Hourly Wage Calculator Ireland

USA Canada United Kingdom Ireland Switzerland Australia New Zealand Hourly wage calculator convert yearly salary to hourly How much is your yearly salary per hour. Full salary after tax calculation for Ireland based on 2272400 annual salary and the 2021 income tax rates in Ireland.

The Salary Calculator Irish Take Home Tax Calculator Salary Calculator Weekly Pay Salary

Universal Social Charge USC.

Hourly wage calculator ireland. 1077 per 2 weeks. The Ireland tax calculator assumes this is your annual salary before tax. Complete the Salary Survey to learn more about wages in Ireland.

For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately. What is the hourly rate for 28000 pounds a year. See how we can help improve your knowledge of Math.

If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Ireland tax calculator and change the Employment Income and Employment Expenses period. 108 per day. Even if youre considering different mortgages we can give you something to think about.

- A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C Weekly salary HW LHD. The latest budget information from April 2021 is used to show you exactly what you need to know. You will make about.

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. The Irish Living Wage rate is 1230 per hour. A standard rate of 20 which applies to lower income levels and a standard tax band of 40 which applies to higher wages.

One of a suite of free online calculators provided by the team at iCalculator. This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor. To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week.

The standard tax credit will be automatically applied when you choose your. Salaries range from 9730 EUR lowest average to 172000 EUR highest average actual maximum salary is higher. Includes Health Insurance Pension Social Security tax rates deductions personal allowances and tax free allowances in Ireland.

That you are an individual paying tax and PRSI under the PAYE system. Even if youre considering. See how different employers pay how satisfied their employees are and what its really like to work there.

In the Weekly hours field enter the number of hours you do each week excluding any overtime. The threshold between these two rates depends on the personal circumstances of the individual. Working hour per week.

The second algorithm of this hourly wage calculator uses the following equations. This is the average yearly salary including housing transport and other benefits. A person working in Ireland typically earns around 38500 EUR per year.

Need more from the Ireland Tax Calculator. Taxation in Ireland Irish Income Tax is a progressive tax with two tax bands. Choose your filing marital status from the drop-down box and choose your age range from the options displayed.

This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor. For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately. Just two simple steps to calculate your salary after tax in Ireland with detailed income tax calculations.

For other sources of income and benefits in kind the calculator assumes that these. Students or other people less than 18 years of age in Ireland have to be paid a rate of not less than 70 of the national minimum hourly wage if they work. This is the average gross salary a single adult without dependents working full-time needs to afford a socially acceptable minimum standard of living.

Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Using The Hourly Wage Tax Calculator. This is the amount of salary you are paid.

Hiring Remote Workers In France A Guide For Us Employers

Beginner S Guide To Book Cover Design Tips Tutorials Ideas Vector Illustration Tutorial Cartoon Tutorial Book Cover Design

Calculating Budget For A Horizon Europe Project Emdesk

Base Salary Explained A Guide To Understand Your Pay Packet N26

Official Launch Wedding Planner Pricing Guide Wedding Planning Worksheet Party Planner Business Wedding Planner Packages

Ie Income Tax Calculator July 2021 Incomeaftertax Com

Average Accountant Salary How Much Do Accountants Make Accounting Salary Http Gazettereview Com 2017 Accounting Services Bookkeeping Services Accounting

The World S Most Popular Theme Parks In 2018 Infographic Theme Park Amusement Parks In California Animal Kingdom Disney

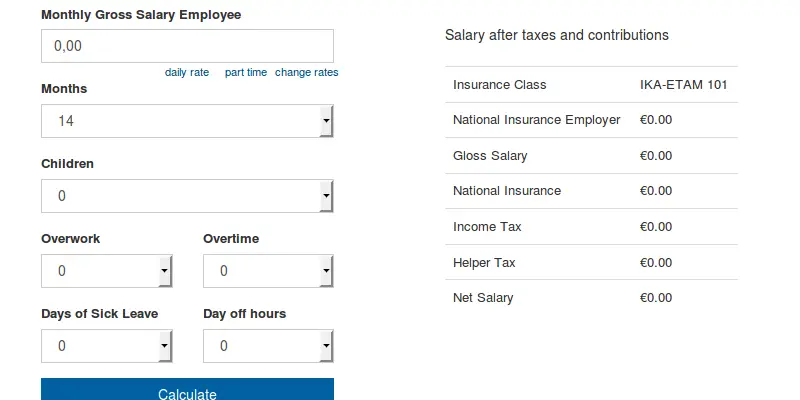

Net Salary Calculator Of Employee For Greece Updated For 2021 Vasilis Vontikakis

Weekly Employees Timesheet Excel Template Employee Work Etsy In 2021 Excel Template Business Worksheet Employee Schedule

Taxcalc Ie An Irish Income Tax Calculator

5 Important Aspects To Consider When Costing Diy Projects Elmens In 2021 Excel Budget Template Budget Template Excel Free Budget Template

Ireland Hourly Rate Tax Calculator 2021 Hourly Rate Salary

Employee Directory Excel Template Employee Planner Business Organization Tracker Printable Excel Planner Worksheet Fillable Sheet In 2021 Excel Templates Excel Small Business Directory

2021 Employee Vacation Request Excel Template Excel Templates Business Calendar Templates

Hourly Rate Calculator The Filmmaker S Production Bible Filmmaking Bible Calculator

Post a Comment for "Hourly Wage Calculator Ireland"