Gross Annual Income Universal Credit

An income of 1week will be assumed for every 250 of savings over 6000 up to a maximum savings level of 16000. The date you were paid.

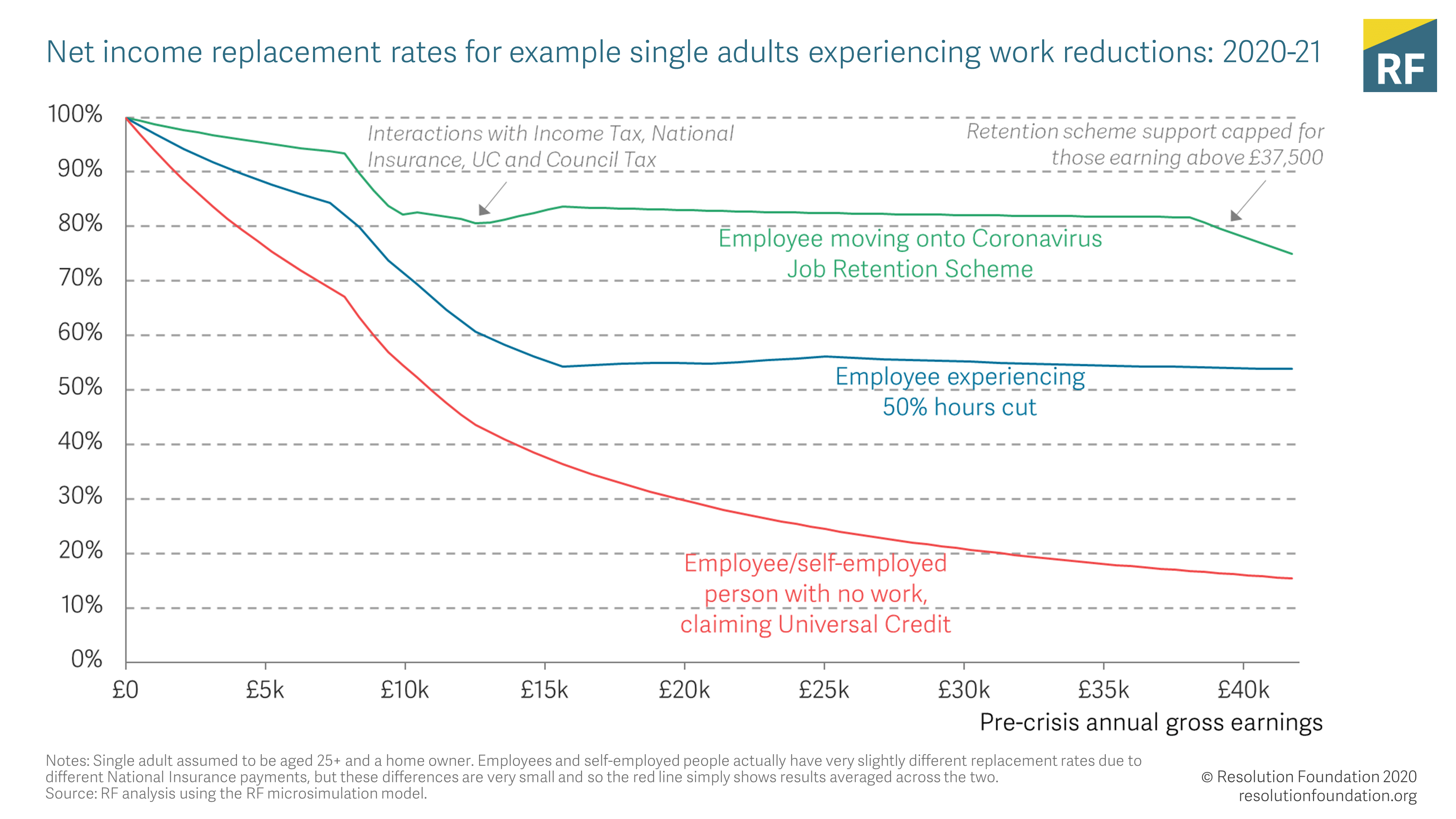

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

Income for Universal Credit purposes will be treated as earned income or unearned income.

Gross annual income universal credit. Its paid monthly - or twice a month for some people in Scotland. 12000 they may be eligible for a 50 reduction of the fee. Linstauration en 2022 dune forme de tiers payant pour le crédit dimpôt versé aux particuliers utilisant un service à domicile devrait contribuer à créer 150 à 200 000 emplois dans les trois ans à venir en partie en les sortant du travail au noir a estimé jeudi la Fédération du service aux particuliers FESP.

So 207 x 063 13041. Employer News Immedis Announces Automation Solution to Simplify and Streamline Delivery of International Payments. PHP 15000 for those with another credit card and PHP 20833 for first-time cardholders Annual fee.

It may come from employment non-means-tested benefits such as Attendance Allowance Disability Living Allowance or Personal Independence Payment. Any capitalsavings you have under 6000 is ignored. On switching to the cash basis and from it to the accruals basis.

If your savings are between 6000 and 16000 it will be treated as if youre receiving an income from this money when calculating your Universal Credit. How much National Insurance you paid. Gross annual income is income before tax.

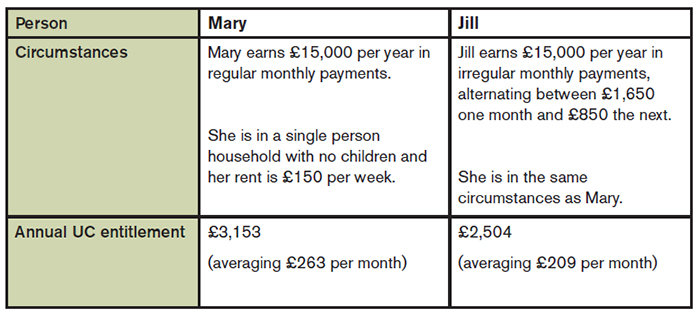

What is income for UC. How much Universal Credit you actually get in any month will be based on the amount of earnings in the RTI system so its important its correct. Universal Credit Plaintiffs Can Lose 1040 Annual Income Overnight I was embarrassed for most of my life but Im not afraid anymore-Cannabis Health News.

Savings in Universal Credit are to be treated in the same way as in means tested benefits. Where your annual net income is how much you bring home in your actual paychecks after deductions are taken out your gross income is how much you earn before deductions and taxes are. People with savings above 16000 will not be eligible for UC.

There are no transitional rules. Unless the application specifies otherwise this is usually what the issuer is looking for. The DWP will take off 435 a month for each 250 or part of 250 of capital above 6000.

For example the DWP will take off 435 if you have. Heres how the amount of capital you have will affect your Universal Credit claim. Disregards in Universal Credit.

For every 1 of the remaining 207 you get 63p is taken from your Universal Credit payment. Details of any contributions made to a pension scheme and whether they are paid from your gross. Your total annual income before anythings taken out.

Crédit Agricole SA. Informs the public that the French and English versions of its 2020 Universal Registration Document and Annual Financial Report have been registered with the French Financial Market Authority AMF on March 24 2021 under number D21-0184. Your gross income minus taxes and other expenses like a 401k contribution.

The home you live in If you have more than 6000 of capital it will reduce your Universal Credit payments. Remission based on income. Your earnings will be assessed monthly to ensure your Universal Credit award is always accurate.

If it is not specifically included as either of these then it will be disregarded. Earned income is subject to a 63 taper whereas unearned. Any capitalsavings you have worth between 6000 and.

The assessment period begins with the first date of entitlement and. When completing their self-assessment tax returns Universal Credit claimants must adjust their annual accounts to ensure that income and expenses are only declared once. In other words what you end up.

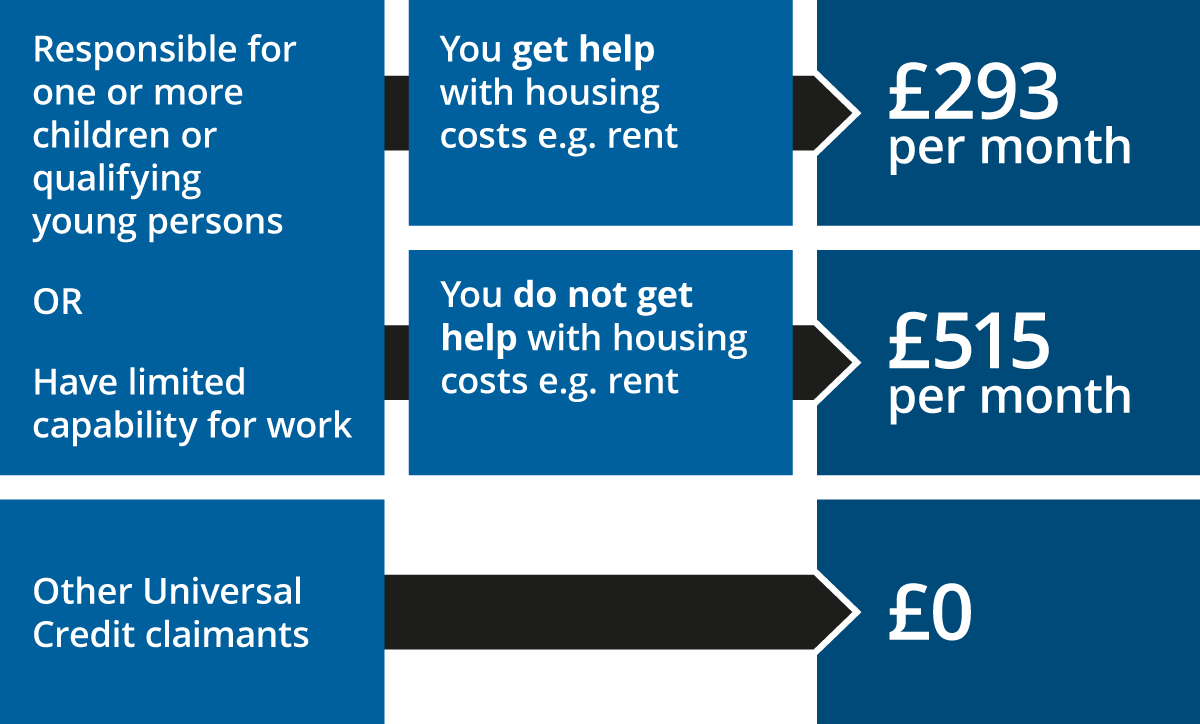

This means you can earn 293 without any money being deducted. Universal Credit is a payment to help with your living costs. Monthly income requirement.

La Commission européenne veut en effet remettre au goût du jour sa directive sur les contrats de crédit aux consommateurs datant de 2008 qui impose un socle réglementaire minimal et commun en Europe. You may be able to get it if youre on a low income out of. No annual fee for life Interest rate.

The Taper Rate is the rate at which your maximum Universal Credit award is reduced as your earnings increase. Universal Credit claimants must leave the cash basis if their annual turnover is greater than 300000. Un certain nombre dÉtats membres ont appliqué la directive 200848CE à des domaines qui ne relèvent pas de son champ dapplication afin de relever le niveau de protection des.

Your gross annual income is the amount you earn before any deductions such as income tax withholding employee benefit costs or retirement plan contributions are deducted from your pay. Savings below 6000 will have no effect. The importance of determining whether income is earned or unearned can be seen in the calculation of UC entitlement.

This income will be 435 for each 250 or part of 250 you hold regardless of whether you receive any income from your savings or not. How much tax you paid. Your gross taxable pay.

If the donors gross annual income is less than. A Taper Rate of 63 means losing 63p of your maximum Universal Credit award for every 1 you earn over your Work Allowance. If your annual salary is 48000 your gross monthly income would be 48000.

Here are a few terms you might see when asked for your annual income on credit card applications. When you phone to report your earnings yourself you will need to provide.

Universal Credit Factsheet Pma Accountants

Http Www Oecd Org Officialdocuments Publicdisplaydocumentpdf Cote Eco Wkp 2018 12 Doclanguage En

Single Dad On Universal Credit Gets Nothing For 2 Months Because Of Pay Cheque Glitch Here S How To Avoid The Same Trap

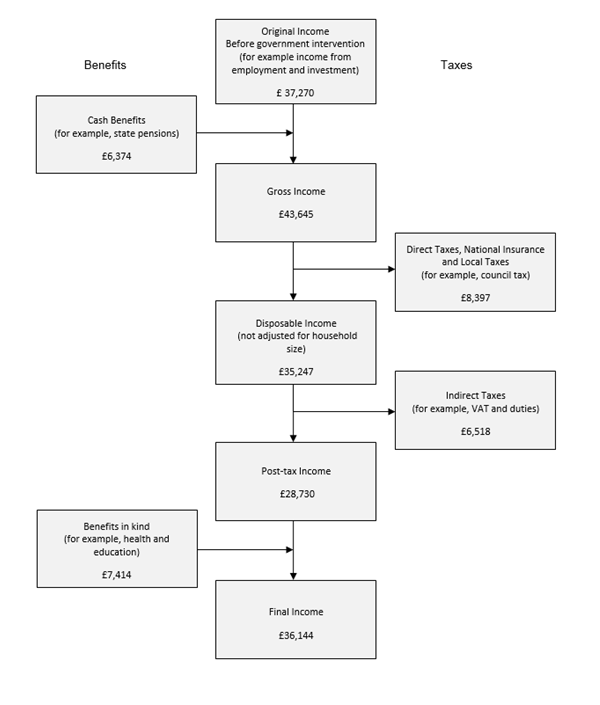

The Effects Of Taxes And Benefits On Household Income Financial Year Ending 2018 Office For National Statistics

Understanding Universal Credit For Employers How Universal Credit Works

Universal Credit Factsheet Pma Accountants

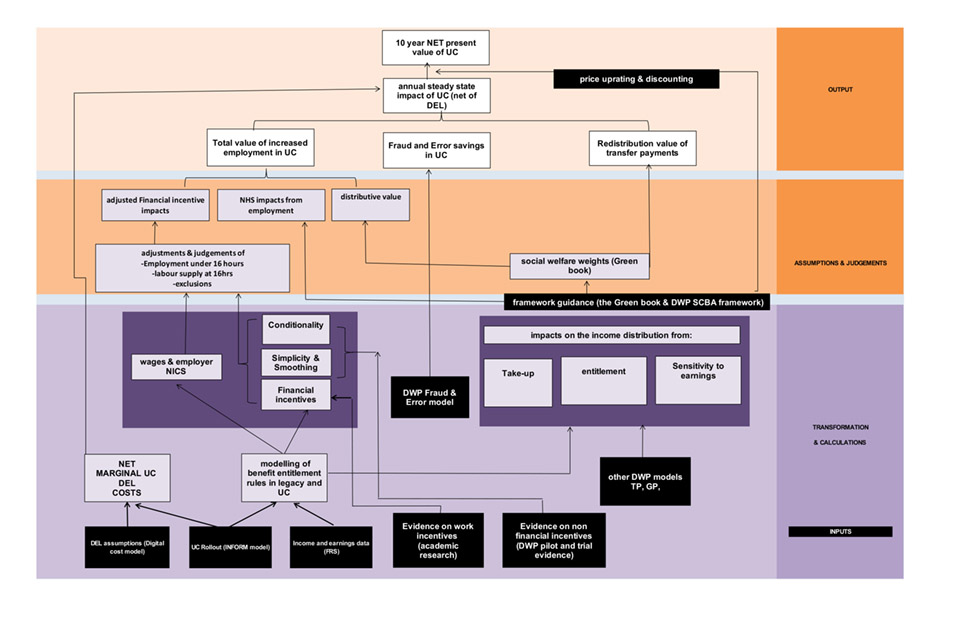

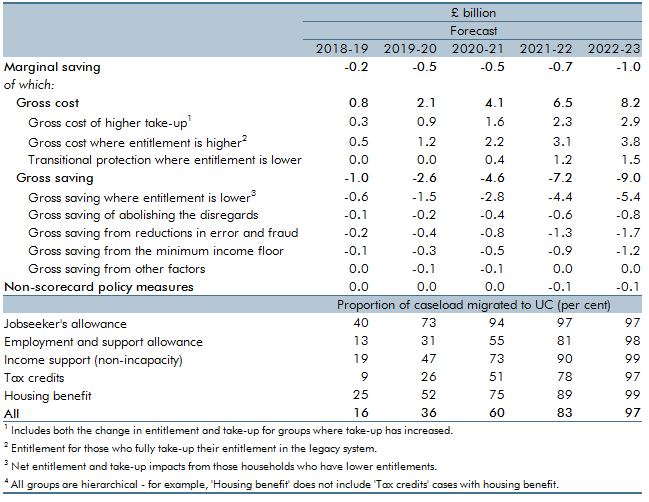

Welfare Spending Universal Credit Office For Budget Responsibility

Understanding Universal Credit How Earnings Affect Universal Credit

Universal Credit Factsheet Pma Accountants

Universal Credit And Employee Pay Low Incomes Tax Reform Group

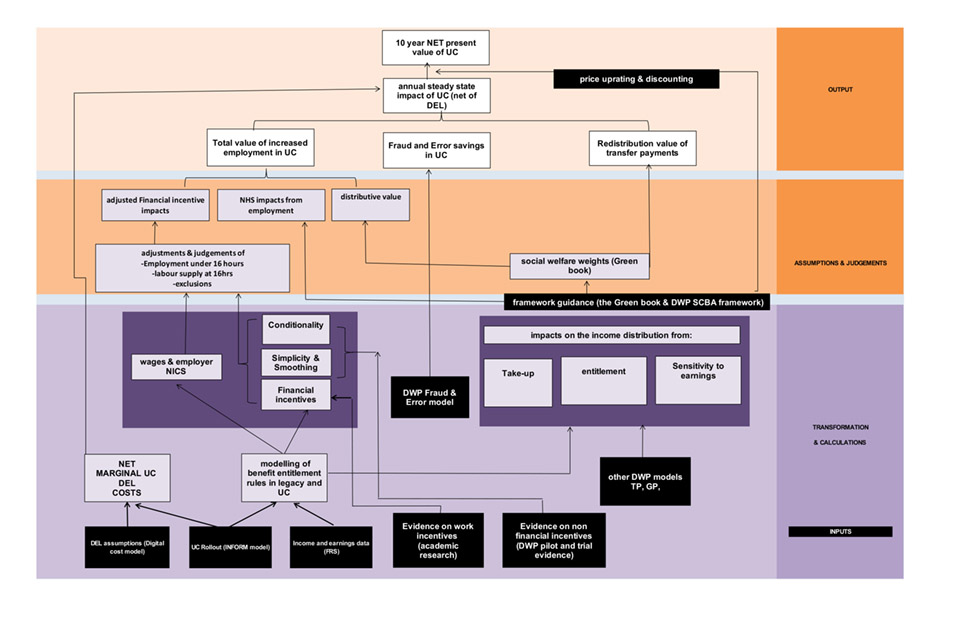

Universal Credit Programme Full Business Case Summary Gov Uk

Https Www Ifs Org Uk Uploads Publications Bns Universal 20credit 20and 20its 20impact 20on 20household 20incomes 20the 20long 20and 20the 20short 20of 20it 20bn248 Pdf

Understanding Universal Credit For Employers How Universal Credit Works

Http Www Oecd Org Officialdocuments Publicdisplaydocumentpdf Cote Eco Wkp 2018 12 Doclanguage En

Https Www Cne Siar Gov Uk Media 4664 Ema Applicationguidance Pdf

Https Www Lbbd Gov Uk Sites Default Files Attachments Universal Credit Full Service A Guide For Las V1 Pdf

Universal Credit Will Be A Disaster For The Self Employed Who Is Listening Rsa

Http Www Oecd Org Officialdocuments Publicdisplaydocumentpdf Cote Eco Wkp 2018 12 Doclanguage En

Https Www Lbbd Gov Uk Sites Default Files Attachments Universal Credit Full Service A Guide For Las V1 Pdf

Post a Comment for "Gross Annual Income Universal Credit"