Salary Sacrifice Journal Entry

SGC super is calculated on the Pre salary sacrifice Taxable wages. If youre using Sage 50 Accounts Plus or Sage 50 Accounts Professional you can use the Memorise and Recall options to create a skeleton salary journal.

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

To correctly post your salary journal each journal needs to have a matching debit and credit in any double-entry bookkeeping system.

Salary sacrifice journal entry. The Salary amount above mentioned is salaries for all employees before passing the entry we should prepare a sheet of salaries payable to all employees and the same will be used as support document for passing this entryThe salary in above Journal entry includes Basic All other Allowances. If you want these expenses kept separate from wages and salaries youll need to keep using manual journals to re-allocate the expense where you want it. Click Nominal codes then click Journal entry.

It has even been deducted net of tax. A salary sacrifice would involve the gross salary being lower the employee has sacrificed some salary and the employers contribution being higher by the same amount. Enter a reference and the date for the salary journal then enter the relevant details on the Nominal Ledger Journals window for example.

Usually the wages are run a few days before they are actually paid and the Income Tax and National Insurance are not due to be paid until the 19th of the following month. In the Search by field select Account and specify the Salary Sacrifice liability account. An employee can sacrifice their salary or wages into a variety of benefits including superannuation.

If the salary sacrifice takes an employees earnings below the LEL for example she may not be entitled to SMP. The figure you will include is the nominal figure eg yearly salary the cycle hire allowance on a yearly basis which will show up on payslips. Also any personal financial arrangements which.

Journal Entry for salary Payment. The way a salary sacrifice works is that the employee who was on a salary of X now agrees to be remunerated by way of a salary of Y and stated benefits going forward. The Gross Wagess is the expense.

The PAYENICs will be based on the gross salary figure. The Ending Balance will be displayed. Create the salary journal When you record details of your payroll your net wages and the money you owe HMRC in tax and insurance is recorded as a liability on your balance sheet to show that this is money owing by your business.

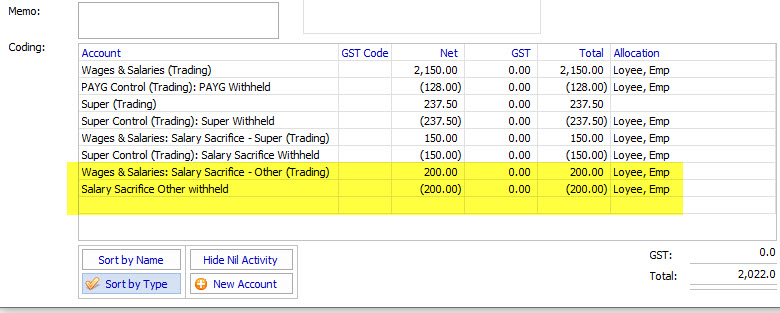

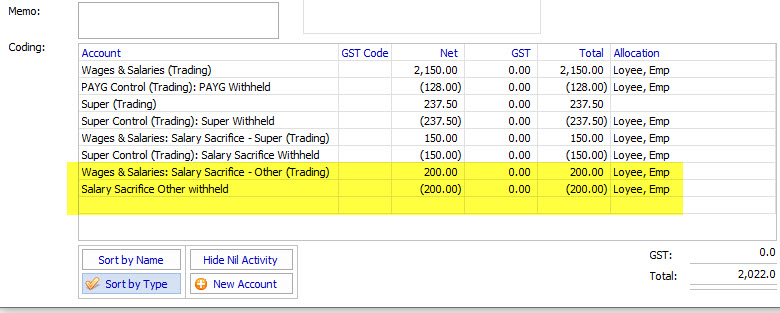

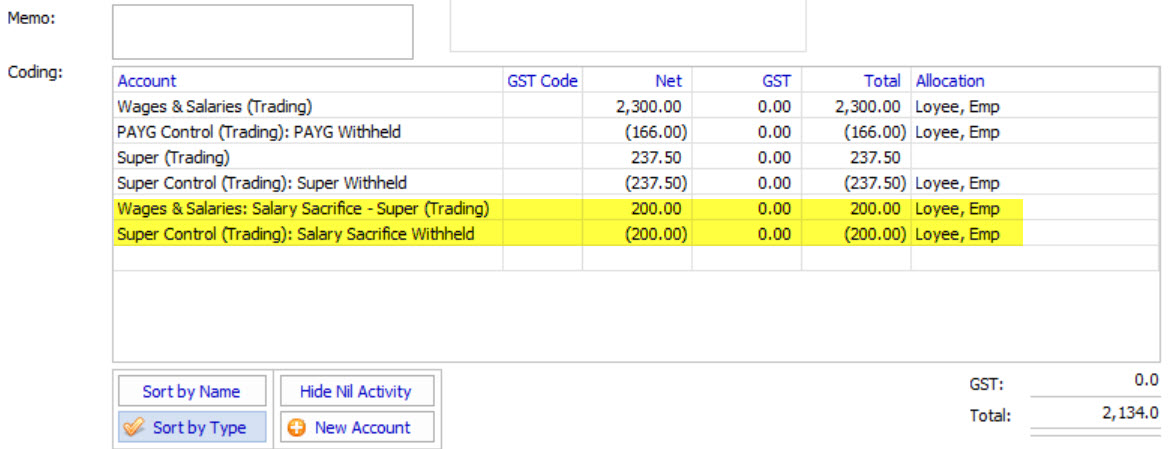

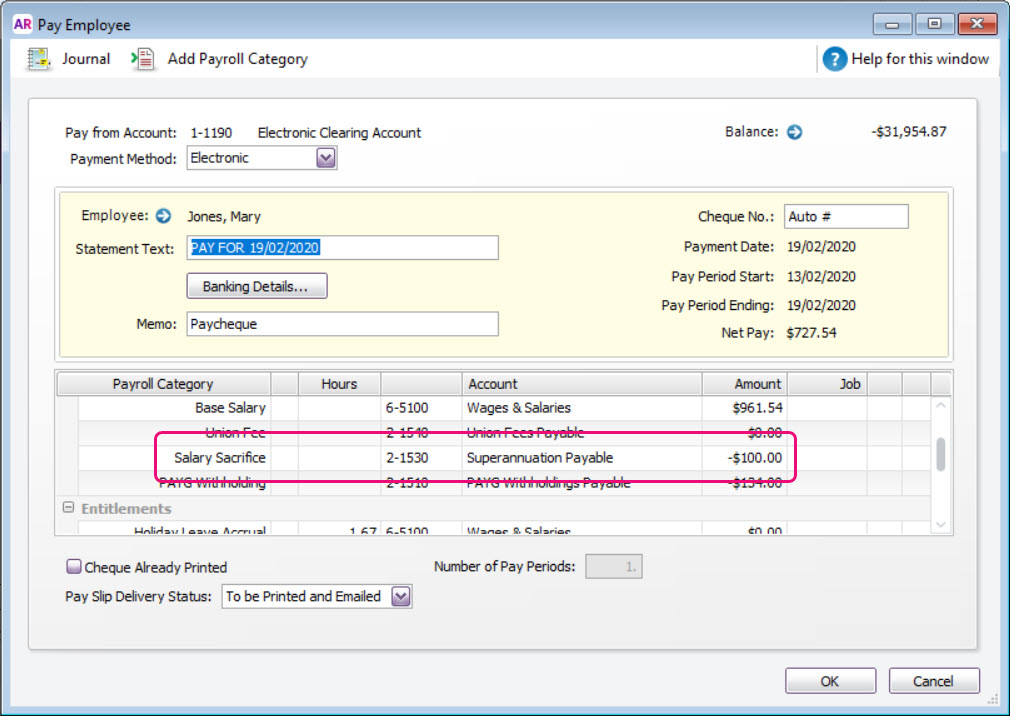

Salary sacrifice arrangements What is salary sacrifice. In addition the employer payroll tax liability needs to be recorded with the following payroll journal entry. The journal entry below recorded in MYOB is correct.

The employees gross pay is reduced as part of a salary sacrifice scheme. Before Salary Sacrifice is entered. The salary sacrifice is taken from their gross salary before tax which means that the employee will pay less Income Tax and National Insurance NI and that the employer will reduce their National Insurance Contributions NICs bill.

Unlike SGC its not always considered an additional expense to the employer. By default Salary Sacrifice will be tracked by the Wages Salaries expense account and the Payroll Deductions liabilities account. There will be an option to turn on the salary sacrifice option.

Use your current 6-XXXX Superannuation Expense and 2-XXXX Superannuation Liability accounts to record the Salary Sacrifice amounts. These are all entered as a Credit in your payroll journal. Certain benefits provided by an employer under an ESSA are subject to fringe benefit tax.

It doesnt appear to be. 1-1220 Electronic Clearing Account 0 CR. The employees contribution appears to be exactly that - the employees contribution.

Once the salary sacrifice is in place the amounts to be reflected in the accounts are the salary of Y the costs of providing the. The Salary Sacrifice is not an expense to your business. A change was introduced on 1 January 2020.

What makes you say this is a salary sacrifice pension. A salary sacrifice arrangement is an agreement to reduce an employees entitlement to cash pay usually in return for a non-cash benefit. Where super salary sacrifice is involved the expense is included as part of wages and salaries.

DR 6-XXXX Superannuation Expense Account XX using Tax code X. After the salary sacrifice has been entered. You can find more on this here.

Add to Payroll General Journal as shown below. In the Dated From and To fields specify a date range which spans the Salary Sacrifice liability accounts life activity in other words from when the salary sacrifice began up to the current date. To be an effective salary sacrifice arrangement ESSA the arrangement must be entered into before the employee becomes entitled to the income eg.

Below is an example of the payment coding. As an employer you can set up a salary sacrifice. The salary journal is no exception.

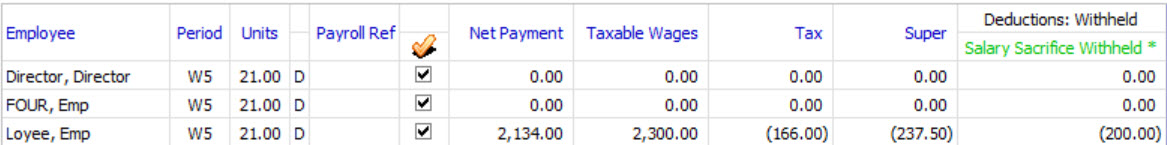

You will notice the reduction in Taxable Wages and Tax as well as an additional accrual journal for salary sacrifice. Before services are performed that will result in the payment of the employees salary etc. This means that any benefits which are based on the employees gross earnings may be affected such as pensions tax credits and maternity pay.

The first entry is the expense charged to the income statement and the second entry is the liability to the tax authorities recorded in the balance sheet control account. You can change the account name and number however it will not be the same accounts used to. If you need to make journal entries its indicative of there not being a valid salary sacrifice.

When there is a Salary Sacrifice agreement the SGC is often calculated based on the reduced salary however it will depend on the actual agreement entered with your employee. Salary sacrifice is an arrangement where an employee agrees to forego part of their future salary or wages in return for their employer providing benefits of a similar value. CR 2-XXXX Superannuation Liability Account XX using Tax code X.

What Is Wages Payable Definition Meaning Example

Format Of Journal Entry Exampale Journal Entry Journal Journal Entries

General Journal Entries Support Notes Myob Accountright V19 Myob Help Centre

How To Pass Journal Entries For Purchases Accounting Education

Journal Entry In Accounting Journal Entry Accounting Journal

Petty Cash Book Meaning Advantages Format Example Book Meaning Book Format Petty

![]()

How To Correctly Post Your Salary Journal

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

Rectification Of Errors Meaning Types Examples Accounting Principles Trial Balance Accounting Process

Plus Two Accountancy Notes Chapter 2 Accounting For Partnership Basic Concepts A Plus Topper Basic Concepts Chapter Accounting

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

General Journal Or Journal Proper In Accounting Journal Learning Objectives Accounting Process

Solved Salary Sacrifice Into Super Gl Treatment Myob Community

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

Trial Balance Accounting Meaning Definition Method Features Advantages Limitation Trial Balance Accounting Financial Statements

Post a Comment for "Salary Sacrifice Journal Entry"