Salary Sacrifice Nz

On their KiwiSaver deduction form KS2 you can inform your employer which rate to use. Salary sacrifice is where an employee packages ie.

Your Guide To Salary Sacrifice In Nz Comparebear

You can calculate results based on either a fixed cash value or a certain proportion of your salary.

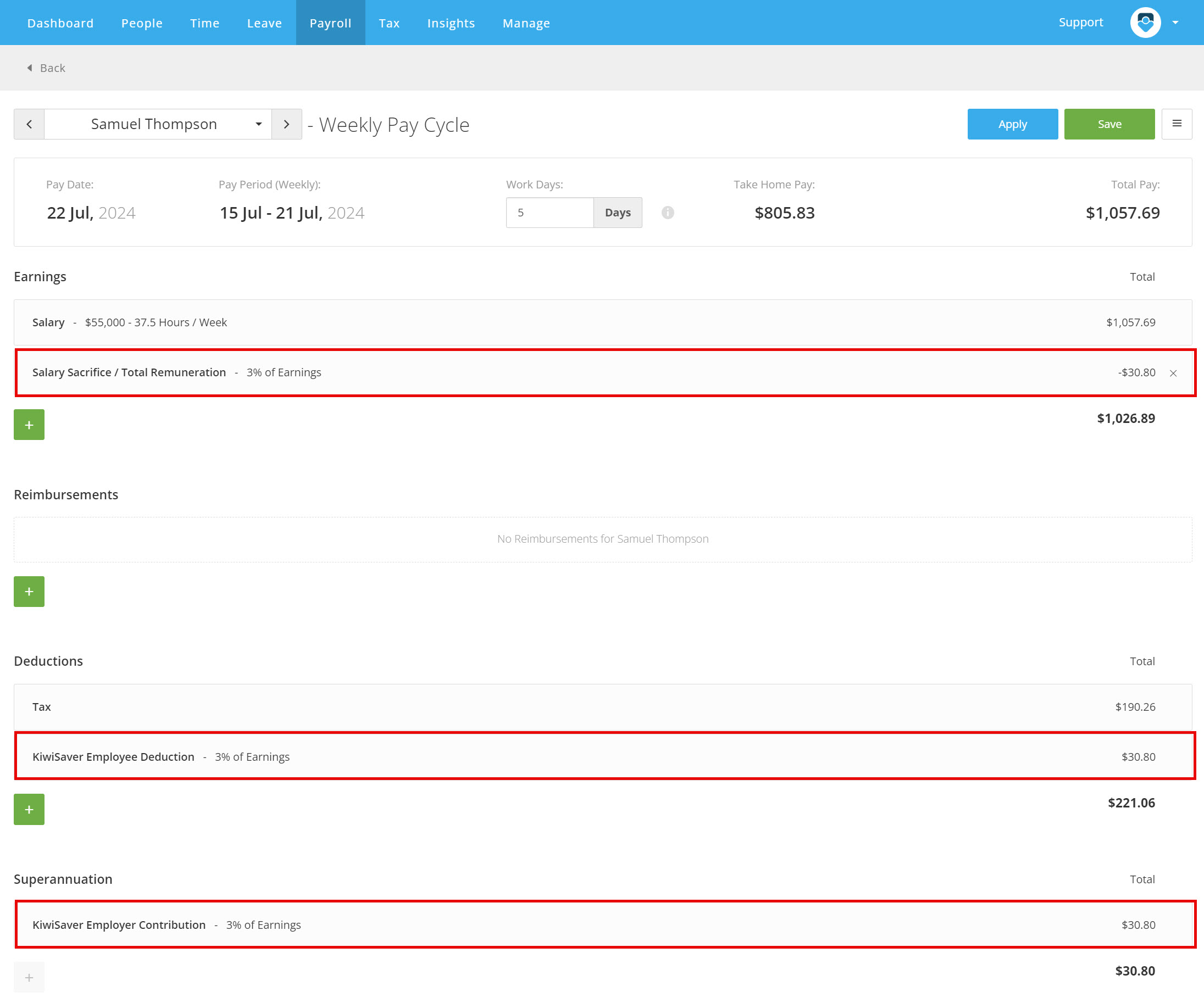

Salary sacrifice nz. To set up an employee with a total remuneration package in FlexiTime simply add Salary Sacrifice Total Remuneration to the employees default pay tab Setup Employee Edit Default Pay with a quantity of 3 or whatever the agreed employer contribution is. How does salary sacrifice work. Employees with sacrifice salary but lower salary usually save on their own ACC levy andor reduce any ACC income benefit that becomes payable.

Employee contributions can be deducted at a rate of 3 4 6 8 or 10 of their gross pay. Because of this some employees may not choose to sacrifice below this level and those who do should evaluate their disability income needs first including employers to help them become aware of the possible consequences. KPMG has asked staff to take a 15 percent pay cut calling it a salary sacrifice needed since it doesnt qualify for the government wage subsidy.

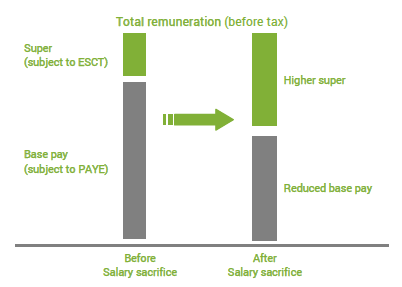

Take this common scenario. Salary sacrificing is sometimes called salary packaging or total remuneration packaging. Both receive base salary of 100000.

Salary sacrifice lets you make contributions to your pension and helps to save on National Insurance at the same time. And employers are looking to simplify salary management. She salary sacrifices 4 per cent of her income in exchange for a contribution of the same amount from her employer.

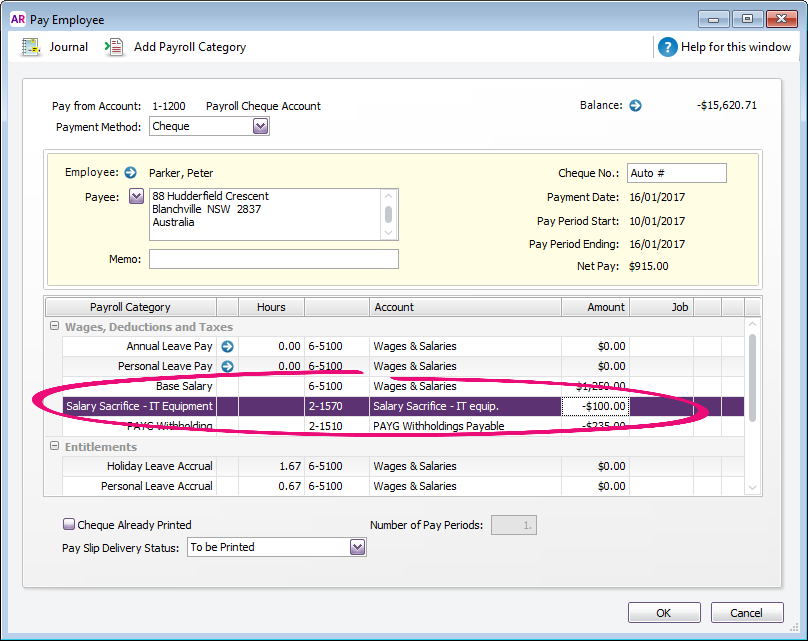

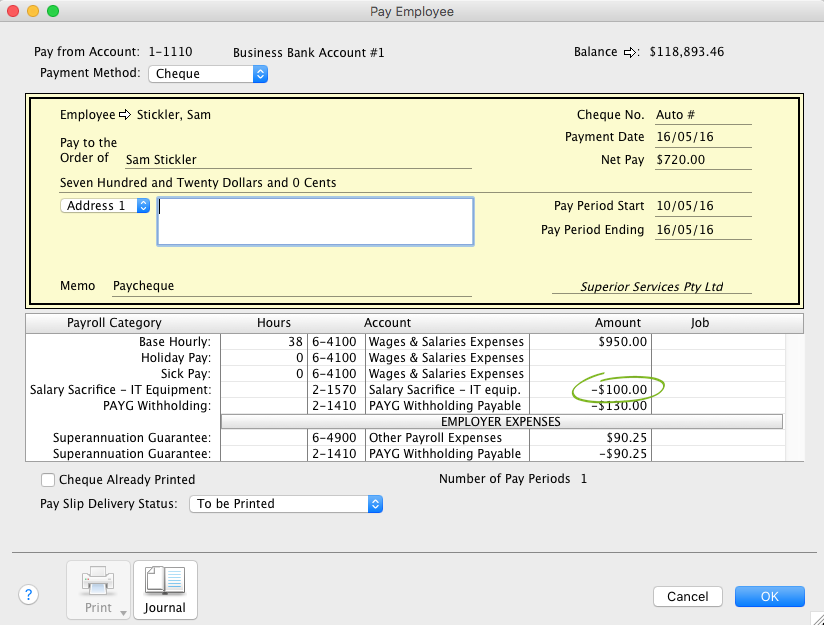

Allocate the purchase of the item being sacrificed to a Salary Sacrifice liability account. The estimates will be refined if you request a formal quote. Salary sacrifice allows you to give up some of your salary so you can claim extra benefits from your employer.

Sandy earns 100000 per year. But the sales manager is provided with company. New Zealands Best PAYE Calculator.

AMP Salary Sacrifice Calculator. This calculator generates factual information about the potential. Swaps part of their cash pay to receive remuneration in another form more suited to their needs such as higher employer contributions to a superannuation scheme.

Under an effective salary sacrifice arrangement. This has been updated for the current tax year of 202122. The minimum contribution for subsidised members is 15 of gross base salary and members may contribute higher amounts at 05 increments.

She also contributes 4. Its a tax-efficient way to make extra contributions to your pension and both you and your employer will pay lower National Insurance Contributions on your reduced salary. Minimum wage rates apply to all employees aged 16 and over who are full-time part-time fixed-term casual working from home and paid by wages salary commission or piece rates some exceptions.

Calculate your take home pay from hourly wage or salary. If you dont specify a contribution rate the default rate of 3 is used. Our Salary sacrifice calculator helps you to compare the effect on take home pay and super contributions by making additional super contributions using two different methods ie as a salary sacrifice contribution or as an after-tax contribution.

The maximum amount of member regular contributions is 3 of gross base salary in most cases though this will vary if you offer a higher Maximum Subsidy Rate to some or all of your SSRSS members. The reason for turning the amount between 39520 and 60000 into an employer contribution is to do with the way PIE income is taxed see d below. The finance manager and the sales manager are effectively doing jobs of equal size and value.

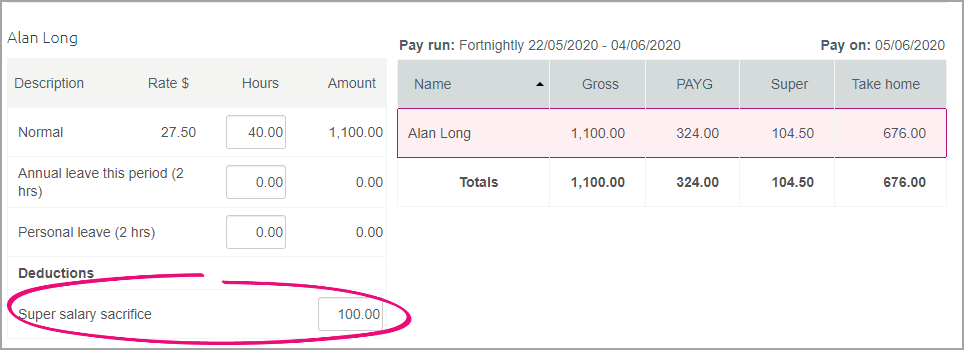

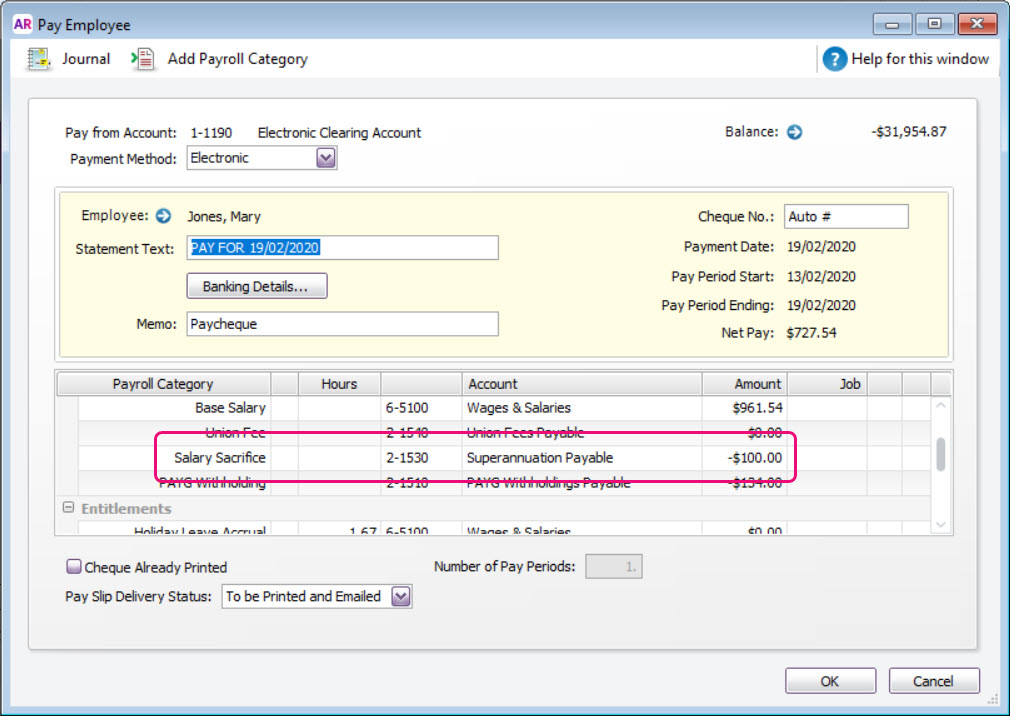

Set up a salary sacrifice deduction and link it to this account. Record the employees pay with the salary sacrifice amount deducted from their pay. It is simple to follow and shows how you can benefit from doing this.

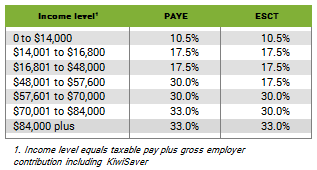

KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. SSCWT of 33 will be payable on the whole of this salary sacrifice. However those firms have not disclosed how much their reductions are.

Against this background consider how company cars are factored into the employees total remuneration package. Under the governments First Home Super Saver Scheme first home buyers can withdraw up. Previous minimum wage rates.

Salary sacrificing into super may also help you save for your first home. Input your total annual. Heres how you can handle this salary sacrifice arrangement in AccountRight.

Deloitte which is also rated as one of the big four did not. It is also cutting partner drawings by 20 to 40 percent a move in line with two other big four accountants EY and PwC. Please note that all figures in the table above are estimates only based on various assumptions and are not definitive.

Concessional contributions such as super guarantee contributions and salary sacrifice contributions that exceed this cap will be taxed at your marginal tax rate plus an excess concessional contributions charge. Types of wage rates. The Novated Lease Calculator provides a reasonable estimate of the cost of salary packaging the selected vehicle and its budgeted running costs under a Novated Lease alongside a comparison with private ownership.

Current minimum wage rates. The employee pays income tax on the reduced salary or wages the employer may be liable to pay fringe benefits tax FBT on the benefits provided in lieu of salary. Tax on sacrificed contributions between 39520 and 60000 is the same as it would have been had it been paid as salary 33 so there is no tax saving there.

Setting Up Salary Sacrifice Superannuation Myob Essentials Accounting Myob Help Centre

Salary Sacrifice Superannuation Fixed Amount Support Notes Myob Accountedge Myob Help Centre

Salary Sacrifice Total Remuneration Welcome To Flexitime Support Centre

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

New Zealand Tax Schedule For Personal Income Tax Download Table

Your Guide To Salary Sacrifice In Nz Comparebear

Salary Sacrifice Total Remuneration Welcome To Flexitime Support Centre

Salary Packaging Myths William Buck New Zealand

Increase Your Net Income With Salary Packaging

Salary Sacrifice Employee Purchases Myob Accountright Myob Help Centre

Salary Sacrifice Total Remuneration For Kiwisaver Payhero

Australia Hays Salary Guide 2013

Http Docs Business Auckland Ac Nz Doc Pensionbriefing 2007 07 Pay Salary Sacrifice Kiwisaver And Pies Pdf

Salary Sacrifice As The Employers Portion Of Contr Myob Community

Salary Sacrifice Superannuation Fixed Amount Support Notes Myob Accountright V19 Myob Help Centre

Covid 19 Coronavirus The State Sector Bosses Who Ignored Jacinda Ardern S Pay Cut Plea Nz Herald

Salary Sacrifice Employee Purchases Support Notes Myob Accountedge Myob Help Centre

Post a Comment for "Salary Sacrifice Nz"