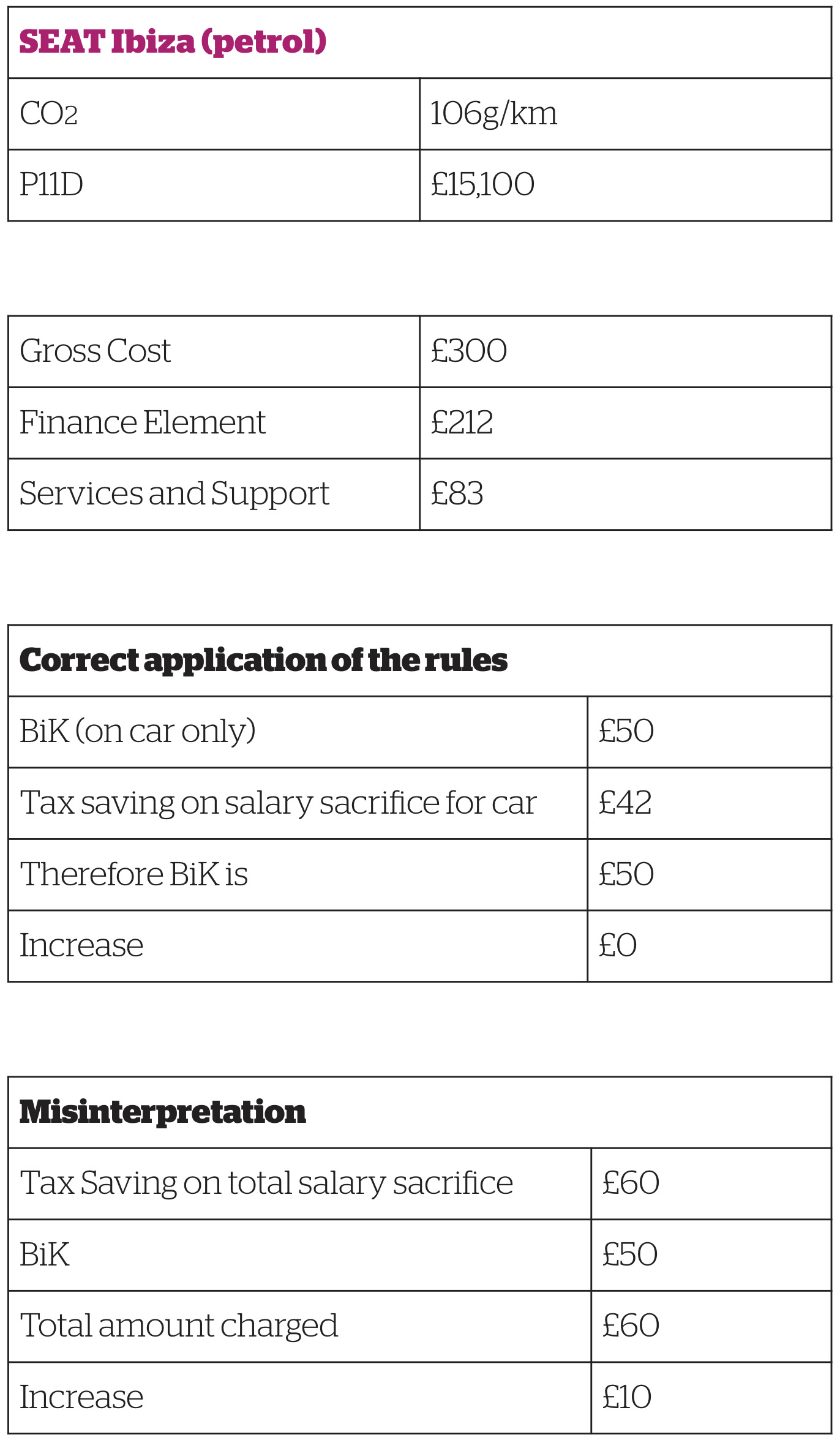

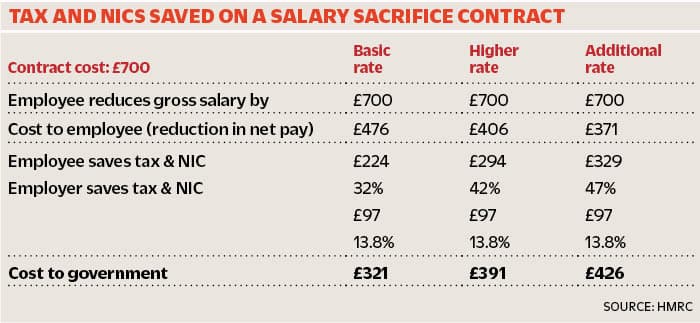

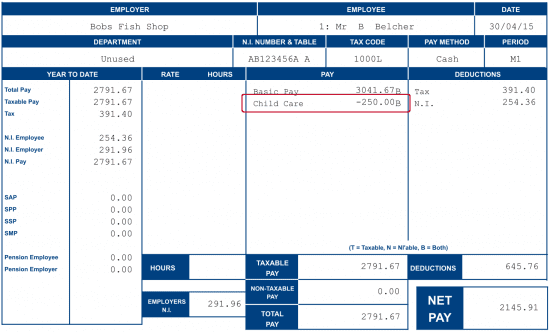

From April 2017 or April 2018 if the scheme was already in place in April 2017 tax benefits are available only on pension contributions ultra-low-emission vehicles cycle-to-work schemes and employer-supported childcare.

Salary sacrifice uk. These can include a range of in kind benefits such as childcare vouchers bikes ultra-low emissions vehicles or periods of annual leave but in this case they take the form of payments into your pension. But is it worth doing. What is salary sacrifice.

Benefits offered can include child care vouchers a company car and additional pension contributions. Read on for the pros and cons of salary sacrifice. Usually the sacrifice is made.

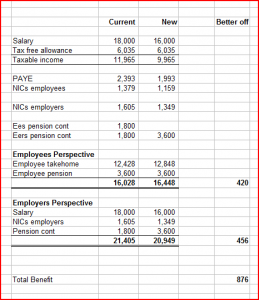

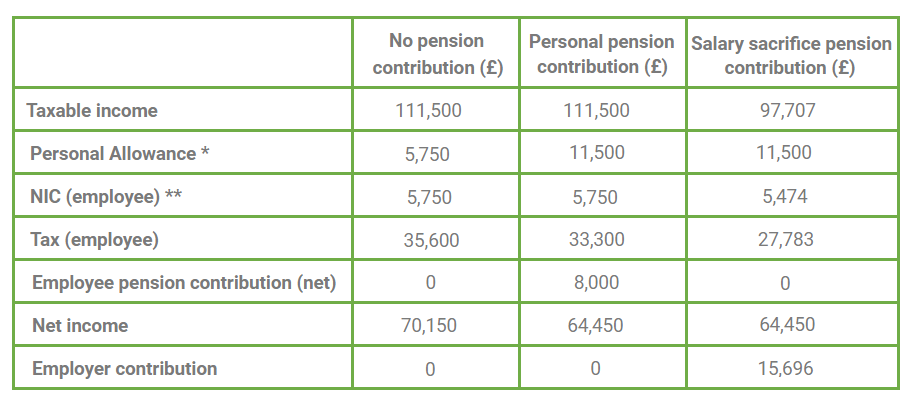

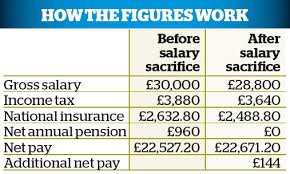

Salary sacrifice is an arrangement in which you exchange part of your salary for extra benefits from your employer such as pension contributions or childcare vouchers. The savings to be made depends on what rate of tax the worker pays and how much of their salary they are sacrificing. Salary sacrifice is also called salary exchange.

Its a tax-efficient way to make extra contributions to your pension and both you and your employer will pay lower National Insurance Contributions. But for a basic rate tax payer charged at 20 if they salary sacrifice 100 of their earnings they can save 20 in income tax and 12 in national insurance contributions. However the range of salary-sacrifice benefits that attract tax and national insurance savings has changed.

Salary sacrifice is when you agree to exchange part of your salary so you can get extra benefits from your employer. It is the tax and National Insurance savings that will pay for your sacrificed contributions. It reduces your immediate overall monthly income but are the long-term benefits worth the short-term sacrifice.

Technically you are still paid the same. Each salary sacrifice calculator allows you to enter salary sacrifice as a fixed amount of a percentage of your Gross pay. The main advantage of salary sacrifice can be higher take home pay as youll be paying lower National Insurance contributions NICs.

There are different levels of the National Minimum Wage. Salary sacrifice is an arrangement employers may make available to employees the employee agrees to reduce their earnings by an amount equal to their pension contributions. The employee agrees to exchange part of their gross before tax salary in return for a non-cash benefit like a pension contribution.

The salary sacrifice adjusted gross pay then provides a full tax calculation and includes personal tax allowances calculates your National Insurance Contributions and Your employers National Insurance Contributions deductions PAYE etc. Salary sacrifice enables you to exchange part of your salary for a non-cash benefit from your employer such as increased pension contributions. Salary sacrifice is a contractual arrangement where an employee gives up the right to receive part of their cash remuneration typically salary but this open to interpretation and could be applied to cash bonuses usually in return for your employers agreement to provide some form of non-cash benefit including but not limited to child care vouchers personal pension bicycles and bus.

Salary sacrifice with Octopus Electric Vehicles is an all-inclusive low admin scheme that offers your employees and your business the benefits of 100 electric vehicles. A Salary Sacrifice or Salary Exchange occurs when an employee agrees to give up the right to a proportion of their pay. Using a Salary Sacrifice arrangement can therefore be used to make Workplace Pension Schemes more cost.

It is just structured in a different way. Salary Sacrifice is an agreement between an employee and their employer. A salary sacrifice happens when an employee gives up the right to part of the cash remuneration due under his or her contract of employment.

This represents a change in the Terms and conditions of their employment. And in exchange the employer then agrees to pay the total pension contributions. Your salary does not change overall.

Its the same as other salary sacrifice schemes such as childcare cycle to work schemes or pension contributions. In return for this reduced salary their employer provides them with an additional employee benefit. Section 62 ITEPA 2003.

A salary sacrifice pension scheme is an arrangement between you and your employer in which you agree to give up a certain amount of your salary in exchange for certain non-cash benefits. Salary sacrifice allows you to give up some of your salary so you can claim extra benefits from your employer. Your employer will also pay lower NICs.

And provides a breakdown of your. You might benefit from more pension contributions from your employer if they are giving you some or. Salary sacrifice is commonly used to boost your pension but you can also give up salary in return.

Salary sacrifice cannot reduce your cash pay below the National Minimum Wage. The National Minimum Wage provides a legally binding minimum hourly rate of pay to workers aged 18 years or over - with few exceptions. Reducing salary results in a saving in individual income tax and employee and employer national insurance contributions.

Https Fleetworld Co Uk Wp Content Uploads 2017 11 Table Jpg

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Salary Sacrifice Pension Scheme

Salary Sacrifice Savvy Financial Planning

Atos Launches Car Salary Sacrifice Scheme Leasing News

Salary Sacrifice Benefits To Change In Accountancy

Everything You Need To Know About Salary Sacrifice Banker On Fire

Salary Sacrifice Pension Scheme How It Works Benefits

How Salary Sacrifice Can Save Smes Money Business Car Manager

How Salary Sacrifice Works Youtube

Salary Sacrifice For Auto Enrolment Brightpay Documentation

Salary Sacrifice Schemes For School Staff Edapt

What Is Pension Salary Sacrifice And Why S It Under Threat Accountingweb

Exclusive 84 Offer Salary Sacrifice Pension Arrangements Employee Benefits

How To Set Up A Salary Sacrifice Deduction E G Childcare Vouchers Iris

School Minibus Company Salary Sacrifice School Minibus Company

Free Company Car Paid For By Hmrc Evision Electric Vehicles

Https Www Unison Org Uk Content Uploads 2019 06 Salary Sacrifice Pdf

Salary Sacrifice And Auto Enrolment Edwards

Post a Comment for "Salary Sacrifice Uk"