Net Salary Calculator Alberta

Total tax - 11566. The adjusted annual salary can be calculated as.

Pin By Eleyne Mari Sharp On Seaglass Christmas Camping Safety Travel Gear Camping Items

EI deduction - 822.

Net salary calculator alberta. George worked the five weeks before Labour Day which is 35 days. Enter your annual income taxes paid RRSP contribution into our calculator to estimate your return. The calculator is updated with the tax rates of all Canadian provinces and territories.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. Annual salary calculator for the minimum wage in Alberta for 2021. Income Tax Calculator Alberta Find out how much your salary is after tax.

Also known as Gross Income. Annual salary calculator for the minimum wage in Alberta for 2019 Hours per week - Holiday Statutory weeks Total annual working hours Minimum wage 15hour 13hour 598week 65543week 2848month x Hourly wage Annual minimum Salary. Salary After Taxes and contributions.

In the 30 days prior to Labour Day he actually worked 21 of them. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Spain affect your income. Where do you work.

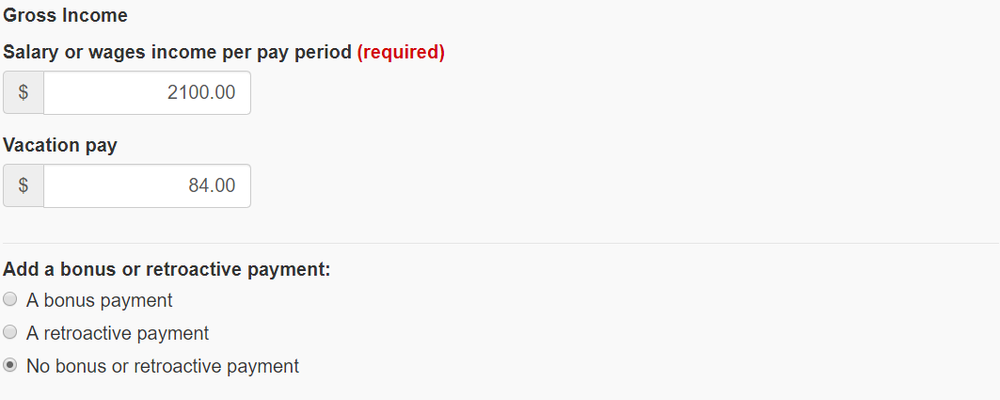

Federal tax deduction - 5185. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Enter your pay rate.

This exceeds the threshold of 15. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. You assume the risks associated with using this calculator.

_____ Yearly Gross Salary Employee. This calculator provides an overview of the annual minimum wage for workers in Alberta excluding the compensation of days off and holidays thus the annual hours worked To calculate only the minimum annual salary including holidays simply indicate 0 in the field Holiday. Your average tax rate is 221 and your marginal tax rate is 349.

Income Tax Calculator Alberta. That means that your net pay will be 40512 per year or 3376 per month. The amount can be hourly daily weekly monthly or even annual earnings.

Salary Before Tax your total earnings before any taxes have been deducted. The reliability of the calculations produced depends on the accuracy of the information you provide. It will confirm the deductions you include on your official statement of earnings.

Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020.

Easy income tax calculator for an accurate Alberta tax return estimate. Net Salary after taxes. Youll then get a breakdown of your total tax liability and take-home pay.

Labour Day is a Monday which is a day George does not usually work. CPP deduction - 2643. Usage of the Payroll Calculator.

Calculate your net income given tax rates pensions contributions and more. Calculate your net income given tax rates pensions contributions and more. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

Provincial tax deduction - 2917. The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD. Your 2020 Alberta income tax refund could be even bigger this year.

The Alberta Income Tax Salary Calculator is updated 202122 tax year. The Alberta Salary Calculator uses personal income tax rates from the following tax years 2021 is simply the default year for the Alberta salary calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Canada Alberta Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to the tax calculator. All bi-weekly semi-monthly monthly and quarterly figures.

George isnt eligible for General Holiday Pay in Alberta. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. Enter your gross income.

Net pay 40434.

Canada Province Salary Calculators 2021

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Workers Compensation Perspectives Are Wages Or Salary Fully Covered By Workers Compensation Insurance

2021 Salary Calculator Robert Half

Saudi Aramco Likely To Invest 6b In Pertamina Oil Refinery Facilities In Cilacap Central Java Revitalization Of The Compl Kilang Minyak Pertahanan Bangunan

How To Save Money In India Getmoneyrich Com Home Loans Loan Business Loans

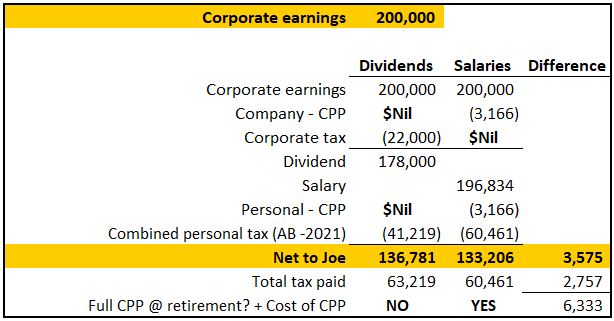

Paying Yourself As A Business Owner Salaries Or Dividends Ah Cpas

Shop Planner Business Planner Etsy Seller Planner Small Business Etsy Business Business Printable Business Goals Business Planner Small Business Organization Business Planning

How To Calculate Income Tax In Excel

Equivalent Salary Calculator By City Neil Kakkar

Novartis Salaries Revealed From 49 608 To 195 686 Find Out How Much The Swiss Pharma Giant Pays Its Employees In The Us Perfect Cv Resume Sales And Marketing

Reading A Pay Stub Worksheet Best Of Pin On Worksheet Template For Teachers Templates Printable Free Printable Checks Free Checking

Tax In Spain Issues You Need To Be Aware Of Axis Finance Com

Avanti Gross Salary Calculator

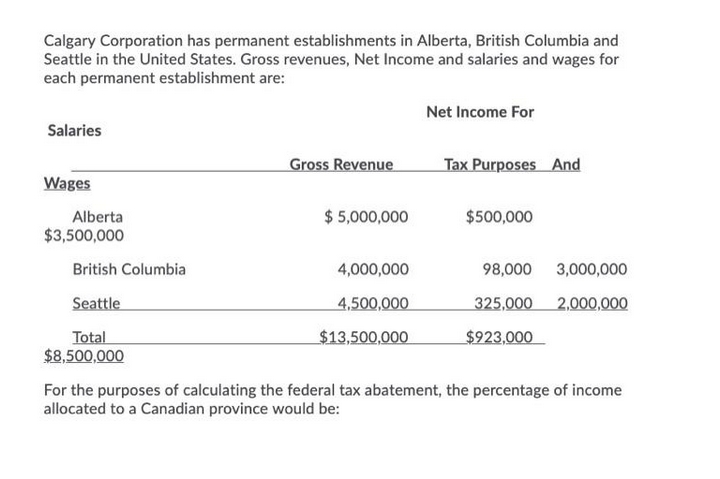

Answered Calgary Corporation Has Permanent Bartleby

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Post a Comment for "Net Salary Calculator Alberta"