Salary Sacrifice Quickbooks

We can however record this via our other payroll software PaySuite. You will notice the reduction in Taxable Wages and Tax as well as an additional accrual journal for salary sacrifice.

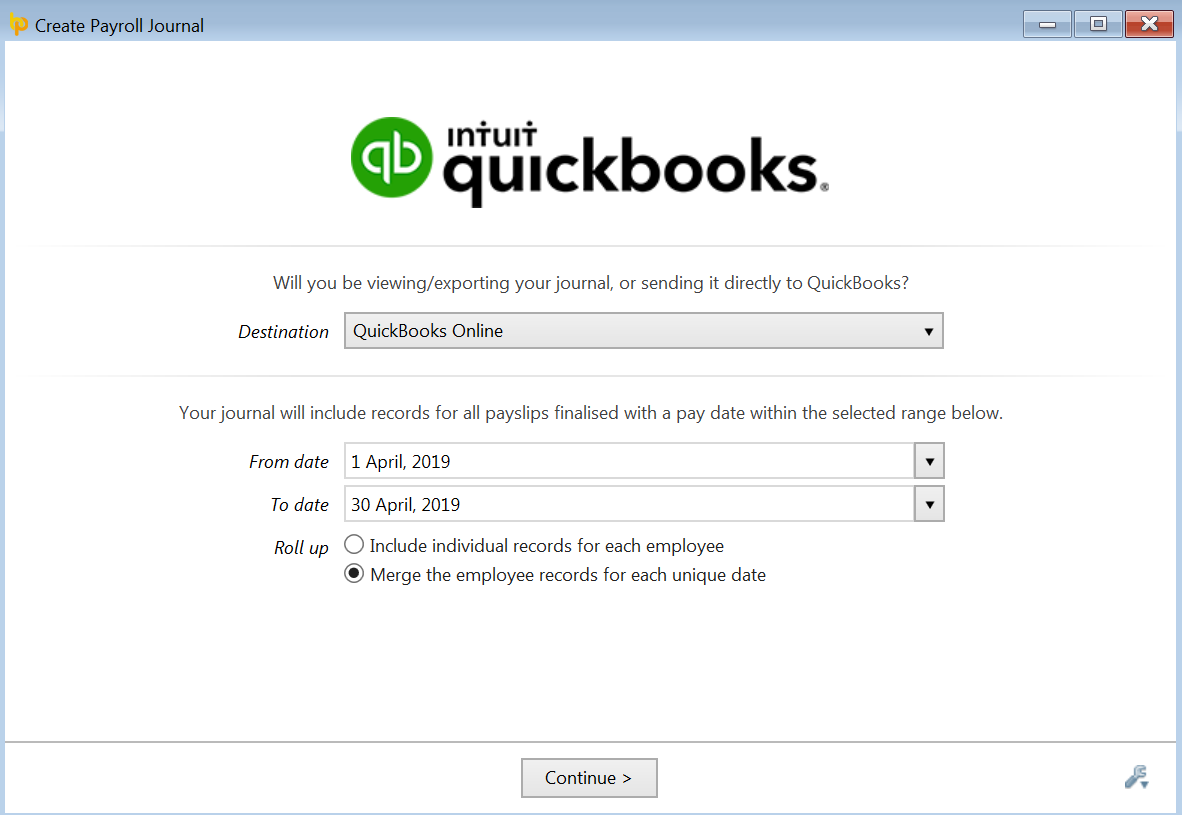

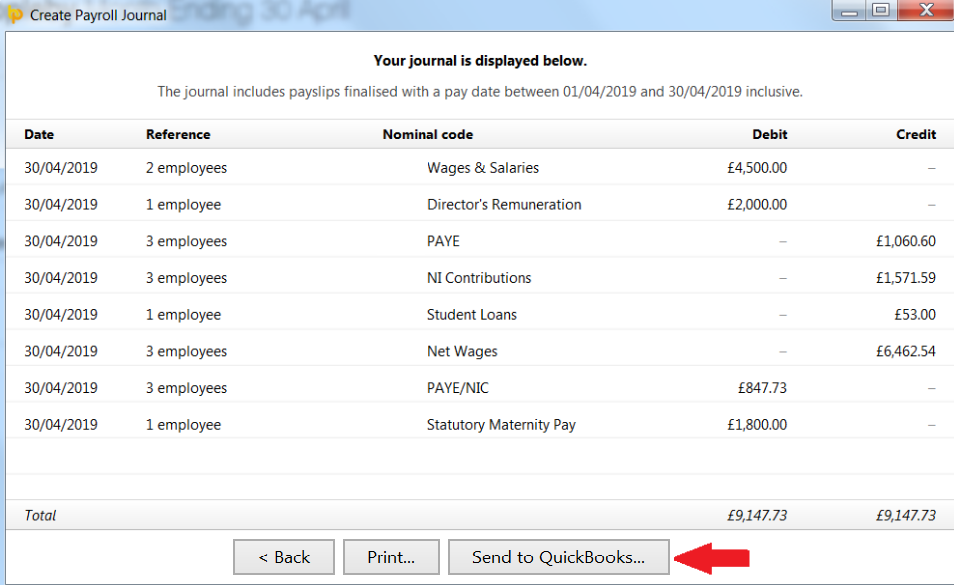

Quickbooks Online Using Api Brightpay Documentation

You can find more on this here.

Salary sacrifice quickbooks. Running it as a post-tax deduction would surely defeat the point of salary sacrifice. Salary Sacrifice is transfered to QuickBooks together with Gross Wages - Reckon Help and Support Centre. When processing your next pay run the salary sacrifice deduction will no longer appear for the employees pay.

Previously in Quickbooks in order to have salary sacrifice calculate correctly two payroll items a Company Contribution Item and a Deduction item needed to be set up. 0 Kudos Cheer Reply. Salary Sacrifice SS arrangements and Other Employer Additional EA amounts Example Mary who receives 5000 per month has negotiated a 12 super instead of the statutory requirement of 9.

Setting up a recurring deduction - salary sacrifice super. At the moment we cannot record salary sacrifice on QuickBooks Online Payroll. While it is an old article the procedures remain valid today.

Setting up a pension salary sacrifice scheme on Advanced payroll we will be using it for the first time this month. Im trying to set up the contribution rate - there are boxes for Eee contribution Eer Contribution Salary Sacrifice and NI - Im not sure what Im supposed to so with these they are not included in the instructions. There is a thorough and detailed explanation of how to handle salary sacrifice in QuickBooks 200910 onwards.

For example a salary sacrifice arrangement for a laptop can be set up as a deducti. This has been amended in new Quickbooks versions since 200910 to a single payroll item and now ensures that the process has been simplified immensely. If you wish to switch to this software please visit our contact page and give us a call and we can raise the request for you.

You could do it this way and have it appear then as a salary sacrifice which would then change her gross figure and compensate this with the salary sacrifice figure. Salary Sacrifice deductions are pre-tax deductions that are sent to a super fund. Select the way the amount will be arrived at.

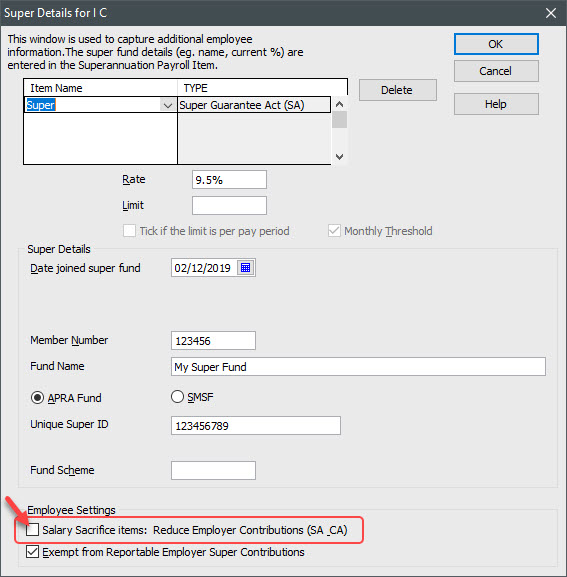

Click the zoom arrow next to the Salary Sacrifice deduction category. They could also be set up in different ways depending on their nature. It is correct in Quickbooks.

However as tax was presumably never reduced you would need to ensure that you reinstated the original amount of tax deducted if it changes. Below is an example of the payment coding. Enter the deduction amount to be applied per pay run.

How to add a super salary sacrifice item to an employees pay in Reckon Account Hosted. For many salary sacrifice payroll items to be setup in QuickBooks. She also salary sacrifices 1000 each month.

QB help chat has suggested reducing my salary through a regular deduction but I cant find a pre-tax deduction option were using QB Online. Select the Salary sacrifice super deduction category from the drop down list. It can be a Fixed amount a Percentage of Gross earnings or Percentage of OTE.

Click Employee and deselect the employee to whom the salary sacrifice applied. What this would mean then is that she has had too much tax taken out of her pay and. Wed like to run the pension as salary sacrifice.

HI lauraringgold Thank you for contacting the Community. What is the best way to set this up. SGC super is calculated on the Pre salary sacrifice Taxable wages.

A salary sacrifice is for when someone has X gross and then deducts an amount from that gross amount. Look at the link. A change was introduced on 1 January 2020.

Enter the or amount 100 in this case set the payment method to pay a super fund and select a fund from the drop down menu choose the effective from date. Before Salary Sacrifice is entered. Select Salary Sacrifice to Super as the type of deduction.

After the salary sacrifice has been entered. Setting up a non-super Salary Sacrifice item for a salary package Using the data file in a previous version of QuickBooks after converting to a newer version We. As a result of assigning a Salary Sacrifice deduction to a Manual payment the system will not view this as a super deduction but instead as a basic.

If the amount is on top of the gross that is more likely to be a company contribution. QuickBooks would be used in the followin. I expected the system to look at an employees notional salary and.

To set one of those up Put your mouse over the cog in the top right hand corner and then select settings. A common mistake made with these deductions is to set them as a manual payment instead of to a super fund. How do I fix this.

My salary sacrifice is not reporting correctly in the STP report.

Reckon Accounts Hosted Pay Payroll Liabilities Youtube

Salary Sacrifice Super Offsets January 1st 2020 What You Need To Know T3 Partners Bas Agents Training And Consulting Online Service

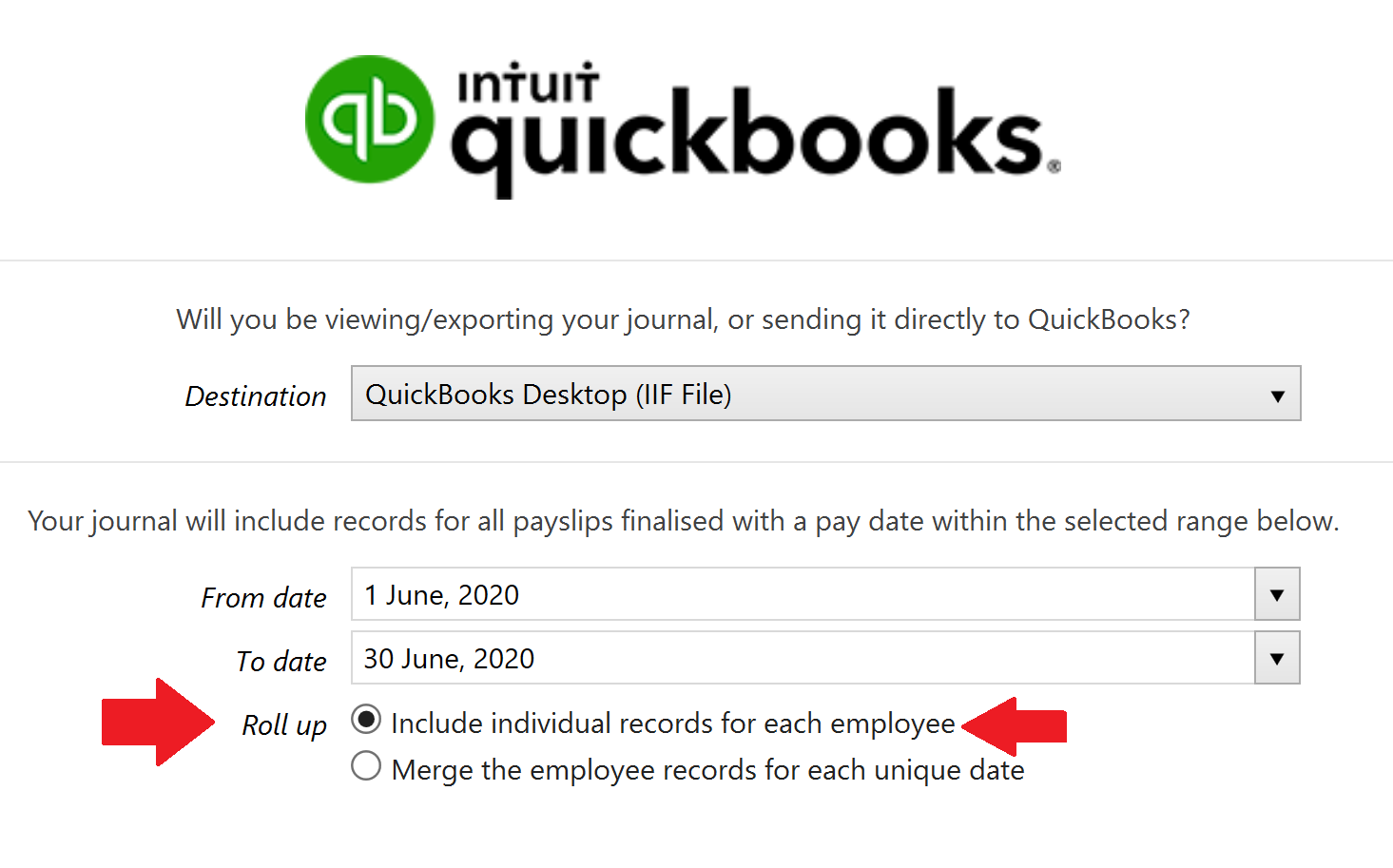

Quickbooks Online Using Api Brightpay Documentation

How To Stop Reducing Sg From Salary Sacrifice New Law Effective From 1 Jan 2020 In Reckon Accounts Reckon Help And Support Centre

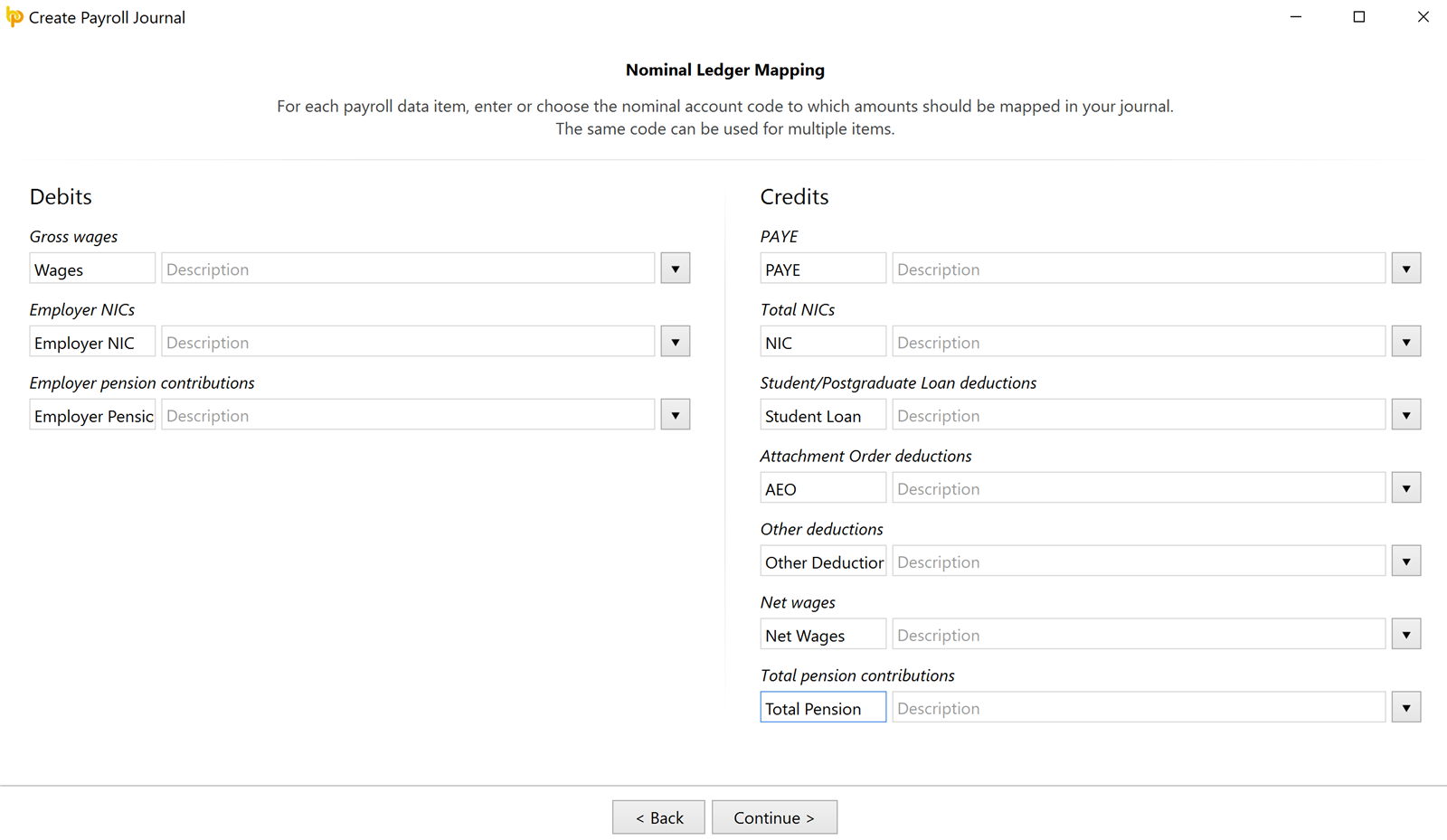

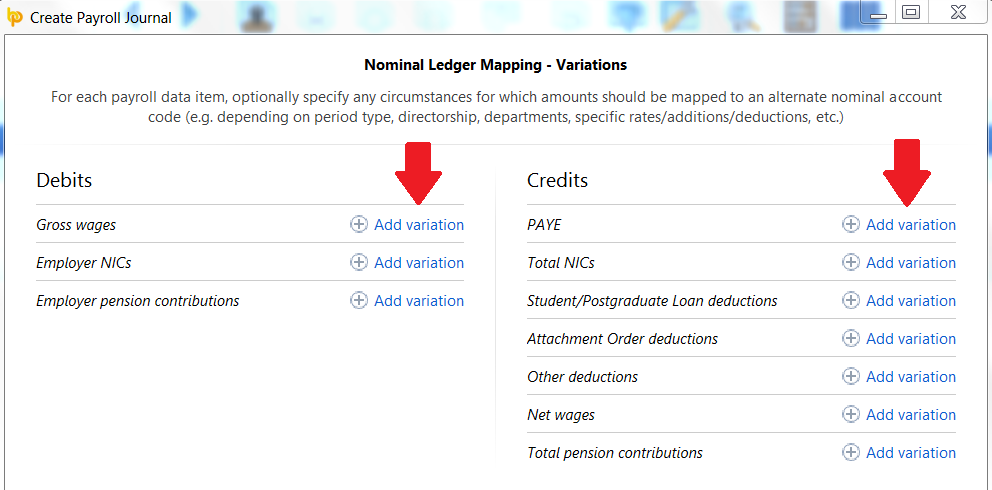

Quickbooks Desktop Version Csv Upload Brightpay Documentation

Quickbooks Desktop Version Csv Upload Brightpay Documentation

Guide Reversing A Manually Processed Salary Sacrificed Super Payment Employment Hero Helpcentre Au

Quickbooks Online Using Api Brightpay Documentation

Reckon Accounts Hosted Create A Super Salary Sacrifice Item Youtube

Akuntan Proyek Cara Melihat Reports Total Expenses Di Intuit Quickbooks Online Su Selviautama

Understanding W1 And W2 Tax Codes In Qbo Payroll Support Au

Quickbooks Desktop Version Csv Upload Brightpay Documentation

Akuntan Proyek Cara Melihat Reports Total Expenses Di Intuit Quickbooks Online Su Selviautama

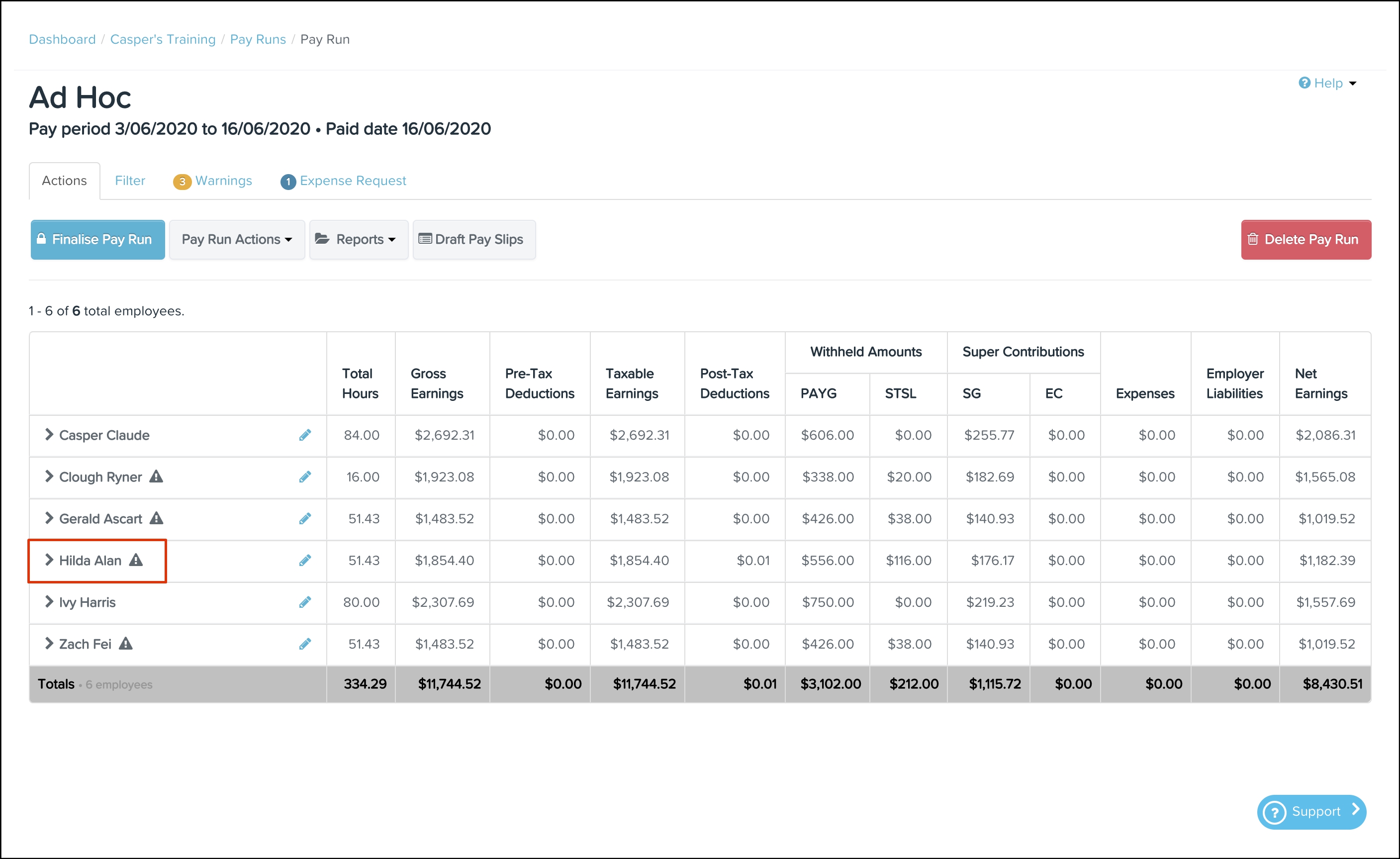

Solved Salaried Employees Do Not Show Salary In Pay Run

Solved Salaried Employees Do Not Show Salary In Pay Run

Akuntan Proyek Cara Melihat Reports Total Expenses Di Intuit Quickbooks Online Su Selviautama

Post a Comment for "Salary Sacrifice Quickbooks"