Net Salary Calculator London Uk

2221 2703 2425. To compute your net income use our salary calculator.

Mortgage Calculator Financial Experts Having Years Of Industry Experience Knowledge An Interest Only Mortgage Mortgage Repayment Calculator Mortgage Calculator

The highest salaries in the UK are in the financial services and in the IT industry.

Net salary calculator london uk. An employer subtracts these taxes from the gross salary as part of its payroll calculations. Many companies and organizations consume a net salary calculator. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

26655 32431 29098. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator. The same as the median gross London income of 3916.

It is a useful tool for calculating compensations as well deductions or addition of bonuses allowances along with other crucial details. A net salary calculator template is a unique document having details about monthly or annual earnings. The latest budget information from April 2021 is used to show you exactly what you need to know.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. Wage is normally used to describe your monthly gross income. The calculator will automatically adjust and calculate any pension tax reliefs applicable.

Your gross income of 3916 per month for a single person is. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. The most recent rates and bands from HMRC inland revenue and UK.

Through a system called Pay As You Earn PAYE the employer then remits the tax directly to HMRC on behalf of the employee. You can enter a percentage or an amount. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to their own.

Higher than the median gross UK income of 3333. Monthly Overtime If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10 15. However with employer contributions also increasing to 2 this will increase our example pension pot by an additional 945 per year.

Use the calculator to work out what your employee will take home from a gross wage agreement. This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no childcare vouchers no student loan payment. This simple tool calculates tax paid and national insurance contributions.

Use the take-home pay calculator to get your monthly or annual net salary after normal UK tax and National Insurance contributions. A net salary is given to the employees worked in an organization after a specific interval of time usually one month. How to use the Take-Home Calculator.

Salary This is your total annual salary before any deductions have been made. We are happy to be considered as the number one calculator on the internet for calculating earnings proving an invaluable tool alongside any small business accounting solution or corporate payroll software. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

5 hours double time would be 5 2. The average UK salary in 2018 is 30500 for men and 25200 for women. See how much of a difference that pay rise would make or calculate your net income in the UK.

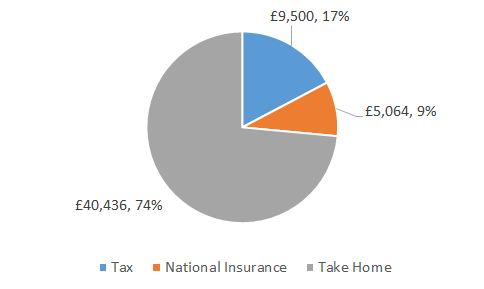

The 20202021 UK Real Living Wage is currently 1075 in London and 930 elsewhere. Annual take-home pay breakdown 2800000 Net Income. Please note if your pension is a relief-at-source type of pension the tax deducted on your pay may be higher than shown here.

Estimate your Income Tax for the current year. Find out the benefit of that overtime. For percentage add a symbol at the end of the amount.

If contribution 50 enter 50. Meaning that an employee earning 27000 per year will now pay an additonal 45 per month towards their pension. The UK PAYE tax calculator salary calculator is active since 1998.

London and Cambridge are the places where the highest average wages have been reported in 2018. Net salary is calculated when income tax and national insurance contributions have been deducted from the gross salary. After this you will pay 20 on any of your earnings between 12571 and 50270 and 40 on your income between 50271 and 150000.

Hourly rates weekly pay and bonuses are also catered for. Anything you earn above 150000 is taxed at 45. So if contributing 5 percent enter 5.

For the 2019 2020 tax year 28000 after tax is 22576 annually and it makes 1881 net monthly salary. A minimum base salary for Software Developers DevOps QA and other tech professionals in The United Kingdom starts at 30000 per year. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more.

UK Tax Salary Calculator. These values refer to your gross income. Find tech jobs in The United Kingdom.

This is known as your personal allowance which works out to 12570 for the 20212022 tax year. To use the tax calculator enter your annual salary or the one you would like in the salary box above. Your net wage is found by deducting all the necessary taxes from the gross salary.

Thank you for using our salary calculator. Why not find your dream salary too. Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear.

Enter the number of hours and the rate at which you will.

Pin By Carmie Mo On Art Tutorials Inspo Net Profit Profit Accounting Training

Nicl Recruitment 2018 For 150 Accounts Apprentices Posts National Insurance Insurance National

National Income Measurement Expenditure Method Mind Map Income Method

Stackable Shoe Drawer Shoe Storage Small Space Shoe Storage Drawers Plastic Storage Drawers

My Etsy Calculator Etsy Business Business Basics Craft Business

Excel Investment Calculator Myexcelonline Excel Tutorials Microsoft Excel Tutorial Excel

Hmrc Tax Refund Revenue Online Services

Salary Slip Limited Company For Microsoft Excel Advance Formula Youtube In 2021 Advance Excel Formula Salary Slip Microsoft Excel

56 000 After Tax Us Breakdown July 2021 Incomeaftertax Com

How To Convert Accrual To Cash Basis Accounting Http Www Svtuition Org 2014 07 How To Convert Accrual To Cash Accounting Education Learn Accounting Accrual

Pin On Web Software Design Company In Bangladesh

Salaire En Angleterre Calcule Ton Brut Net Facile

Novartis Salaries Revealed From 49 608 To 195 686 Find Out How Much The Swiss Pharma Giant Pays Its Employees In The Us Perfect Cv Resume Sales And Marketing

Mortgage Calculator 5 Mortgage Calculator Traps To Avoid Mortgage Loan Origin Mortgage Amortization Calculator Mortgage Calculator Tools Mortgage Amortization

35 000 After Tax 2021 Income Tax Uk

Post a Comment for "Net Salary Calculator London Uk"