Salary Sacrifice On Tax Return

A salary sacrifice. One example of a salary sacrifice arrangement is to have some of your salary or wages paid into your super fund instead of to you.

What Is The 1040 And What S The Difference Between The 1040 1040a And 1040ez Gobankingrates

The reduced salary will appear on the form P60 from his employer at the end of the tax year and that is all that needs to be entered on the Employment page of his tax return.

Salary sacrifice on tax return. No - you do not show any salary sacrifice separately. Salary sacrifice is an arrangement with your employer to forego part of your salary or wages in return for your employer providing benefits of a similar value. Agrees to permanently forego part of their future entitlement to salary or wages receives benefits of a similar cost to the employer in return.

If you are under Self Assessment then you must include all pension contributions in your tax return except those under a salary sacrifice or net pay arrangement. Salary sacrifice is also commonly referred to as a salary packaging or total remuneration packaging. You can save more than 40 of Income tax higher tax slab earners.

The idea behind this is fairly straightforward. Salary sacrifice is an arrangement whereby you forego part of your salary or wages in return for your employer providing benefits of a similar value. The employee agrees to exchange part of their gross before tax salary in return for a non-cash benefit like a pension contribution.

Is no more and no less than a reduction of an employees salary. No - you do not show any employers pension contributions on an employees tax return. Do I need to include salary sacrifice on my tax return.

As the laptop is exempt from FBT payroll tax is payable on the 62000 salary. Higher-rate taxpayers will always receive tax relief on 10000 of their salary sacrifice pension payments. You show the gross pay from his P60 which will be after the sacrifice.

Under a salary sacrifice arrangement between the employer and their employee the employee agrees to forgo part of their future entitlement such as salary or wages in return for benefits of a similar value. Salary sacrifice is commonly used to boost your pension but you can also give up salary in return for benefits such as bikes mobile phones and bus passes. An employees current salary is 65000 per year.

Reducing salary results in a saving in individual income tax and employee and employer national insurance contributions. Salary sacrifice options vary as employers must choose to opt into a scheme. They are neither taxable on the employee nor can he claim any tax relief on them.

One example of a salary sacrifice arrangement is to have some of your salary or wages paid into your super fund instead of to you. Salary sacrificing is sometimes called salary packaging or total remuneration packaging. A salary sacrifice arrangement is also referred to as salary packaging or total remuneration packaging.

How much tax relief will I get on my salary sacrifice pension contributions as a higher-rate taxpayer. You give up part of your salary and in return your employer gives you a non-cash benefit such as childcare vouchers or increased pension contributions. No you dont need to show any salary sacrifice on your tax return.

Salary Sacrifice is an agreement between an employee and their employer. It is an arrangement between an employer and an employee where the employee. The employee negotiates with the employer for the purchase of a laptop computer under a salary sacrifice arrangement reducing their salary to 62000.

You can also let HMRC know directly so that your tax code can be adjusted to give relief on each pay day instead of waiting for the end of the tax. Its an arrangement between an employer and employee where the employee agrees to forego part of their future salary or wage in return for some other form of non-cash benefits of. The maximum amount of tax relief that can be deducted is 30000 of pension payments made through salary sacrifice or other means.

You only need to include your gross pay which will be after the salary sacrifice has been taken into account. Many organisations now offer salary sacrifice schemes. If youre under self-assessment for tax you must include all pension contributions in your tax return except those under a salary sacrifice or net pay.

Check with your employer to see which salary sacrifice schemes are on offer if any.

When How And Do I Need To Lodge A Tax Return Finance For Young Australians

Cash Transaction Limit In India Per It Act 2019 Income Tax Tax Software Filing Taxes

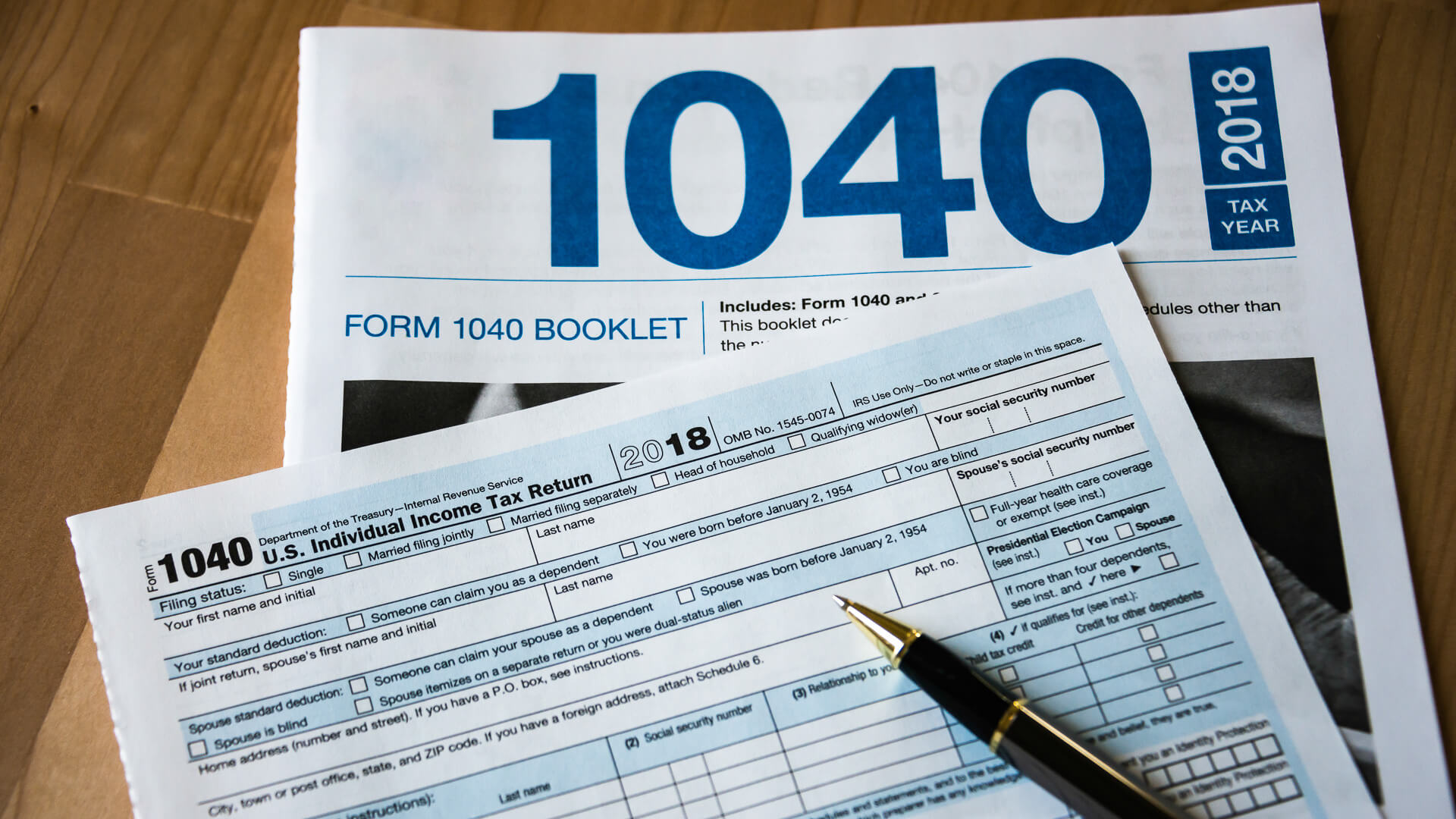

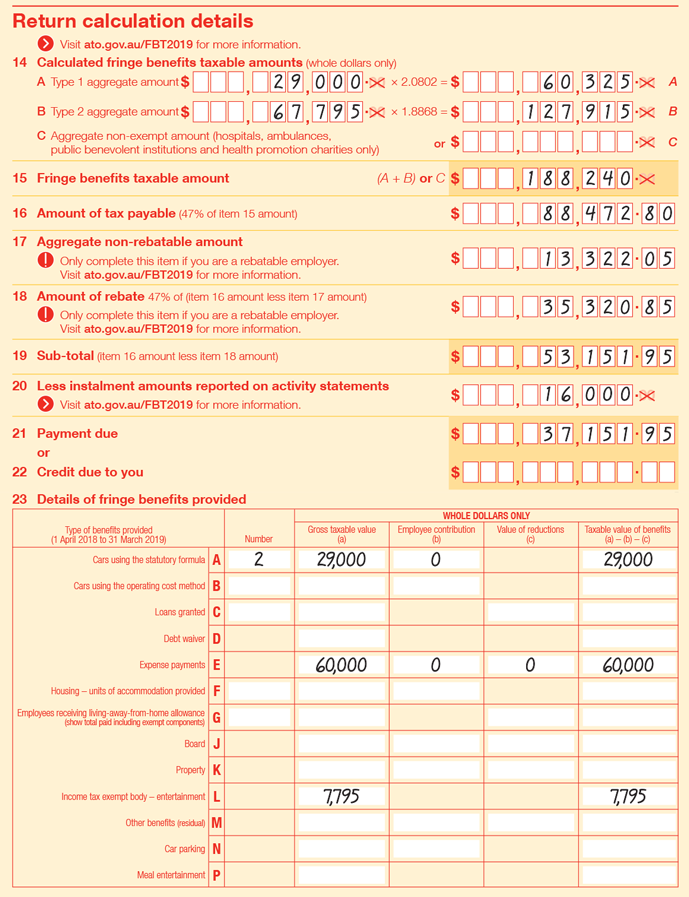

Completing Your Fbt Return 2018 Calculation Details Taxable Employers Australian Taxation Office

When How And Do I Need To Lodge A Tax Return Finance For Young Australians

Tax Returns Gold Coast Tax Accountants Grow Advisory Group

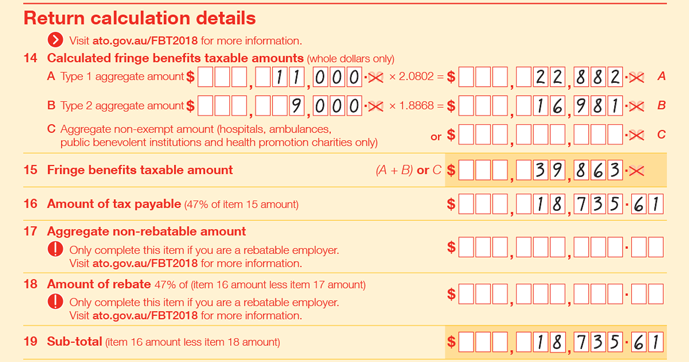

Claimable Expenses What You Can Claim On Your Tax Return

What Is Salary Sacrifice And Scheme And How Does It Work Check Out Our Salary Sacrifice Scheme Salary Sacrifice Pensions

Get Your Irs Refund Cycle Chart 2021 Here Tax Refund Business Tax Deductions Income Tax Return

Tax Refund Calculator 2020 2021 Tax Return Estimator Industry Super

The Times Group Income Tax Return Income Tax Tax Return

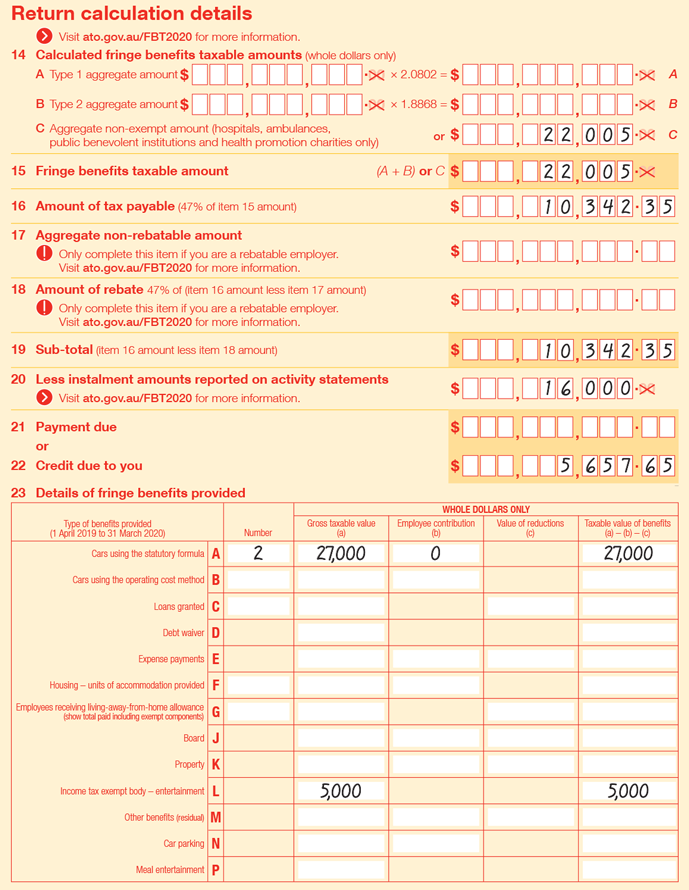

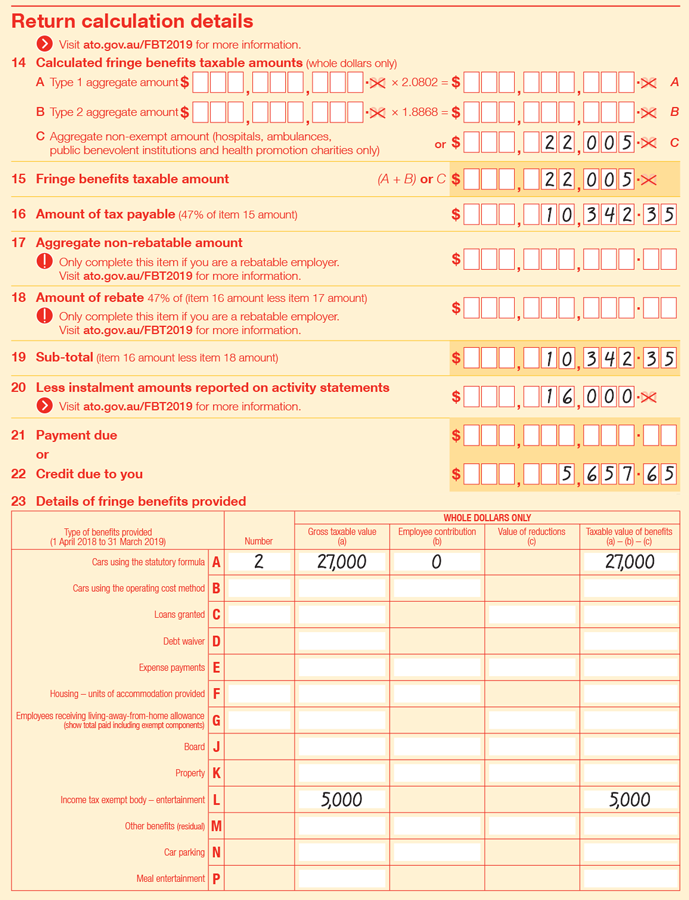

Worked Examples Not For Profit Employers Completing Your Fbt Return Australian Taxation Office

Worked Examples Not For Profit Employers Completing Your Fbt Return Australian Taxation Office

What Happens If I Don T Lodge A Tax Return Tax Help Tax Deductions Tax Return

Find An Experienced Accountant At Dns Accountants We Understand Your Business Needs That Our Accountant Focus On Y Accounting Tax Accountant Business Planning

Free Income Tax Filing In India Eztax Upload Form 16 To Efile In 2020 Filing Taxes Income Tax Income Tax Return

Do Nonprofits File Tax Returns If They Re Tax Exempt

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Worked Examples Not For Profit Employers Completing Your Fbt Return Australian Taxation Office

Post a Comment for "Salary Sacrifice On Tax Return"