Gross Monthly Income 41000 Per Year

If you earn 41000 a year then after your taxes and national insurance you will take home 31520 a year or 2627 per month as a net salary. Employer Superannuation is payable at 95 of Gross Income.

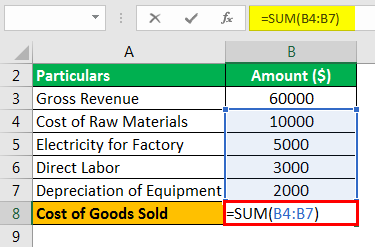

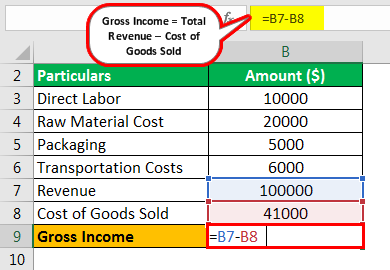

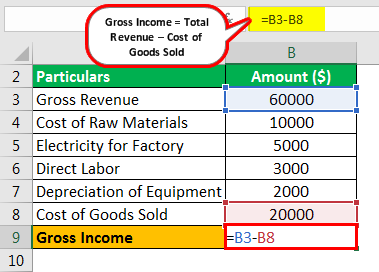

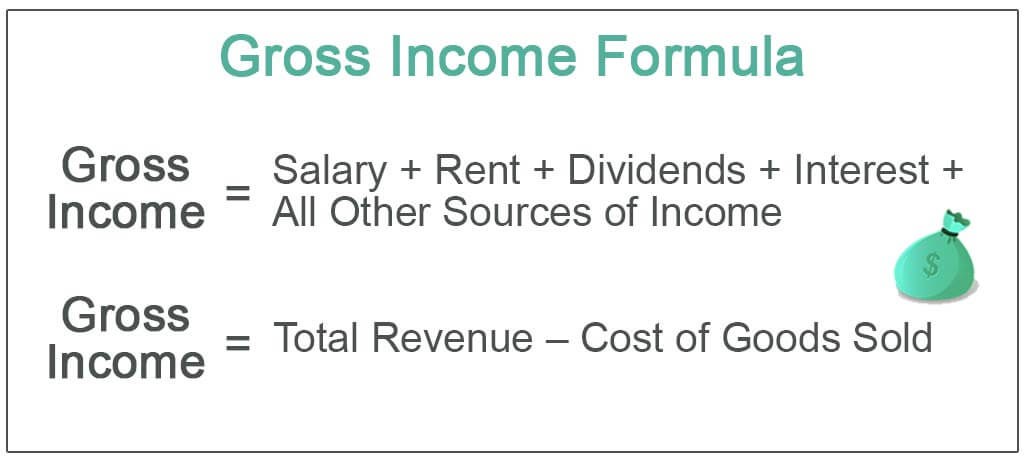

Gross Income Formula Step By Step Calculations

This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no childcare vouchers no student loan payment.

Gross monthly income 41000 per year. 35000 Salary Take Home Pay. Determining hourly pay in a monthly period requires a more complex formula. Based on a 40 hours work-week your hourly rate will be 1683 with your 35000 salary.

Of course some months are longer than others so this is just a rough average. Pay Related Social Insurance PRSI is a tax payable on the gross income after deducting pension contributions. Joaquin makes 11 per hour as a waiter working 20 hours per week.

41000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations. Salary Take Home Pay. Lenny makes 3750 per month.

Since there are 12 months in a year you can estimate the average monthly earnings from your 41000 salary as 341667 per month. Is a progressive tax applied on the gross income after certain capital allowances but before pension contributions. Gross Salary - Income Tax After deductions 3714936.

101 lignes Salary hourly based on 41000 per year. So a basic salary of 4100000 is a 4638518 Salary Package on top of which can include company car costs healthcare costs and other employee related business costs. If you earn 35000 a year then after your taxes and national insurance you will take home 27440 a year or 2287 per month as a net salary.

This equates to 2629 per month and 607 per week. Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 41000 to cover the total cost of debt payment s insurance and property tax. Gross monthly income 1040.

To find his annual income he multiplies his hourly wage by the hours of work he puts in each week. Gross monthly income 12480 12. 3316350 net salary is 4100000 gross salary.

Divide by the months in a year. 41000 after tax and national insurance will result in a 2627 monthly net salary in the tax year 20192020 leaving you with 31520 take home pay in a year. What is a 41k after tax.

Based on a 40 hours work-week your hourly rate will be 1970 with your 41000 salary. Hourly pay x hours worked 11 x 20. If you work 5 days per week this is 121 per day or 15 per hour at 40 hours per week.

Employer Superanuation for 2021 is payable on all employee earning whose monthly income exceeds 45000 which equates to 540000 per annum. Guide to getting paid. 119 of your income is taxed as national insurance 488592 per year.

The total cost of employment for an employee on a 4100000 Salary per year is 4638518 this is also known as the Salary Package. Individuals that earn less than 12012 EUR per year are exempt from the Universal Social Charge. If you earn 41000 in a year you will take home 31520 leaving you with a net income of 2627 every month.

See how we can help improve your knowledge of Math Physics Tax Engineering and. If your income is 41000 41k a year your after tax take home pay would be 3042808 per year. Annual Income Monthly Pretax Income Monthly taxes 25 Monthly Post-tax Income.

With her yearly income amount she can now divide by 12 for the months in the year to determine her gross monthly income. On a 41000 salary your take home pay will be 31542 after tax and National Insurance. Gross monthly income 3750.

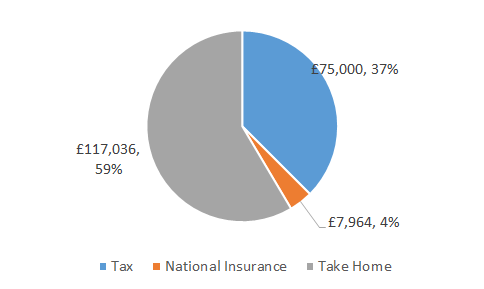

Our salary calculator indicates that on a 41000 salary gross income of 41000 per year you receive take home pay of 31542 a net wage of 31542. The total tax you owe as an employee to HMRC is 9458 per our tax calculator. For the 2019 2020 tax year 41000 after tax is 31416 annually and it makes 2618 net monthly salary.

Annual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annualGross annual income refers to all earnings Earnings Before Tax EBT Earnings before tax or pre-tax income is the last subtotal. One of a suite of free online calculators provided by the team at iCalculator. What is Gross Annual Income.

Thus in doing our calculations here we assumed 2 percent for insurance and property tax and 34 percent for. This is 253567 per month 58516 per week or 11703 per day. Annual take-home pay breakdown 4100000 Net Income.

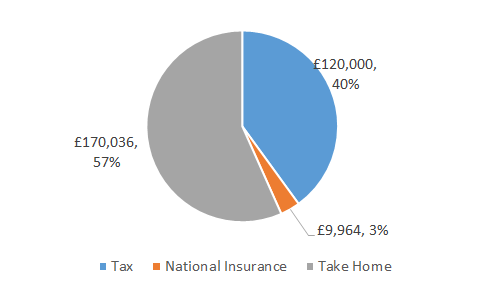

Youll pay 139 of your income as tax This means the tax on your 41000 per year salary is 568600. PRSI is only applicable to salaries higher than 5000 EUR per year. You will pay a total of 5700 in tax this year and youll also have to pay 3780 in National Insurance.

Income Income Period. Now lets see more details about how weve gotten this monthly take-home sum of 2627 after extracting your tax and NI from your yearly 41000 earnings. Miss Avasarala finds that she makes 12480 per year.

How much do I make each month.

41 000 After Tax Us Breakdown July 2021 Incomeaftertax Com

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Income Formula Step By Step Calculations

Negotiating Your Salary What Is Considered A Good Salary In France What Salary Can I Aspire To Todo Lo Que Necesitas Saber Para Estudiar Trabajar E Instalarte En Francia

41 750 After Tax After Tax Calculator 2019

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

41 000 After Tax 2021 Income Tax Uk

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Is A Gross Salary Of 40 000 Euro Good In Vienna What Would The Average Living Expenses For A Single Person With An Average Lifestyle In Vienna Quora

Gross Income Formula Step By Step Calculations

Negotiating Your Salary What Is Considered A Good Salary In France What Salary Can I Aspire To Todo Lo Que Necesitas Saber Para Estudiar Trabajar E Instalarte En Francia

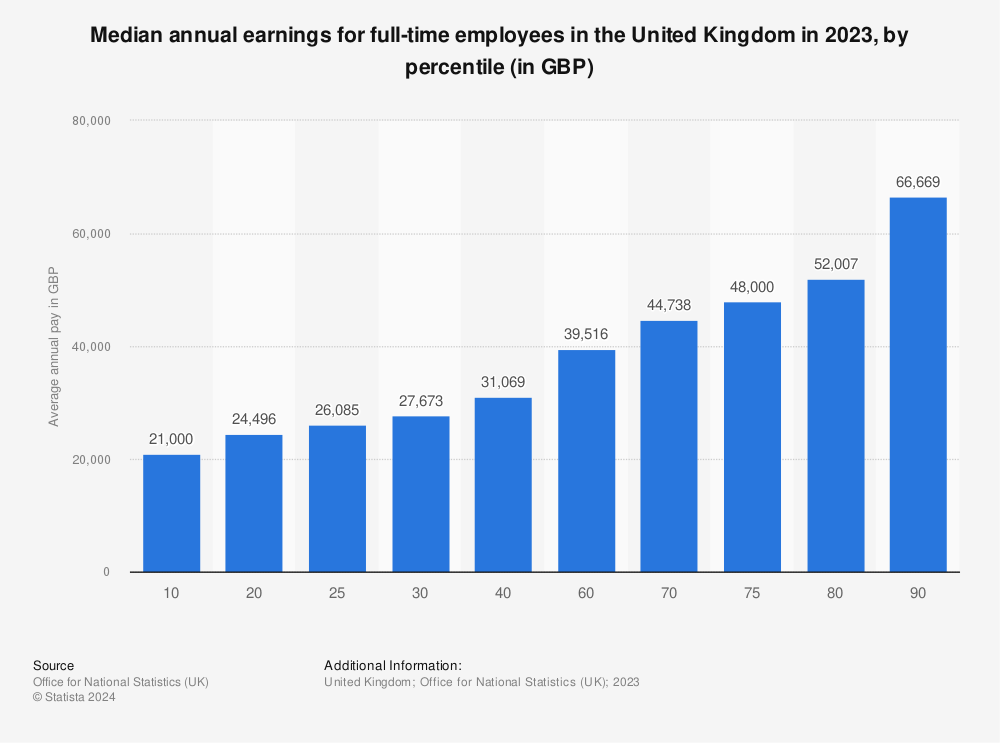

Uk Salary Percentiles 2019 Statista

Post a Comment for "Gross Monthly Income 41000 Per Year"