Net Income Calculator Quebec 2020

Net weekly income Hours of work week Net hourly wage. Income tax calculator takes into account the refundable federal tax abatement for Québec residents and all federal tax rates are reduced by 165.

Liu V Sec Implications For Disgorgement Calculation Fra

You can use the calculator to compare your salaries between 2017 2018 2019 and 2020.

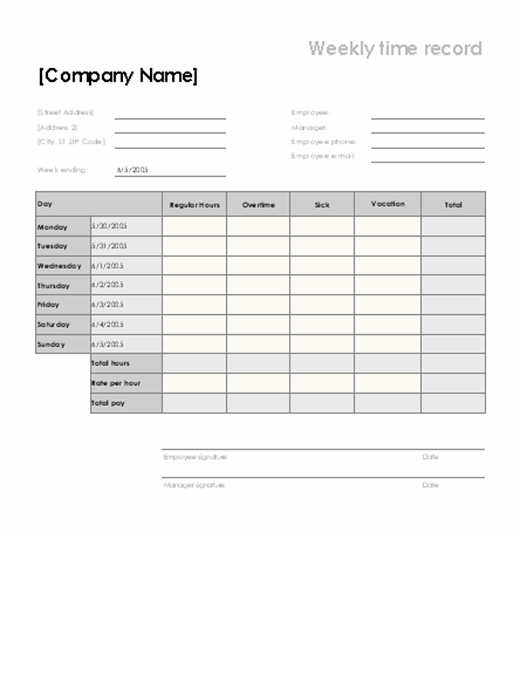

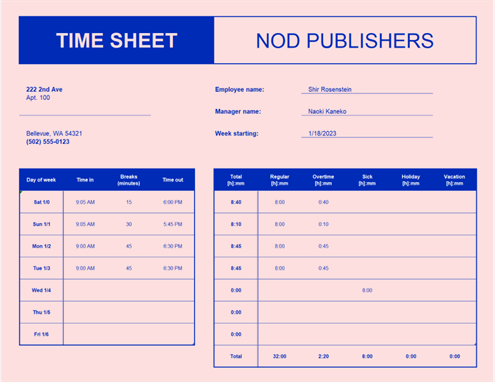

Net income calculator quebec 2020. The Quebec Salary Calculator uses personal income tax rates from the following tax years 2021 is simply the default year for the Quebec salary calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Canada Quebec Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to the tax calculator. Formula for calculating net salary in BC. Net annual salary Weeks of work year Net weekly income.

In the event that you are looking to calculate your income in Quebec you can choose a substitute territory here. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. Your average tax rate is 221 and your marginal tax rate is 349.

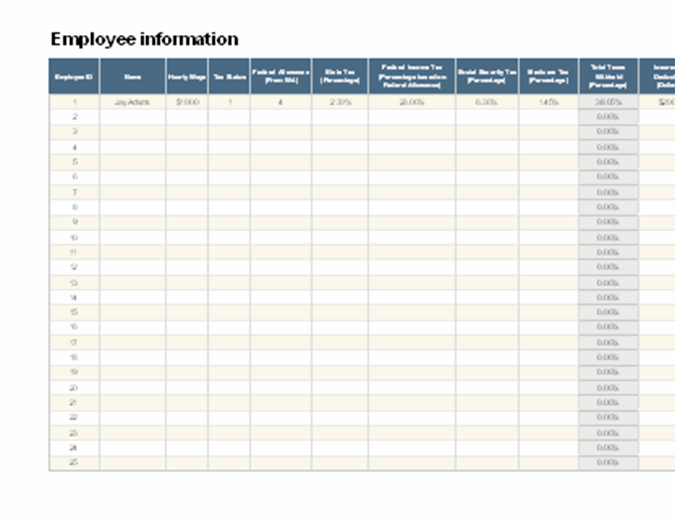

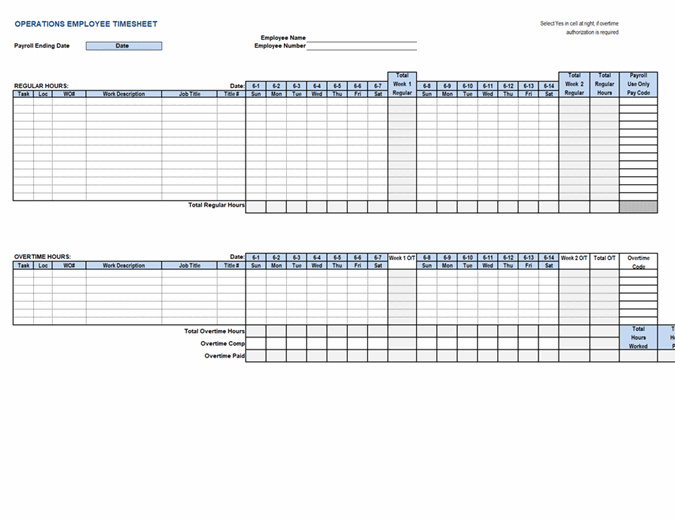

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Threshold Maximum Rate Cut-off CPP. Bekreftelsen kommer med en gang.

Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. You assume the risks associated with using this calculator. Total pension income eligible for pension splitting based on age-QUEBEC Maximum pension amount transferable FEDERAL 50 x A12 x months married Maximum pension amount transferable QUEBEC 50 x B.

350000 289800 525 58700 2018 525 EI. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. 85636 158 54200 Net take-home.

The Quebec Income Tax Salary Calculator is updated 202122 tax year. The reliability of the calculations produced depends on the accuracy of the information you provide. Canadian Payroll Calculator by PaymentEvolution.

7 lignes Income Tax Calculator Quebec 2020. Usage of the Payroll Calculator. Gross annual income Taxes CPP EI Net annual salary.

Enter your pay rate. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary Net annual salary Weeks of work year Net weekly income. Bekreftelsen kommer med en gang.

Quebec provincial income tax rates 2020. The calculator is updated with the tax rates of all Canadian provinces and territories. That means that your net pay will be 40512 per year or 3376 per month.

Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. Formula for calculating net salary The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Annonce Reserver på Quebecs Leeds.

The Debt Consolidation. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. Use our Income tax calculator to quickly estimate.

If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by consolidating them into one loan. In 2020 Quebec provincial income tax brackets and provincial base amount was increased by 19. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances.

Personal Tax calculations and RRSP considering for 2020 with chronicled pay figures on average profit in Quebec for each market division and area. Basic personal amount in Quebec for year 2020 is 15532. It will confirm the deductions you include on your official statement of earnings.

The Quebec income tax calculator is updated for the 2020 duty year. Annonce Reserver på Quebecs Leeds. The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD.

The amount can be hourly daily weekly monthly or even annual earnings. This means that high-income residents pay a higher percentage than low-income residents. This marginal tax rate means that your immediate additional income will be taxed at this rate.

![]()

Pin By Itachi Uchia On Mahadev Christmas Bulbs Christmas Ornaments Holiday Decor

Pin On Mortgage Payment Calculator

Get Granite In The Kitchen And Bathrooms Renovate Any Home With A Fha 203k Or Fannie Mae Homestyle Loan Renovation Loans Home Renovation Loan Remodeling Loans

Budget Template In Excel Excel Budget Template Simple Budget Template Excel Budget

A Social Trading And Investment Platform On Behance Investing Social Trading

Costum Flight Ticket Invoice Format Excel In 2021 Invoice Format Invoice Template Microsoft Word Format

Ecological Footprint Calculator Ecological Footprint Ecology Footprint

Goldstein Today S Kids On Hook For Trudeau S Canada Child Benefit Dollar Bill Canadian Money Dollar

Pin By Lama Lola On S P Learning Websites Learning Apps Programming Apps

For Free Solutions To Math Questions Try Wolfram Alpha Math Apps Student Apps Wolfram

Pin By Itachi Uchia On Mahadev Christmas Bulbs Christmas Ornaments Holiday Decor

Daily Marketing Calendar Template For Excel Free Download Tipsographic Business Plan Template Spreadsheet Template Business Template

Extra Payment Calculator Amortization Schedules Accelerated Payments Amortization Schedule Mortgage Payoff Pay Off Mortgage Early

Business Loan Calculator And Amortization Schedule Bdc Ca

Epingle Par Emilie Baumann Sur Voyages Je Te Veux Tout Est Possible Reve

Post a Comment for "Net Income Calculator Quebec 2020"