Net Salary If You Earn 55000

Yearly 1 SalaryTax Component 5500000. If you work 5 days per week this is 156 per day or 20 per hour at 40 hours per week.

How To Calculate Net Income Formula And Examples Bench Accounting

5500000 Income Tax Calculations for 2018.

Net salary if you earn 55000. Anything you earn above 180001 is taxed at 45. If you work 5 days per week this is 14485 per day or 1811 per hour at 40 hours per week. 2021 Cost of Employee Calculation for an Employee on a 5500000 Annual Salary.

This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no. You may be able to rule out a potential job offer when considering other costs associated with the increase. For example a comparison of a 30000 salary against a 35000 salary a gross difference of 5000 results in a net difference that is different due to tax and other deductions.

Income Tax Due 17500. Taxes are deducted monthly from the gross salary by the employers on behalf of the employees. This equates to 3382 per month and 781 per week.

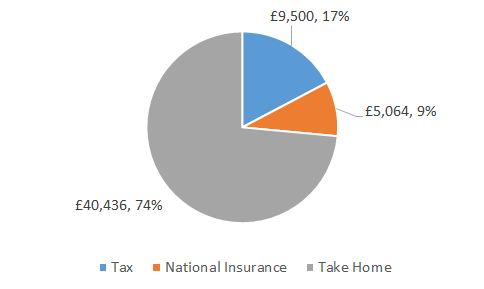

Annual Salary in 2021 522500. By admin on 14 August 2019 For the 2019 2020 tax year 55000 after tax is 40436 annually and it makes 3370 net monthly salary. There is an interest allowance interest from banks building societies trusts annuities etc depending on your income tax band.

Based on a 40 hours work-week your hourly rate will be 2163 with your 45000 salary. This equates to 313851 per month and 72427 per week. This figure is for guidance only and does not in any way constitute financial advice.

Higher rate tax payers can earn 500 tax free. The total cost of employment for an employee on a 5500000 Salary per year is 6264058 this is also known as the Salary Package. Your hourly rate will be 2645 if youre working 40 hours per week.

If you are single you will pay a rate of 3 if your income is between 250000 and 500000 EUR and 4 for income exceeding 500000 EUR. The actual total amount of annual tax you will pay for the year is 2142.

The taxation in Ireland is usually done at the source through a pay-as-you-earn PAYE system. 100000 150000. See how we can help improve your knowledge of Math Physics Tax Engineering and.

55000 after tax and National Insurance will result in a 3378 monthly net salary in 2019 leaving you with 40540 take home pay in a year. On a 50000 salary your take home pay will be 3766216 after tax and National Insurance.

4297970 net salary is 5500000 gross salary. What You Should Know About Your Net Salary Calculator. The Medicare levy is charged at 2 of your taxable income and contributes to the costs of Australias.

On the other hand if the salary increase is via a pay rise then you can see exactly how much that pay rise is worth. Basic rate tax payers can earn up to 1000 in savings income tax free. Low Income Tax Offset 110000.

For the 2020-2021 tax year the first 18200 you earn is tax-free. Social Contributions the employer withholds employees social security contributions at source and remits the total amount to the social security authorities. Youll then pay 19 on earnings between 18201 and 45000 325 on earnings between 45001 and 120000 and 37 on earnings between 120001 and 180000.

On a 55000 salary your take home pay will be 40589 after tax and National Insurance. While you will still pay tax according to your projected annual earnings 60000 your end-of-year tax will only be calculated on your actual earnings 30000. You will pay a total of 9500 in tax this year and youll also have to pay 4960 in National Insurance.

Comment your rolox use. The income tax Pay Related Social Insurance PRSI and the Universal Social Charge USC. One of a suite of free online calculators provided by the team at iCalculator.

Subscribe and turn on post notifications3. Employer Superannuation in 2021. So a basic salary of 5500000 is a 6264058 Salary Package on top of which can include company car costs healthcare costs and other employee related business costs.

Like and subscribe for more free robuxEnter roblox 10000 robux giveaway1. 55000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations. What is a 55k after tax.

45000 Salary Take Home Pay If you earn 45000 a year then after your taxes and national insurance you will take home 34240 a year or 2853 per month as a net salary. The amount of tax depends on the income and personal circumstances of the individual and it includes. Your personal allowance will be which means youll only pay tax on from your salary.

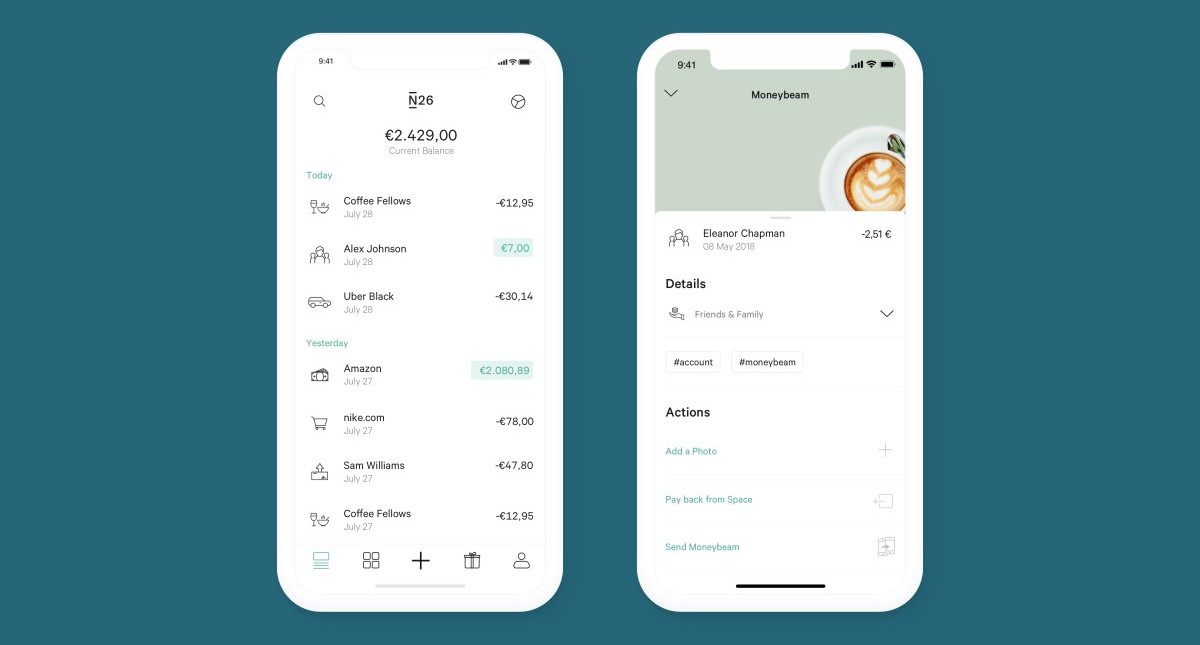

Base Salary Explained A Guide To Understand Your Pay Packet N26

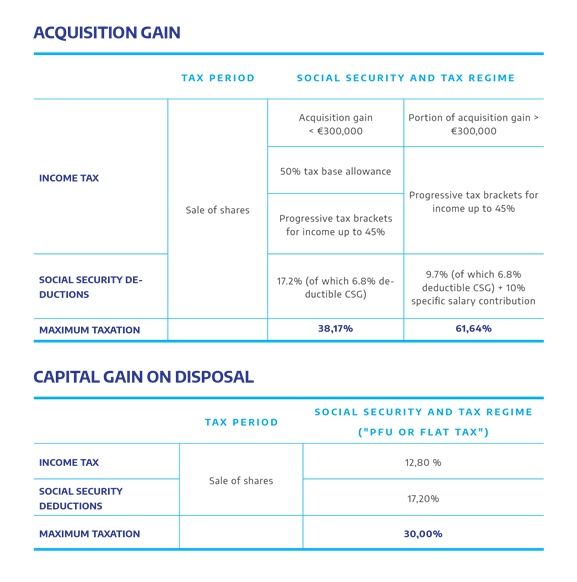

Restricted Stock Units Rsu Or Aga Welcome To France

Base Salary Explained A Guide To Understand Your Pay Packet N26

July 2020 Business Due Dates Dating Business How To Plan

Tax Planning For Salaried Individual Accounting Taxation How To Plan Tax Income Tax

32 Fun Jobs That Pay 20 An Hour Or More With Little School School Jobs Work From Home Jobs Job

Base Salary Explained A Guide To Understand Your Pay Packet N26

Net And Gross Income 1 Financial Literacy Worksheets Budgeting Worksheets Budget Spreadsheet Template

Youtube Video In 2020 Youtube Videos Youtube Online Jobs

Best Of How To Write An Invitation Letter For Us Visa From China And Pics Business Invitation Lettering China Invitation

Puns Powerpoint Template Keynote Template Presentation Slides Templates Powerpoint Presentation Templates

Maxing Out My 401 K While Earning 55 000 In Washington Dc Tax Refund Income Budgeting

55 000 After Tax 2021 Income Tax Uk

Park University Ac 202 Chapter 13 Homework All Solutions Worked Out Step By Step Chapter 13 Cost Of Goods Sold Chapter

Epingle Sur Travaux D Eleves Edaa

Post a Comment for "Net Salary If You Earn 55000"