Gross Monthly Income Calculator Philippines

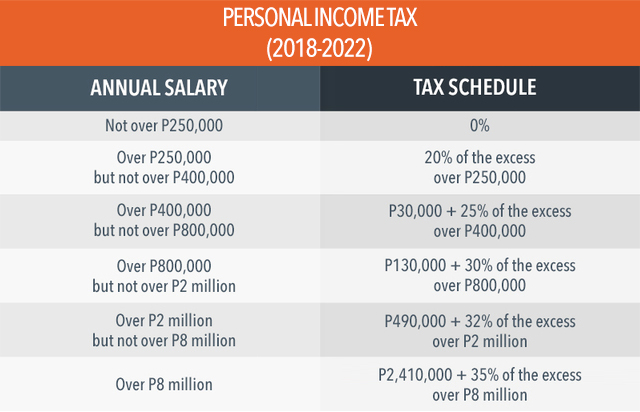

Procedures for Availment of Tax Subsidy of GOCCs. Figures shown by the calculator are based on the tax reforms tax schedule for 2017 2018 and 2019 including deductible exemptions and contributions.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

A quick and efficient way to calculate Philippines income tax amounts and compare salaries in Philippines review income tax deductions for income in Philippines and estimate your tax returns for your Salary in Philippines.

Gross monthly income calculator philippines. Free Shipping on orders over US3999 How to make these links. En 30 mayo 2021 30 mayo 2021 por Deja un comentario en gross annual income calculator philippines. SSS Pension calculator helps you compute how much monthly pension you can receive.

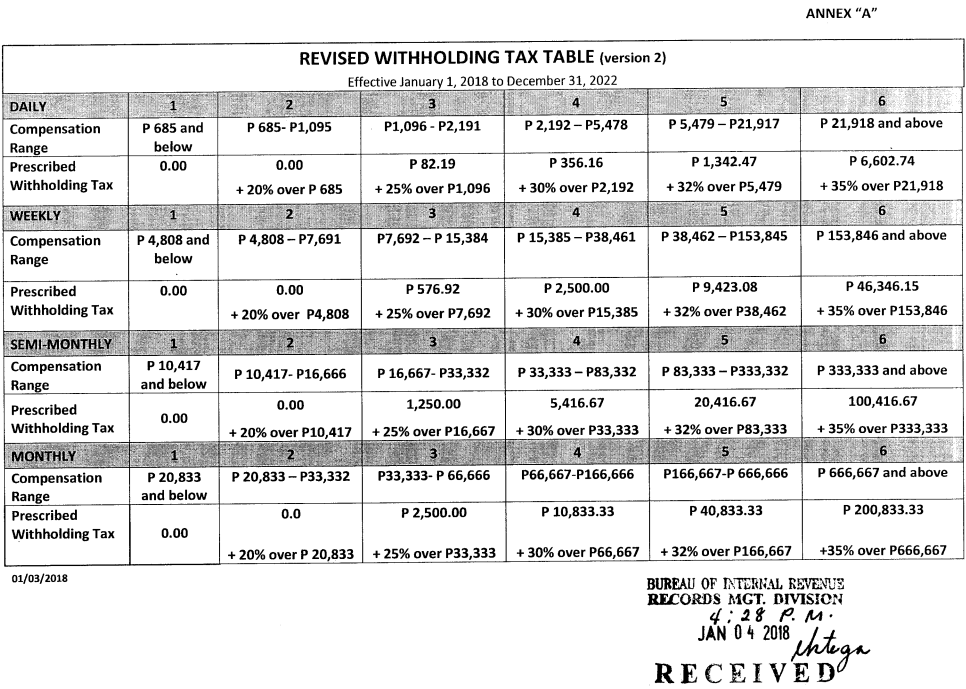

Gross salary is however inclusive of bonuses overtime pay holiday. Calculate your income tax social security and pension deductions in seconds. This tax calculator will provide a simplified computation of your monthly tax obligation under the new tax reform.

Businesses that are non-VAT are very-well aware of this tax as percentage tax. This income is taxed at progressive rates on gross income after deduction of personal and additional exemptions. Calculate your take home pay in Philippines thats your salary after tax with the Philippines Salary Calculator.

Gross annual income calculator philippines. It is relatively simple in computation. Gross annual income calculator philippines.

Please do not use the app as a replacement. We are continuously working with Certified Public Accountants when making changes to this app. Monthly amortization This is the calculated monthly amortization payments in PHP.

Gross annual income calculator philippines. An example would be start of working age at 25 and retirement age of 65. Subtract your total deductions to your monthly salary the result will be your taxable income.

Notice the selling expenses admin expenses and taxes are not taken into account. One of a suite of free online calculators provided by the team at iCalculator. May 30 2021 in Informació general.

While it automatically generates the SSS PhilHealth. EMPLOYED MEMBERS How much is your gross monthly income. After middle-income class only two classifications are left.

We created this to allow individuals to have an idea on how much their net pay would be. Gross annual income calculator philippines. So 65 - 25 40 resulttoLocaleString monthly pension.

Get an estimate of how much monthly pension you will receive when you retire. Gross monthly income calculator philippines. Convenient as it may be the DOFs online tax calculator doesnt yield 100 accurate results.

How many working years until 65. Calculate you Annual salary after tax using the online Philippines Tax Calculator updated with the 2019 income tax rates in Philippines. This online calculator computes your monthly income tax due and net take-home pay under the TRAIN law vs.

May 30 2021 By In Uncategorized. Money online Tutorial March 11 2021 February 20 2021. The monthly amortization should not exceed 40 of the Gross Monthly Income and Gross Monthly Income can be calculated by simply dividing the monthly amortization by 40.

Gross monthly wage refers to your monthly paycheck before taxes and other deductions. Highlights of the FIRB Accomplishment Report CY 2014. But 3 is the usual rate for most industries.

Gross Monthly Income Calculator. For the most part this is about 3 of ones gross monthly profit. For individuals seeking to secure CR1 spousal visas or adjust their status to lawful permanent residency green card that threshold increases to 125.

Sweldong Pinoy is for personal use. Gross annual income calculator philippines. Monthly Gross Income Calculator Mortgage Payoff Calculator Calculate The Monthly A Mortgage.

Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor. Based on the Republic Act RA 10963 the Act which is known as the Tax Reform for Acceleration and Inclusion or the so-called TRAIN the accompanying tax rates will be applied for annual or yearly income tax for every Filipino citizen. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Industries such as those that deal with the rental of property have a different set of tax rates that reach up to about 7. One of a suite of free online calculators. The old tax system based on your monthly gross income.

The upper-income class and the rich. Maaring magbayad ang mga propesyunal na kumukita ng 3 milyon pababa ng 8 na buwis sa lahat ng kabayarang siningil ng propsesyunal sa halip na magbayad ng personal income tax at percentage tax. Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400 Base on our sample computation if you are earning 25000month your taxable income would be 23400.

Magnitude of Tax Subsidy Grant and Utilization By Recipient 2006-2015. Net salary 57 829 2 100 2 300 net salary 57 829 4 400. It also shows how much youll save on taxes per month and per year.

Free Downloadable Recipe Cost Calculator Spreadsheet Money Saving Mom Food Cost Money Saving Mom Saving Tips

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Calculating Gross Pay Worksheet Home Amortization Spreadsheet Watchi This Before You Apply Your First Va Loan Student Loan Repayment Spreadsheet Worksheets

What S Ideal Monthly Income For Family Of 4 Family Income Income Family Of 4

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

How To Calculate Foreigner S Income Tax In China China Admissions

Tax Calculator Compute Your New Income Tax

Gross Income Formula Step By Step Calculations

Annual Income Learn How To Calculate Total Annual Income

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

How To Compute Philippine Bir Taxes

Tax Calculator Philippines 2021

How To Compute Your Income Tax In The Philippines

Gross Income Formula Step By Step Calculations

Looking For A Better Way To Track Your Business Income And Expenses Here S A Free Busine Small Business Expenses Business Budget Template Spreadsheet Business

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Budget Spreadsheet Template

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Post a Comment for "Gross Monthly Income Calculator Philippines"