Salary Sacrifice Uk Pension

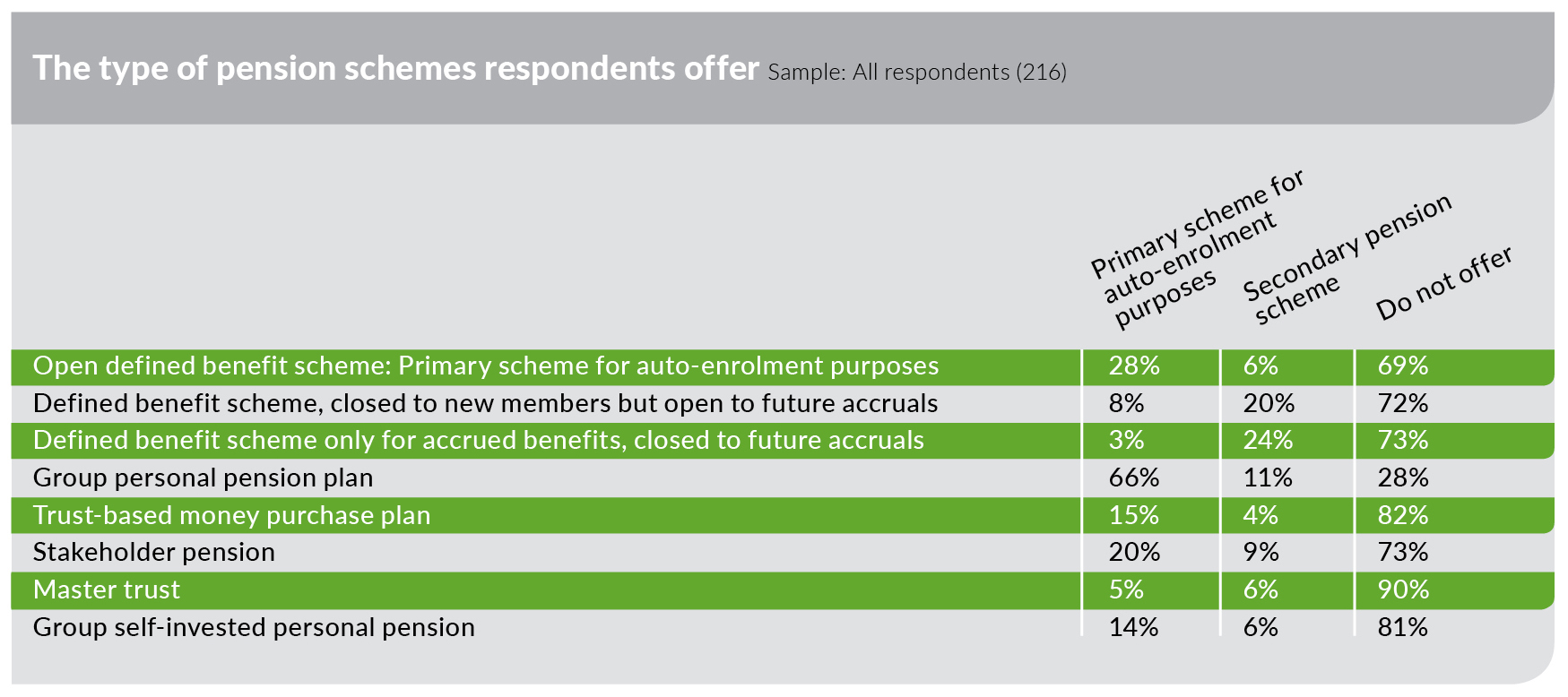

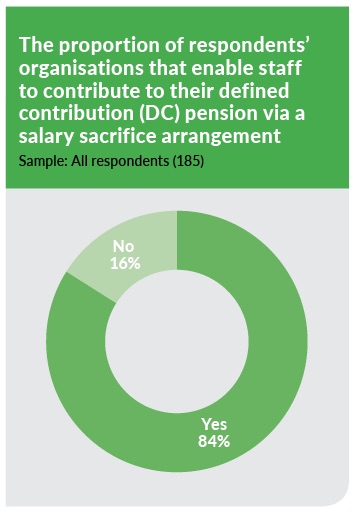

According to the research 78 of respondents said that their workplace pensions include salary sacrifice schemes with another 9. What is a salary sacrifice pension.

Exclusive 74 Offer Salary Sacrifice Pension Arrangements Employee Benefits

Transfer your UK Pension to a Recognised Overseas Pension Scheme.

Salary sacrifice uk pension. Salary sacrifice is commonly used to boost your pension but you can also give up salary in return for benefits such as bikes mobile phones and bus passes. Annonce Get access to your capital at a time and place you want in the currency of your choice. If youre part of a workplace pension you and your employer will contribute every month.

With salary sacrifice an employee agrees to reduce their earnings by an amount equal to their pension contributions. October 22 2019 Tony Stevens Salary Sacrifice Pension. If the amount of your salary you choose to sacrifice brings you below a certain threshold you may lose a proportion of life cover your employer provides.

It means that contributions from your employer increase except that they are really. Salary sacrifice is a tax-efficient way for you to make pension contributions. The minimum your employer must contribute is 3 in the UK though they can choose to contribute more.

What are the downsides of salary sacrifice. Salary sacrifice schemes allow employees to agree to reduce their earnings by an amount equal to their pension contributions and in exchange the employer then agrees to pay the total pension contributions. One way to increase these contributions is via a salary sacrifice scheme.

It allows you to give up some of your gross salary in exchange for a non-cash benefit such as an employer contribution. Salary sacrifice can affect an employees entitlement to earnings related benefits such as Maternity Allowance and Additional State Pension. Salary sacrifice pension tax relief Usually the personal contributions you make to your pension are eligible for tax relief from the government.

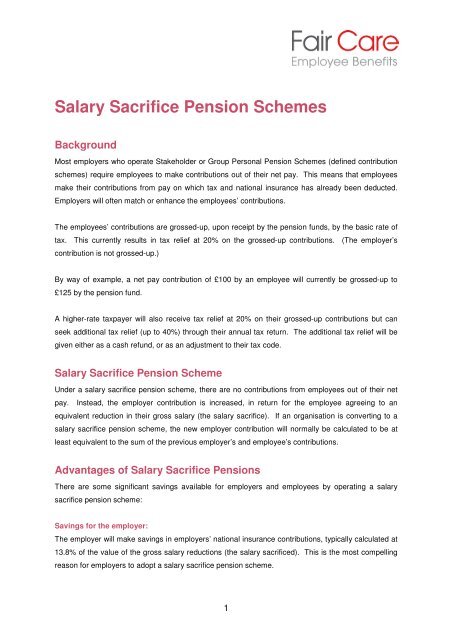

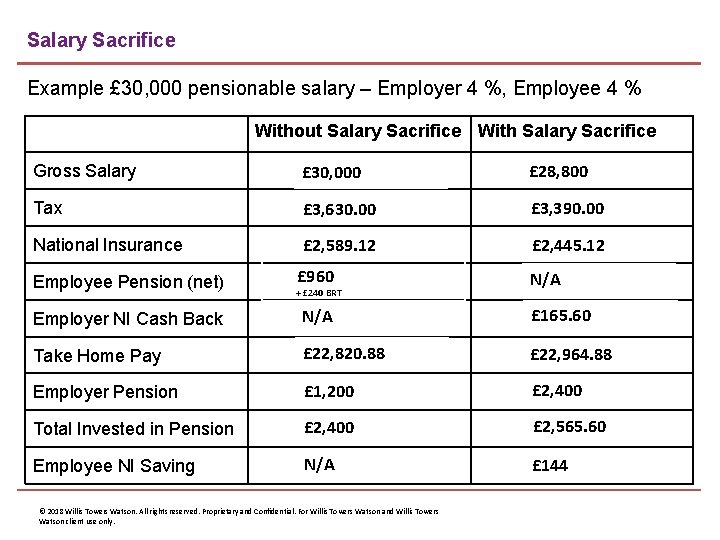

Salary sacrifice pension example On a salary of 25000 20000 after tax suppose you currently put 5 or 1250 1000 250 tax relief at 20 into your pension each year and your employer contributes 3 resulting in a total of 2000 into your pension each year. Salary sacrifice enables you to exchange part of your salary for a non-cash benefit from your employer such as increased pension contributions. Find out more about tax relief.

Annonce Get access to your capital at a time and place you want in the currency of your choice. This means tax relief cannot be claimed because the employee has been taxed on a lower amount of salary. It reduces your immediate overall monthly income but are the long-term benefits worth the short-term sacrifice.

There are two ways in which you can do this simple salary sacrifice and SMART Save more and reduce tax. November 14 2019 Tony Stevens Salary Sacrifice Pension Salary sacrifice is an arrangement in which you exchange part of your salary for extra benefits from your employer such as pension contributions or childcare vouchers. The total limits for tax benefits on payments into a salary sacrifice pension scheme include an employees total pension pot and is currently capped at 40000 per year before additional taxes are incurred for basic rate taxpayers.

Salary sacrifice pension tax relief. Salary sacrifice may affect an employees entitlement to contribution based benefits such as Universal Credit and State Pension. This is a way to make your pension saving more tax-efficient and could mean your take home pay increases.

If you sacrifice some of your salary to make payments into your pension then you are also lowering your income. If for example the non-cash benefit is a pension contribution your employer would pay this along with a contribution they might make directly into your pension pot. A salary sacrifice scheme is a facility that many employers pension schemes can accommodate where instead of receiving your full salary your employer gives you a non-cash benefit towards your pension instead.

The current rules let you pay up to 100 of your salary or 3600 a year into your pension whichever is higher and still get tax relief. A lower income could mean reduced benefits from your employer. Salary sacrifice means you can exchange part of your salary in return for a non-cash benefit from your employer.

Transfer your UK Pension to a Recognised Overseas Pension Scheme. A way to save and reduce your Income Tax and National Insurance Your employer might offer you the option of salary sacrifice as part of their pension scheme. The standard amount of tax relief is a 25 tax top up for basic rate taxpayers meaning that if you put 100 into.

It may reduce the cash earnings on which National Insurance contributions are charged.

Salary Sacrifice Factsheet Uss

8 X 8 Group Personal Pension Plan Pension

Exclusive 84 Offer Salary Sacrifice Pension Arrangements Employee Benefits

Salary Sacrifice Workplace Pensions The People S Pension

What Is A Salary Sacrifice Pension And How Does It Work Unbiased Co Uk

Infographic A Snapshot Of Employee Benefits Travail

Find An Experienced Accountant At Dns Accountants We Understand Your Business Needs That Our Accountant Focus On Y Accounting Tax Accountant Business Planning

Salary Exchange Salary Sacrifice Fair Financial Ltd

What Is Salary Sacrifice And Scheme And How Does It Work Check Out Our Salary Sacrifice Scheme Salary Sacrifice Pensions

Salary Sacrifice For Auto Enrolment Brightpay Documentation

A Guide To Salary Sacrifice Pensions

Https Quantumadvisory Co Uk Wp Content Uploads 2017 07 Salary Sacrifice Flyer A5 Final Pdf

Https Www Unison Org Uk Content Uploads 2019 06 Salary Sacrifice Pdf

Exclusive 84 Offer Salary Sacrifice Pension Arrangements Employee Benefits

Salary Sacrifice Pension Schemes Fair Care

United Kingdom Pension Reform Infographic Blog Marketing Infographic Business Blog

Free Form Letter 7 Facts You Never Knew About Free Form Letter Letter Template Word Business Letter Template Business Letter Format

Salary Sacrifice Workplace Pensions The People S Pension

Post a Comment for "Salary Sacrifice Uk Pension"