Net Salary Calculator Quebec 2020

Enter your pay rate. This marginal tax rate means that your immediate additional income will be taxed at this rate.

A Social Trading And Investment Platform On Behance Investing Social Trading

Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany.

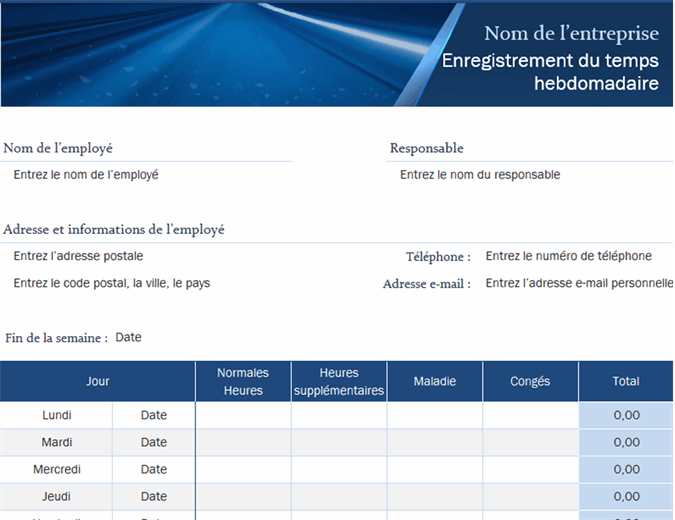

Net salary calculator quebec 2020. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. The information presented here is based on the fiscal regulations in Canada in 2020. Hours per week x 52 weeks per year Holiday Statutory weeks x hourly wages Annual Salary.

Usage of the Payroll Calculator. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. The amount can be hourly daily weekly monthly or even annual earnings.

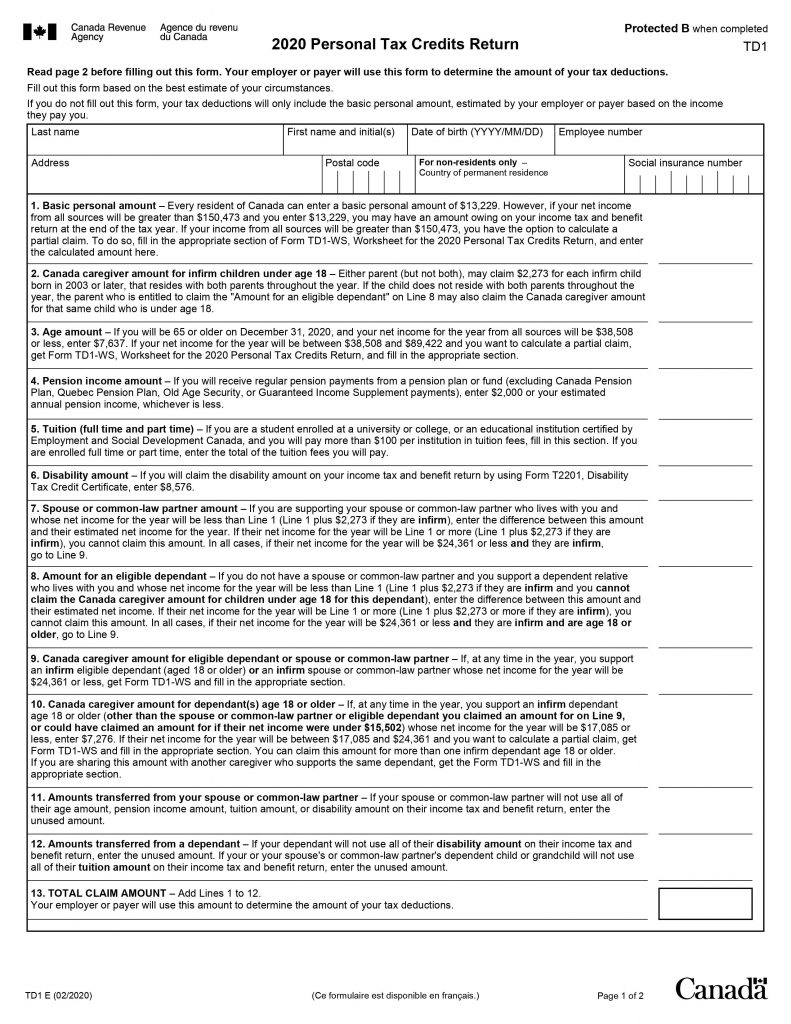

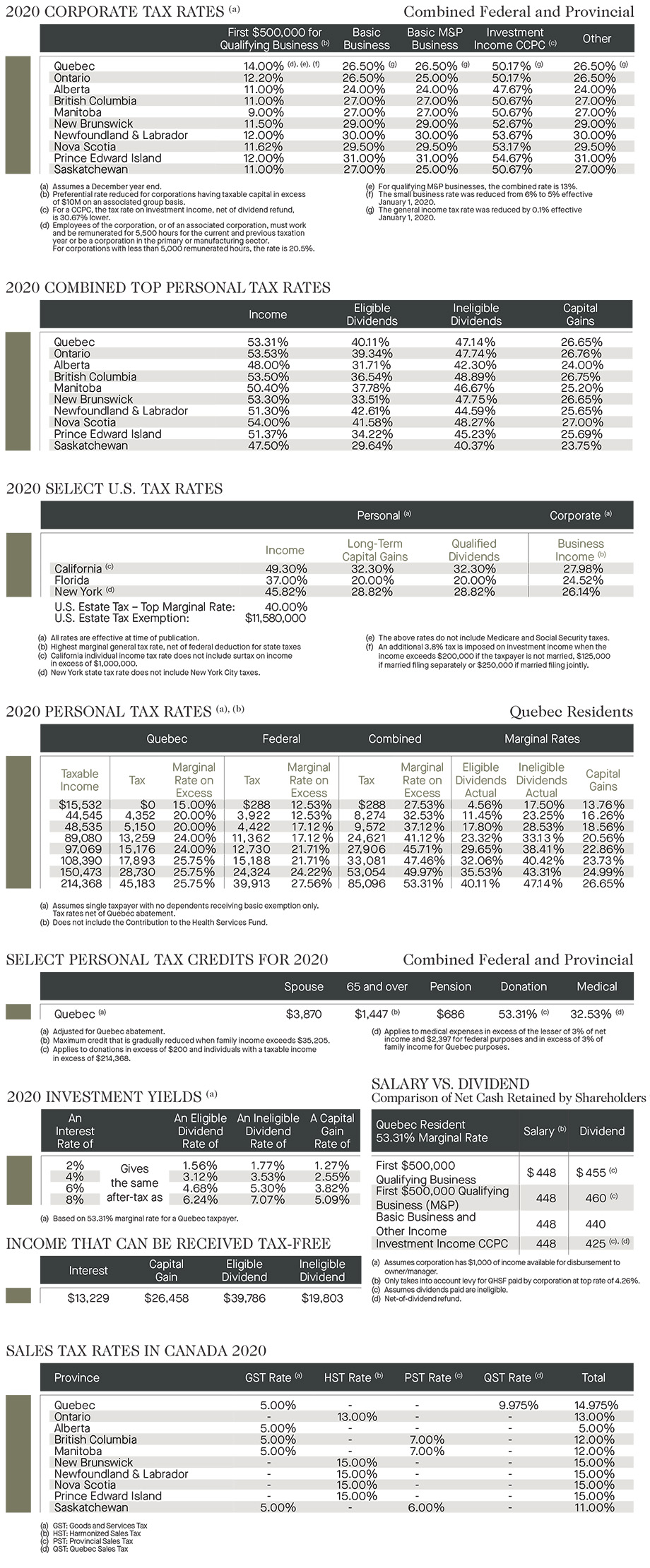

The Quebec Salary Calculator uses personal income tax rates from the following tax years 2021 is simply the default year for the Quebec salary calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Canada Quebec Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to the tax calculator. The Debt Consolidation. For example the basic personal amount is increasing from 15532 in 2020.

Quebec income tax rates are staying the same for both 2020 and 2021 but the levels of each tax bracket will be increasing. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by consolidating them into one loan. This term is commonly more related with specialized employees.

The Quebec Income Tax Salary Calculator is updated 202122 tax year. Financial Facts About Canada The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

Quebec Income Tax Calculator. Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and.

The calculator covers the new tax rates 2021. Quebec provincial income tax rates 2020 In 2020 Quebec provincial income tax brackets and provincial base amount was increased by 19. The calculator is updated with the tax rates of all Canadian provinces and territories.

Accountants bookkeepers and financial institutions in Canada rely on us for payroll expertise and payroll services for their clientele. Formula for calculating net salary in BC. Bekreftelsen kommer med en gang.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2020 income tax refund. That means that your net pay will be 40512 per year or 3376 per month. Gross annual income Taxes CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income Net weekly income Hours of work week Net hourly wage.

Quebecs personal income tax system is indexed against the Quebec consumer price index CPI. This means that tax brackets and tax credits will increase by 126. Visit cra-arcgcca for more details.

How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany. Income tax calculator takes into account the refundable federal tax abatement for Québec residents and all federal tax rates are reduced by 165. Basic personal amount in Quebec for year 2020 is 15532.

Annonce Reserver på Quebecs Leeds. Calculate your Gross Net Wage - German Wage Tax Calculator. Salary is a fixed standard payment normally paid on a monthly or yearly basis.

Trusted by thousands of businesses PaymentEvolution is Canadas largest and most loved cloud payroll and payments service. Dutch Income Tax Calculator. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488.

The indexation factor for 2021 is 126 or 10126. Your average tax rate is 221 and your marginal tax rate is 349. Annonce Reserver på Quebecs Leeds.

7 lignes Income Tax Calculator Quebec 2020. Formula for calculating the annual salary. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020.

Bekreftelsen kommer med en gang.

Formulaires Fiscaux Canadiens Guide Des Documents Pour Les Vacanciers Travaillant

Salary Calculator 2020 21 Take Home Salary Calculator India

Avanti Gross Salary Calculator

What Is The Average Net Worth Of A Canadian By Age And Province Save Spend Splurge

Pin By Lama Lola On S P Learning Websites Learning Apps Programming Apps

Ontario Td1 Pension Tax Credit

Marginal Tax Rates Under The Canada Recovery Benefit Finances Of The Nation

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Daily Marketing Calendar Template For Excel Free Download Tipsographic Business Plan Template Spreadsheet Template Business Template

55 000 After Tax 2021 Income Tax Uk

2020 Quebec Tax Rate Card Richter

Quebec Income Calculator 2020 2021

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Epingle Par Emilie Baumann Sur Voyages Je Te Veux Tout Est Possible Reve

Post a Comment for "Net Salary Calculator Quebec 2020"