Gross Annual Income Compute

Find your total gross earnings before deductions on your pay stub. If you are an employee and earn an annual salary you can quickly compute your gross monthly income by dividing your yearly salary by 12.

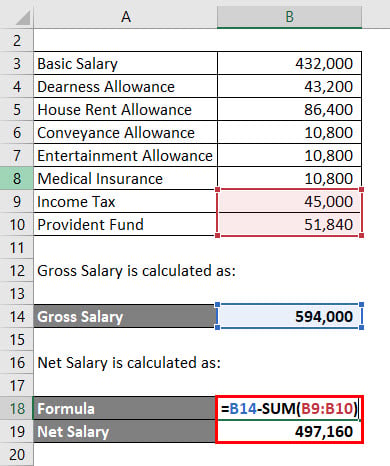

Salary Formula Calculate Salary Calculator Excel Template

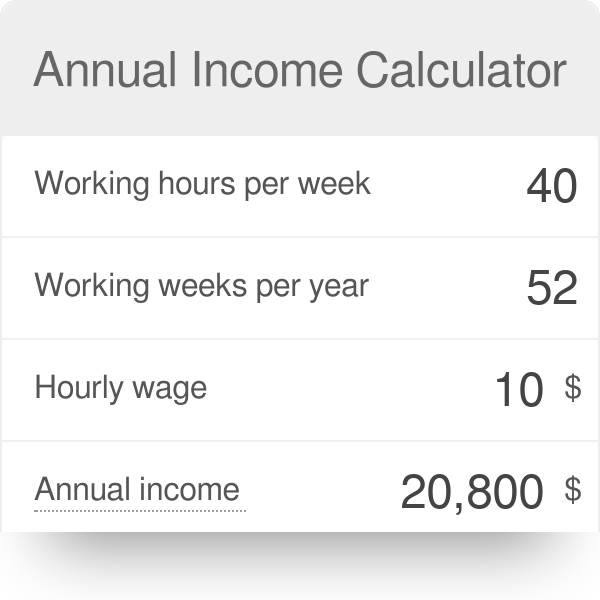

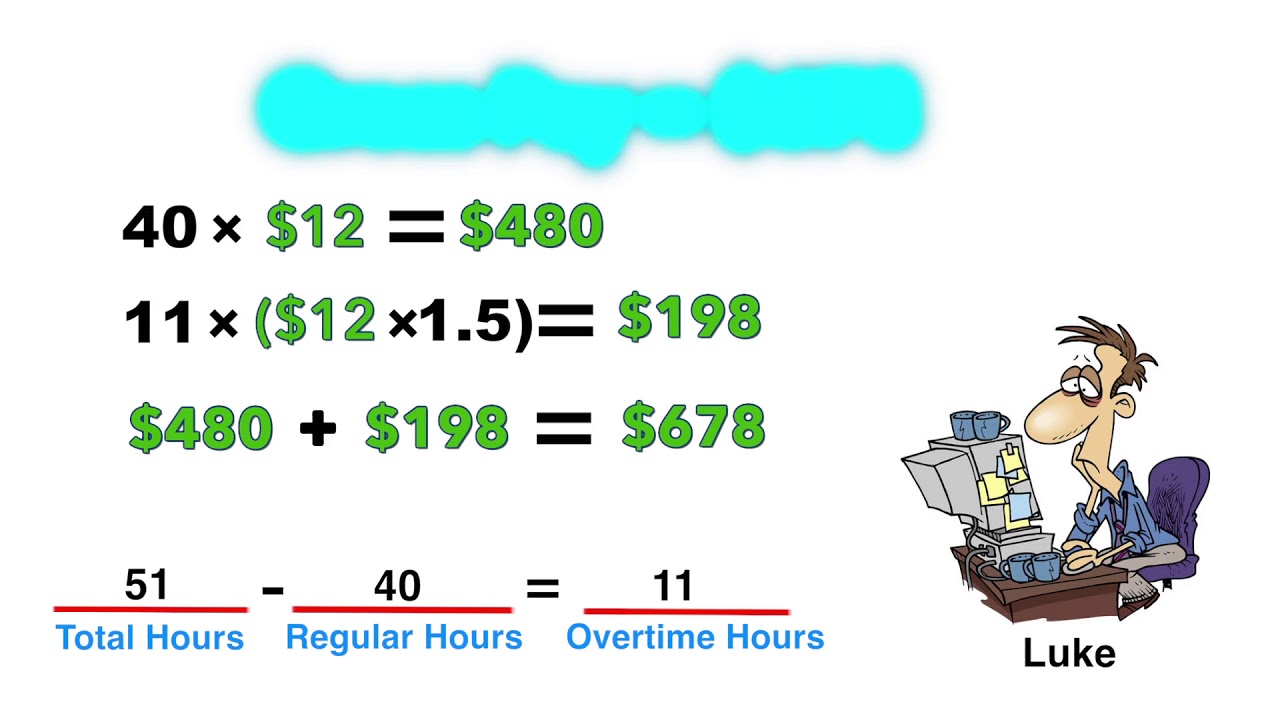

Just remember to use your gross hourly wage.

Gross annual income compute. Get the annual gross income. De très nombreux exemples de phrases traduites contenant annual gross Dictionnaire français-anglais et moteur de recherche de traductions françaises. Skip the Gross Compensation Income field because this figure is.

Calculate your annual salary with the equation 1900 x 26 49400. Gross annual income is the sum total of all income earned in a given year for an individual or a company. Computation of total income tax due.

The resulting number can be multiplied by 52 for the weeks in the year. Since the mixed-income earner is exempted from paying income tax on compensation he only has to file and pay the Php. 1 of their gross annual income and in situations of hardship maximum.

De très nombreux exemples de phrases traduites contenant combined gross annual income Dictionnaire français-anglais et moteur de recherche de traductions françaises. Suppose you are paid biweekly and your total gross salary is 1900. Calculate your annual salary.

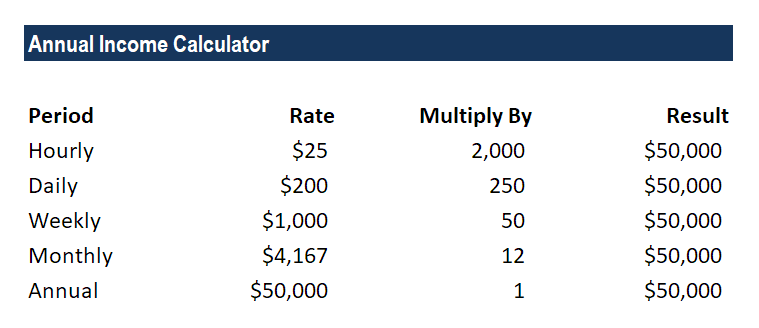

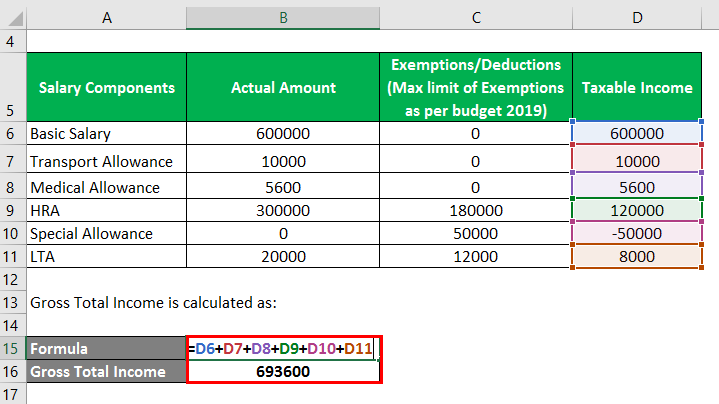

Gross Revenue Formula To calculate it the only thing you need to do is sum all incomes that were recorded from sales. Gross income per month Annual salary 12. The result in the fourth field will be your gross annual income.

Php 180000 x 008 Php 14400. Gross income per month Hourly pay x. Php 15000 x 12 months Php 180000.

If youre wondering how to calculate gross annual income by yourself - use the formula mentioned earlier. The final result can be divided by 12. 2 of their gross annual income.

Gross annual income refers to all earnings Earnings Before Tax EBT Earnings before tax or pre-tax income is the last subtotal found in the income statement before. Gross Revenue Total Revenue dont include Cost of Goods Sold How do you Calculate Gross Revenue. It is different from net income which refers to th.

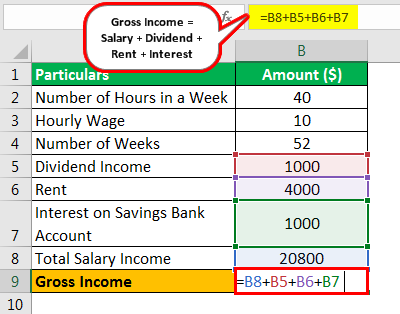

The first four fields serve as a gross annual income calculator. Under Regular Compensation type your basic. Find out all the sources of income like salary dividends rent etc.

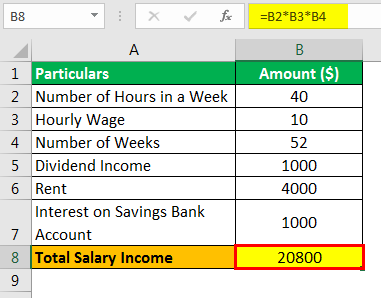

To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator. Multiply the gross income by 8 to compute the income tax due. Gross Income Salary Rent Dividends Interest All Other Sources of Income.

To determine gross monthly income from hourly wages individuals need to know their yearly pay. Annual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. Proceed to the Taxable Compensation Income section.

According to Measom a distinction must be made between being paid twice a month and every two weeks and confusing the two results in a wrong calculation. Add up the income taxes due on compensation income and business income. Aggregate all these sources of income obtained in the first step.

How often a person gets paid and the amount determines annual gross income. One example is a 1200 weekly pay being multiplied by 52 to get an annual gross income of 62400. To do the calculation for an individual use the following steps.

De très nombreux exemples de phrases traduites contenant annual gross premium income Dictionnaire français-anglais et moteur de recherche de traductions françaises. De très nombreux exemples de phrases traduites contenant total gross annual income Dictionnaire français-anglais et moteur de recherche de traductions françaises. Select your payroll period how often you receive your pay.

Pick Semi-Monthly if you receive your salary twice per. They can do so by multiplying their hourly wage rate by the number of hours worked in a week. If youre paid based on an hourly basis you will have to find your gross annual income first Multiplying your hourly rate by the number of hours you work a week then multiplying this amount by 52 you get your gross annual income.

Multiply this amount by the number of paychecks you receive each year to calculate your total annual salary.

How To Calculate Net Income 12 Steps With Pictures Wikihow

4 Ways To Calculate Annual Salary Wikihow

Gross Annual Income Calculator

How To Calculate Net Income 12 Steps With Pictures Wikihow

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

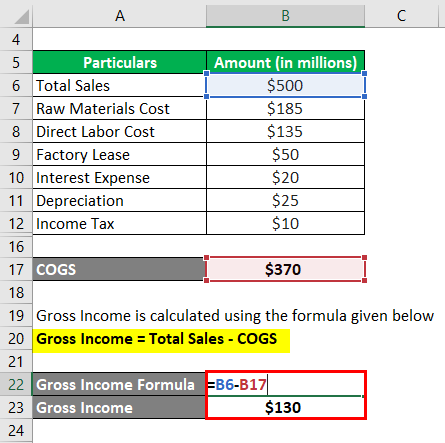

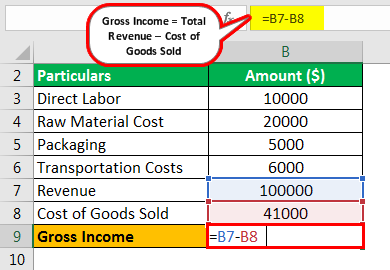

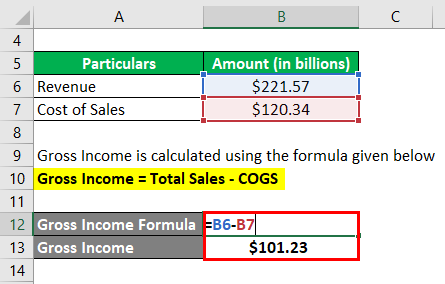

Gross Income Formula Step By Step Calculations

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Income Formula Step By Step Calculations

Annual Income Learn How To Calculate Total Annual Income

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

How To Calculate Net Salary Gross Salary In Excel Youtube

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Gross Pay Youtube

Gross Income Formula Calculator Examples With Excel Template

How To Calculate Net Income 12 Steps With Pictures Wikihow

Gross Income Formula Step By Step Calculations

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Compute Quarterly Income Tax Return Philippines 1701q Business Tips Philippines

Gross Income Formula Calculator Examples With Excel Template

Post a Comment for "Gross Annual Income Compute"