Gross Monthly Income E-4

A Senior Airman receives a monthly basic pay salary starting at 2263 per month with raises up to 2747 per month once they have served for over 6 years. This FREE Monthly Income Statement Template features all 12 calendar months as well as a year to date total.

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Gross Monthly Income Hourly Rate x Number of Hours Weekly x 52 12.

Gross monthly income e-4. Consider yourself an hourly paid employee earning 35 per hour working 40 hours per week. A Specialist receives a monthly basic pay salary starting at 2263 per month with raises up to 2747 per month once they have served for over 6 years. For example if you earned 40000 last year and 50000 this year -- no matter when you received those payments over the course of the years -- the lender adds the income for both years 40000 50000 90000 and divides by 24 months to determine your average monthly gross income which is 3750 in this example 90000 24 months 3750 in average monthly income.

A Specialist is a enlisted soldier in the United States Army at DoD paygrade E-4. What is Gross Monthly Income. The resulting number can be multiplied by 52 for the weeks in the year.

The base pay is the same for an E-4 in all branches of service ranging from 25668 to 31158 per year. Vérifiez les traductions gross monthly income en français. A Senior Airman is a enlisted airman in the United States Air Force at DoD paygrade E-4.

In addition to basic pay Senior Airmans may receive additional pay allowances for housing and food as well as special incentive pay for hostile. This figure probably appears on your job offer letter and paycheck. Cherchez des exemples de traductions gross monthly income dans des phrases écoutez à la prononciation et apprenez la grammaire.

To determine your gross monthly income take your hourly rate and multiply it by 40 number of hours in a week and 52 number of weeks in a year. In digits that would be 35 x 40 hours per week which is equals to 1400. Gross Monthly Categorical Eligibility Income Standards as referenced at 106 CMR 364 Author.

They can do so by multiplying their hourly wage rate by the number of hours worked in a week. You now have a monthly income of 8400 or barely 2x rent. This Income Statement has a classic and professional design.

Gross income per month Hourly pay x Hours per week x 52 12. Network User Created Date. The SrA rank is an enlisted rank equivalent to a corporal in the Army and Marines and a Petty Officer Third Class in the Navy and Coast Guard.

An E-4 in the Air Force is called a senior airman abbreviated SrA. The final result can be divided by 12. Enter your monthly revenue and expense figures and the template will auto populate all calculated fields.

The template calculates Net Sales Gross Profit and Net Income. Gross monthly income is a financial term that is more commonly used for individuals. What if the gross income was reduced by 25 for federal income tax and 6-7 for state income tax.

Use the side-by-side layout to easily compare one months. When factoring in bonuses and additional compensation a E4 - Army - SpecialistCorporal at US Army can expect to make an average total pay of 2588 per month. This income ceiling or average gross monthly household income is also applicable when you are applying for your CPF Housing Grants.

1292021 23743 PM. Gross Monthly Categorical Eligibility Income Standards effective 02012021 Assistance Unit Size 200 of Federal Poverty Level 1 2147 2 2903 3 3660 4 4417 5 5173 6 5930 7 6687 8 7443 For each additional member Add 757. If you see their self-reported income of 12000 you might think theres enough income to cover rent obligations.

De très nombreux exemples de phrases traduites contenant gross monthly household income Dictionnaire français-anglais et moteur de recherche de traductions françaises. An applicant could have 12000 monthly gross income and wants to rent a 4000month apartment. Gross monthly income per household NIS.

Gross monthly income can also include additions such as overtime bonuses. After multiplying this amount by 52 you will get your gross annual income amount. Gross monthly income refers to the total amount you earn in a given month before taxes and other deductions.

The way that HDB calculates the formula may be different from what you think. Last updated on June 14th 2021. With a gross monthly income of 450000 here are the maximum amounts you can afford to spend per month on home costs.

Below is a sample of annual Regular Military Compensation for a servicemember at E-4 pay level with 3 years of military service. Translations in context of Gross monthly income in English-French from Reverso Context. You may be considering to apply for a HDB flat but one of the eligibility criteria is the income ceiling.

To determine gross monthly income from hourly wages individuals need to know their yearly pay.

3 Ways To Work Out Gross Pay Wikihow

Military Compensation Pay Retirement E8with24years

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Would Be The Expected Salary In Ongc After Psus Pay Revision In 2017 Quora

Wage Levels Switzerland Federal Statistical Office

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Household Monthly Income Per Person Calculator

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Will Be The Gross Salary In The Pgcil Of Rs 50 000 160 000 Pay Scale Now Quora

Military Compensation Pay Retirement E7with20years

Average Annual Wages France 2019 Statista

2018 Military Pay Charts Military Benefits

Earnings Statistics Statistics Explained

Military Pay Calculator Military Benefits

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

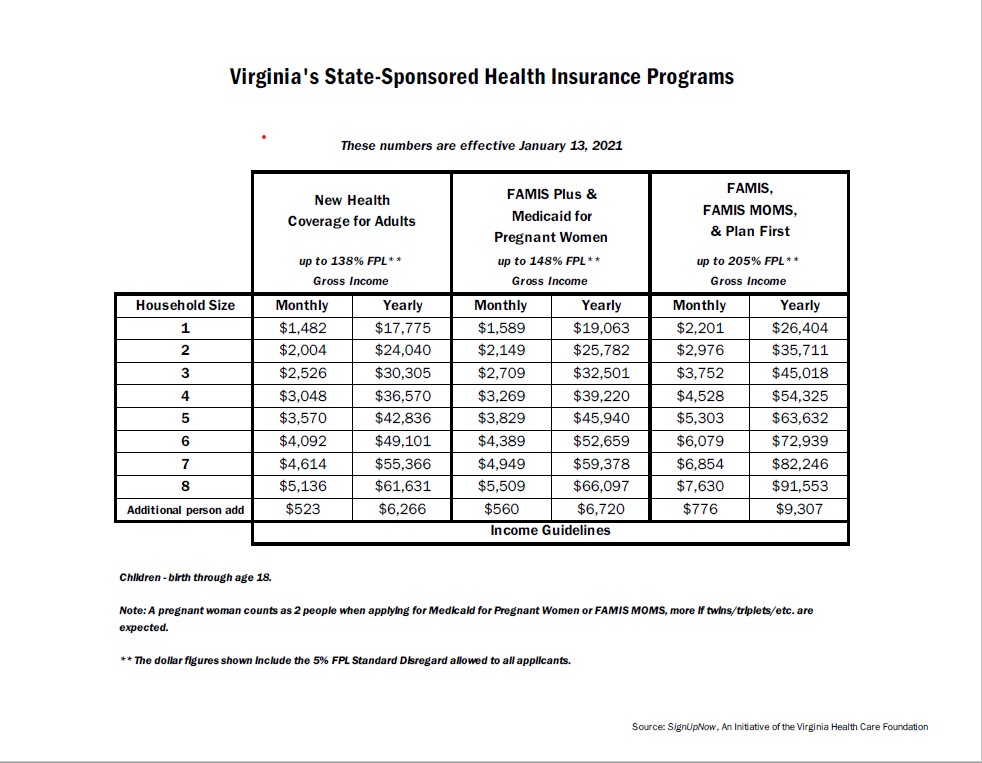

Virginia Health Care Foundation Income Guidelines

Should I Use Net Income Or Gross Income For Tenant Screening The Closing Docs

Annual Income Learn How To Calculate Total Annual Income

Post a Comment for "Gross Monthly Income E-4"